Whether you admit it or not the market has us all trained like Pavlov’s dogs. Grab yourself a copy of Meditations (Marcus Aurelius) or The Prince (Niccolò Machiavelli) and one thing becomes painfully. Despite all our technological advances human nature in essence has not changed one bit. And believe me when I tell you that Ms. Market has a bonafide PhD in how to press our buttons, a.k.a. the scientific study of fuckwithretailology.

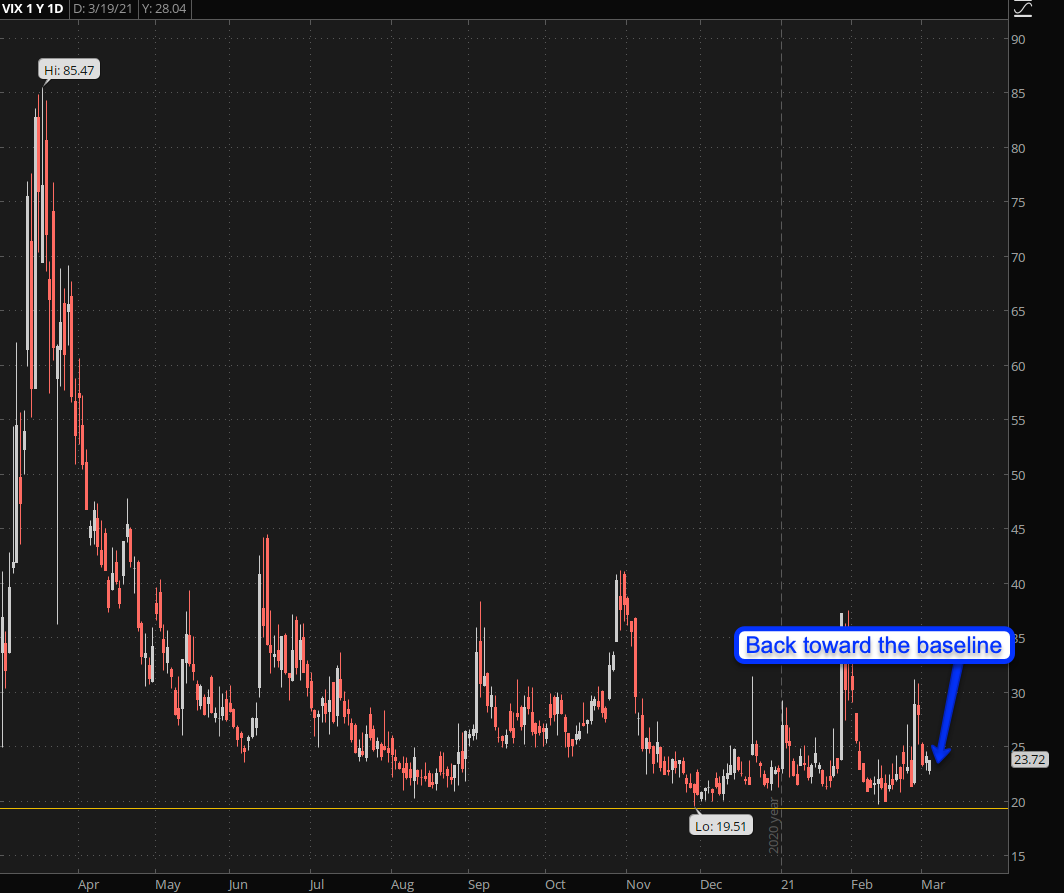

Which is easily demonstrated by simply glancing at a VIX chart. Have you ever pondered as to why the lower/bullish IV range goes from about 10 to the 20 mark? Medium IV only occupies about 10 handles, and once you get to 30 it either turns within a few handles or all hell breaks loose.

That’s called non-linear distribution in geek speak and offers us great insights into human psychology. Which alternates between utter complacency and bare naked fear in roughly a 4:1 ratio. Understanding this can be very useful from a trading perspective.

Let me introduce you to a new friend called the SRVIX. Yes, it’s clearly related to implied volatility but not in the way you may imagine. The symbol is actually an abbreviation for CBOE Interest Rate Swap Volatility Index and if the words ‘interest rate swap’ somehow rings a bell then you probably have heard of Michael Burry and his giant claim to fame CDS trade which eventually banked him and his whinging clients a veritable fortune.

So why would I look at this chart? Am I about to trade credit default swaps? Not really but I use it as canary in the coal mine of sorts in that large spikes and especially important inflection points give me deeper insights on how institutional traders perceive the market at any moment in time.

As you can see there was a large spike almost exactly a year ago and if you timed it properly you were able to ride the remaining sell off all the way to the bottom. Getting out was actually pretty easy as the signal recovered much quicker than any other volatility indicator. In other words: institutional traders know a lot of things you’ll never even hear about – unless you’re an implied volatility junkie like yours truly.

Now if you would have me guess the question in your mind right now then I’d point at: Has the crisis been averted or is this only the quiet before the storm?

To answer that please meet me down in the lair:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.