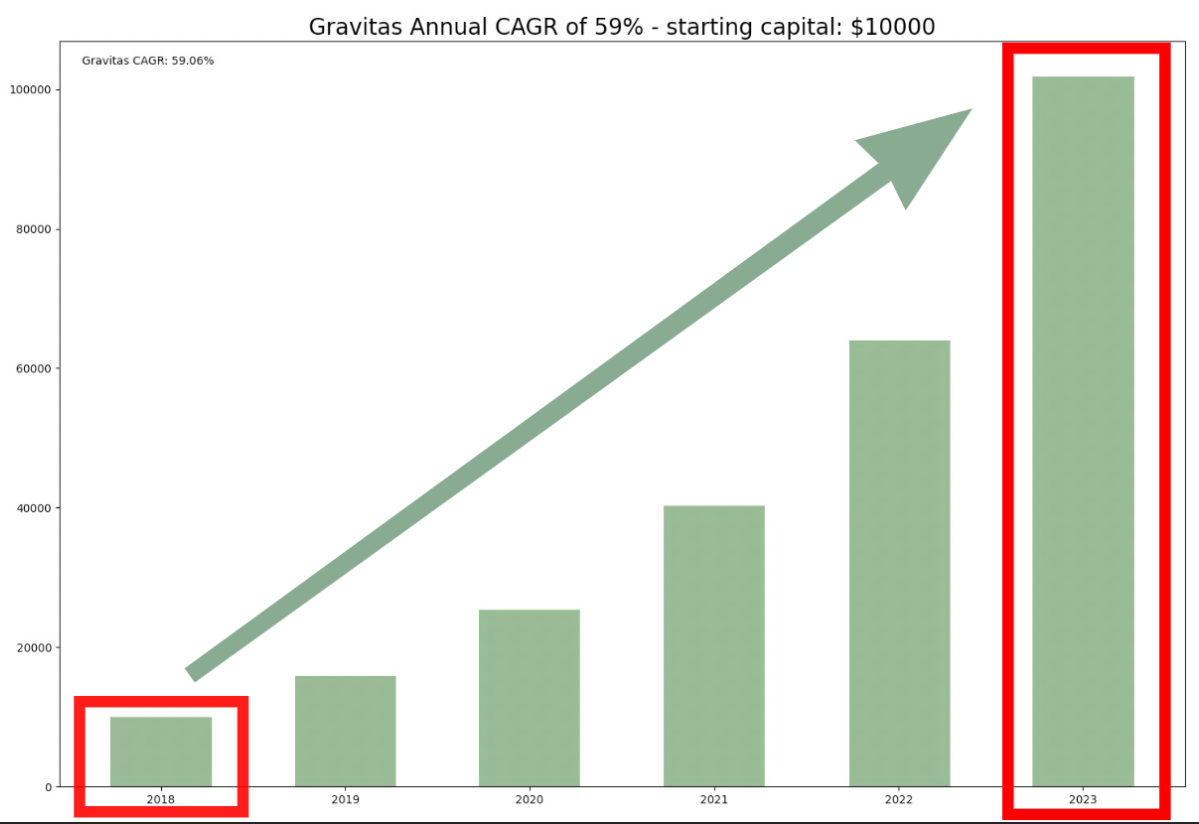

A bunch of people emailed in asking about my recent GRAVITAS post where I showed this chart of my systems performance over the past 6 years…

As you can see, GRAVITAS has a Compound Annual Growth Rate (CAGR) of 59.06%, but many were curious as to what would be considered “good performance” for a trading system

Well, let’s compare my system to some of the top hedge funds in the world.

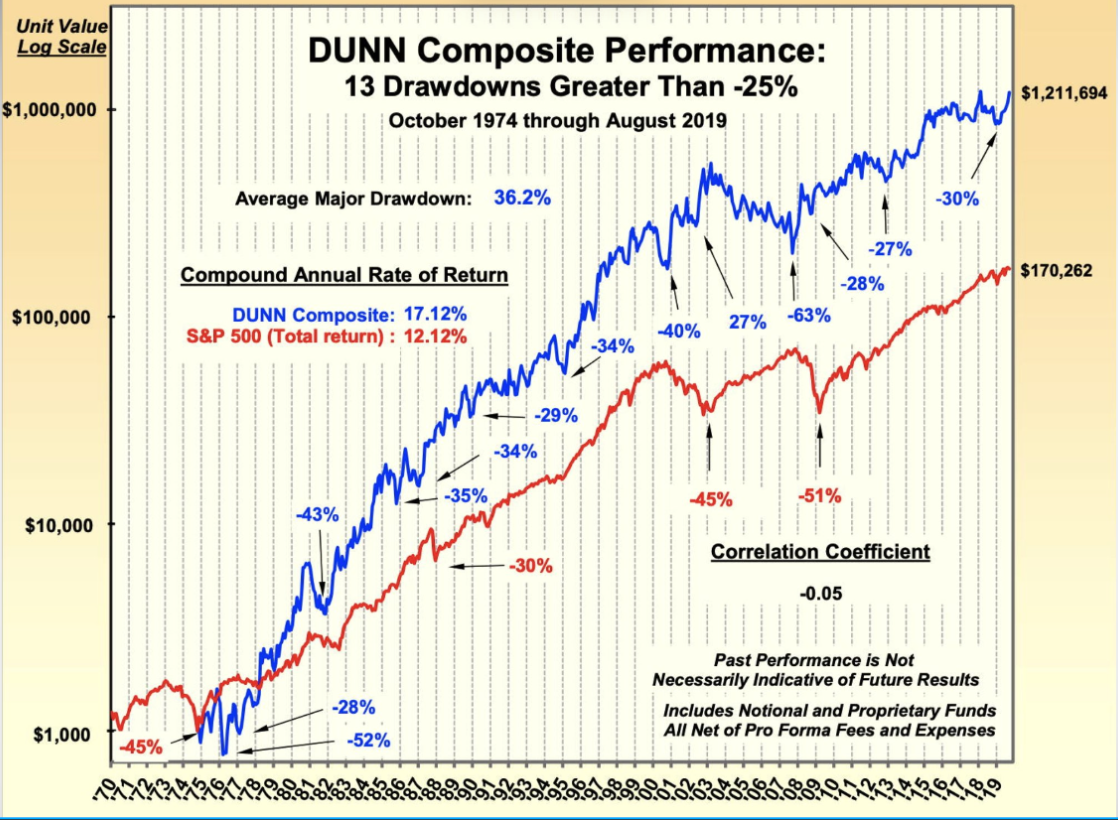

First we have Dunn Capital, who are the all-time grand champ of compounding performance.

They’ve turned $1,000 into $1.2 million over 40 odd years… not too shabby!

Their average CAGR is 17.12% but with massive drawdowns, some of them reaching over 60%

But they’ve still performed phenomenally compared to the S&P 500 which achieved an average return of 12.12% over that time

So they clearly beat the S&P 500 BUT with big drawdowns

They’re doing 17.12% per year, we’re doing 59.06% per year.

Here’s another top hedge fund, Mulvaney Capital (no relations)…

They do an average of 14.9% a year, and that’s VERY respectable on traditional markets.

But at the end of the day, they’re still only doing 14.9% while we’re doing 59.06%.

And finally let’s look at one of the biggest Crypto whales: MicroStrategy

They’re holding over 28,000 Bitcoin at an average price of $55,000

Meaning they are down BAD… hundreds of millions of dollars in the red

So there’s 3 examples of some of the TOP financial firms out there

But the bottom line is, GRAVITAS performs FAR better than almost anything else

And there are literal fortunes to be made

Because remember – GRAVITAS prints money regardless of market direction

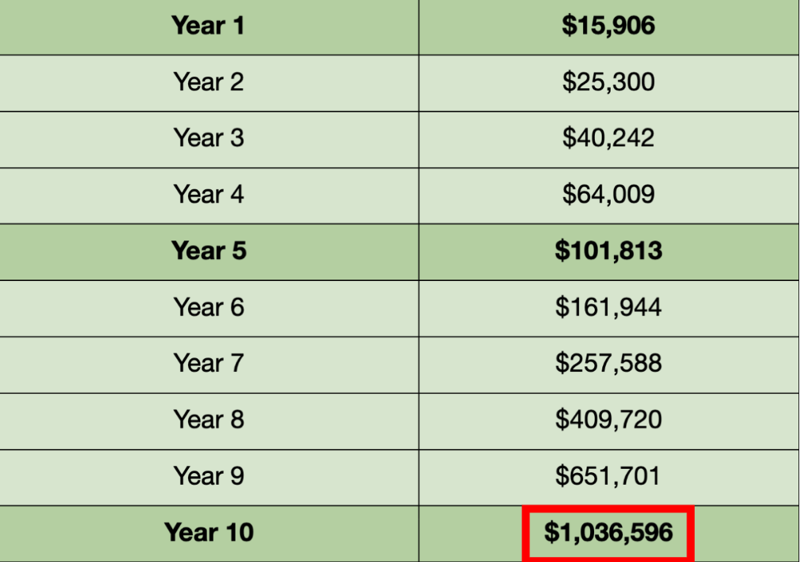

And the secret sauce is COMPOUNDING… which will take care of most of the heavy lifting for us

Over the past 6 years our average Compound Annual Growth Rate is 59%

So if we start with only $10,000 here’s what will happen…

By the end of year 1, you’ll be at almost 16 thousand dollars

At the end of year 5, it’ll be over 100 thousand dollars

And by year 10, it will surpass 1 million dollars

10,000 into 1 million…

Those returns are better than any hedge fund on this planet

And you’ll have the opportunity to get involved and start grabbing some of those returns VERY SHORTLY.