If there’s one thing I consider myself to be pretty good at it’s looking at a particular scenario and assessing its probability of playing out. In fact it’s been my bread and butter activity over the past 15 years, and by all intents and purposes I have it down to a science.

Like any good analyst I look at charts, find correlations, run the stats, some backtests, or perhaps some simulations, and in the end I usually have a pretty good lock on whether or not a particular event is going to play out over an x amount of time.

Suffice it to say my track record during all those years, albeit not spotless, has been pretty damn good.

Which is probably the reason why you’re here reading this post in the first place.

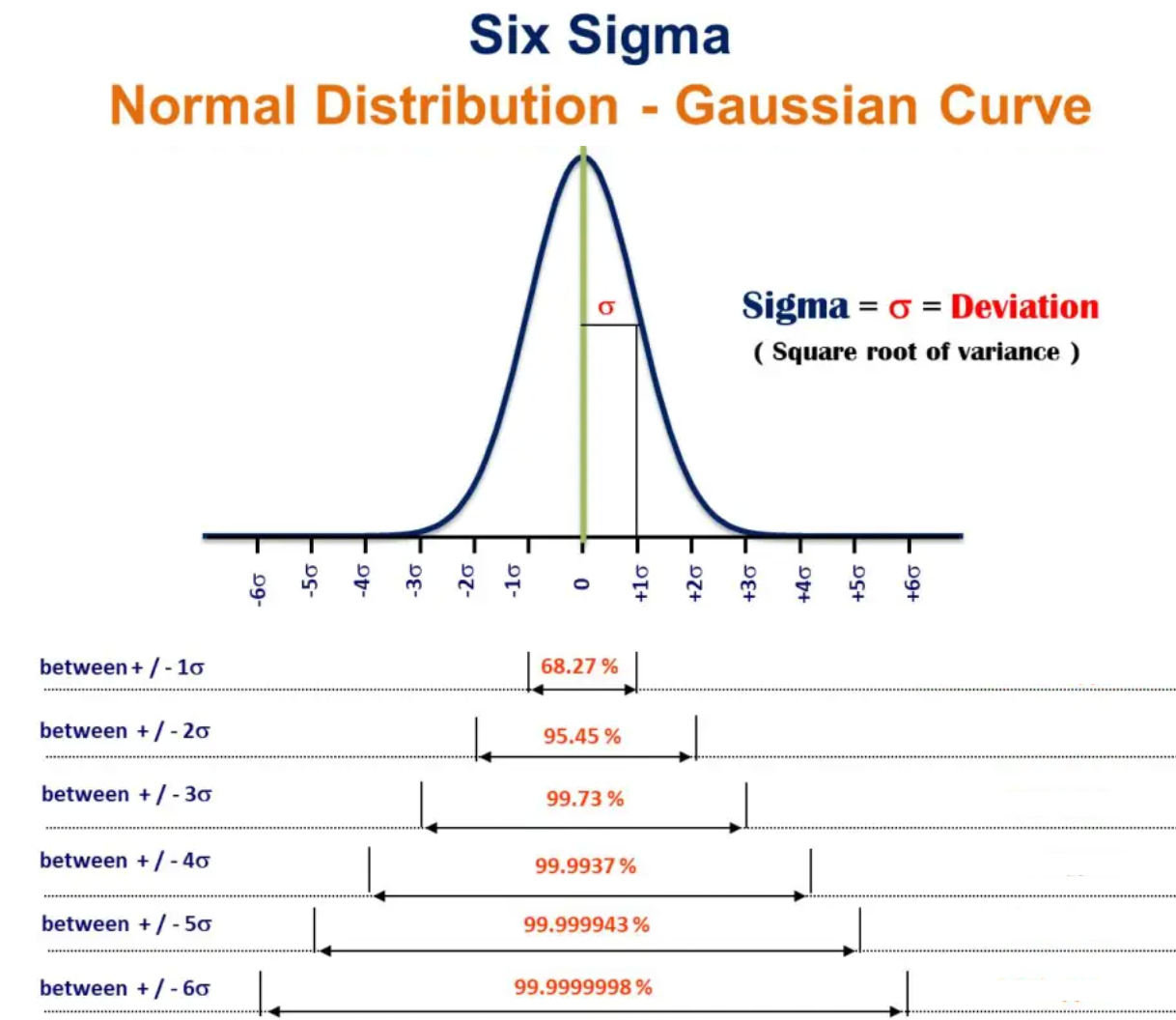

Now since about the 2008 financial crisis the one phenomenon that has been fascinating me has been that of six sigma events.

A.k.a. long tail events ‘six sigma’ is a nerdy way of labeling scenarios with a probability that are so infinitesimal, they should almost never happen.

But for some strange reason they do, and a lot more frequently than you – or I – would anticipate.

Nassim Taleb to his credit even wrote a book about it.

However the biggest problem with six sigma events is not that they happen so rarely – it’s the part of you not expecting them.

Case in point: the tree that almost killed me yesterday.

It’s a mighty fruit tree that stands right in front of our entrance door and provides us with comforting shade during summer.

This spring it was full of beautiful blossoms reminiscent of some Japanese anime.

Since we had a ton of rain starting in April all the way through June it’s now producing a ton of fruit. In fact there are so many of them that one big branch already broke and fell off the other day.

You would think that’s the end of the story, but it’s not.

Because since that branch fell my wife has been warning me to not park underneath that tree again as other branches may fall and mess up our brand new Hilux.

Yeah, it’s the PICKUP TRUCK she cares about, but I digress.

We usually don’t park there anyway, but as you can imagine it’s a good spot to load or unload heavy items, for example right after shopping for groceries or heavy garden tools

Now here’s my snarky response to her: “Come on sweetheart, what are the odds of a branch falling right when I’m unloading something for a few minutes?”

Well you probably already guessed what happened. Yesterday I was unloading a bunch of boxes from our truck and right when I was grabbing one from the backseats I hear a loud crack right on top of me.

There was no wind, no rain, no bald eagle, no nothing – it was a beautiful day with clear skies. Meaning there were no extraneous factors that could have affected that branch breaking at that very moment.

But it did and not just that – it broke and landed right on top of my head. Fortunately my instincts kicked in and as soon as I heard the crack I crouched down and protected my noggin’ with my arms.

I still caught quite a bit of the weight but fortunately the Hilux took most of the impact (no scratches or dents though – kudos to Toyota for awesome build quality).

Of course adding insult to injury, I will never hear the end of this.

I am laughing about it now but that branch is heavy enough it could have killed me.

It might not show on the picture but someone actually had to come and cut it up with a chainsaw before disposing of it.

By now you’re probably wondering why I’m sharing this sordid tale with you in the first place.

No I wasn’t fishing for sympathy, in fact I walked away from the entire experience without as much as a scratch.

Go figure. Another high sigma probability but let’s not test your patience.

Look, my point is this: Do NOT ever under estimate the probability of something happening that may appear extremely unlikely at that particular time, but – should it happen – could inflict significant damage.

Yes of course I am talking about trading here. Specifically about downside risk, portfolio management, and maintaining strict delta neutrality in this volatile market.

For weeks now I’ve been quetsching about an effervescent equities market that continues to bubble higher and higher on nothing but bad news, low market breadth, and a falling Dollar.

I’ve been rather prolific about the fact that we are looking at high tail risk here on BOTH sides, meaning going long here bears as much risk as going short.

Yes, volatility CAN be your friend – but dang it, she’s a cruel mistress that requires experience and a bit of finesse to be kept in check.

So trade accordingly. And whatever you do: don’t ever park underneath a tree laden with fruit after a wet spring season.

BTW, if you enjoy my work and are looking for returns like the P&L above then shoot us an email and we’ll get you set up with our Unlimited signal service by the end of the day.

It’s fairly low frequency and only takes high probability trades with the aim of producing consistent and reliable side income.

Yes even in this crazy market.