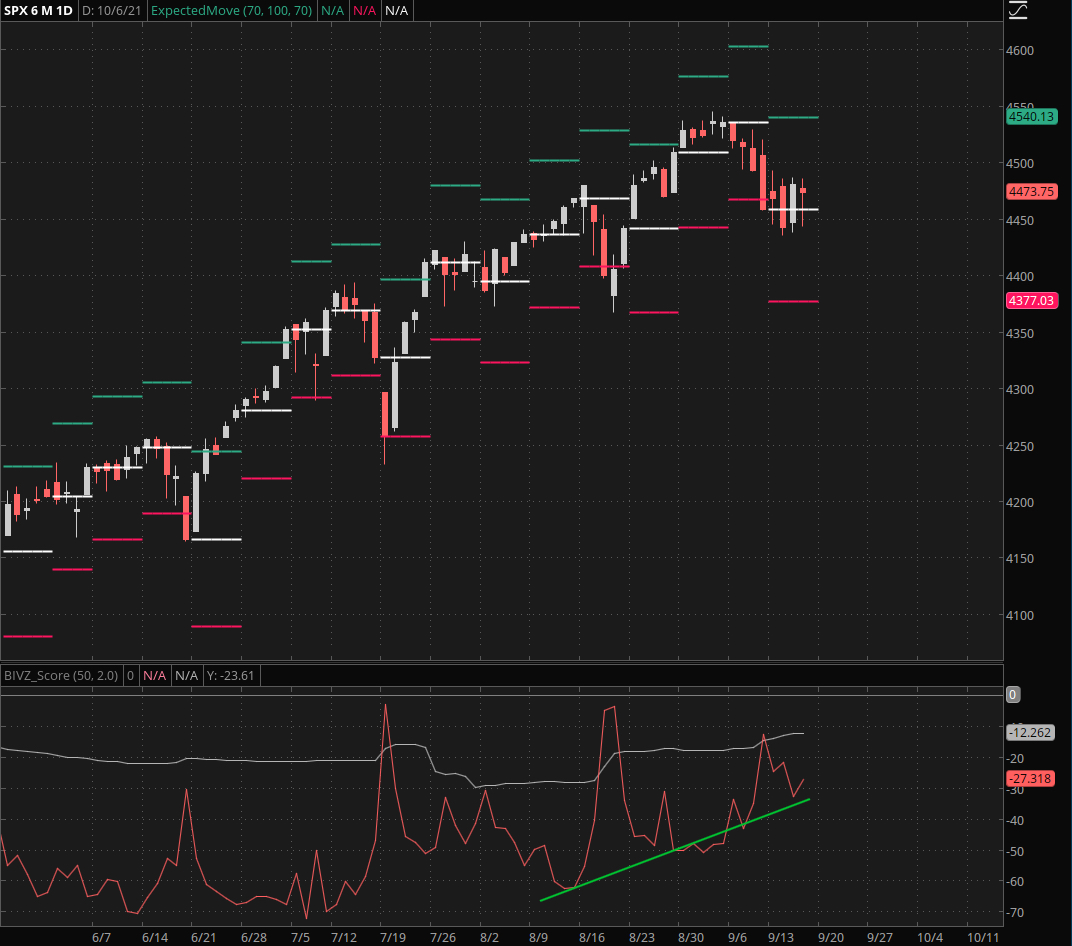

I’m going to give you the quick and dirty on what matters this Friday. Price always matters of course but since we’re heading into a quadruple witching after two weeks of sideways churn institutional traders are now faced with a dilemma.

Which is called gamma risk. You got a nice taste of that already last Friday when the SPX made a sudden swing toward the downside. Much to the joy of yours truly as I had placed a spread exactly at max profit, but let’s cover that in more detail a bit further below.

Gamma risk occurs when a sideways market produces an accumulation of positions near and outside the weekly expected move (EM). As open interest accrues around the same thresholds the risk of a run-away spike in either direction (up or down) increases significantly.

Retail loves to buy OTM options and institutional traders are all the happier to sell them. A long going and happy relationship that ends up in a loss for the retail side of the transaction over 90% of the time. Yup the stats are brutal on that one.

Nevertheless there is always the looming risk of a huge move that extends beyond the weekly EM so what is any self respecting market maker supposed to do?

Hedge himself of course and that’s usually done via the purchase of long positions in the ES futures. The more price moves toward or beyond the weekly thresholds the more ES futures he will buy.

So what that means in plain English is this:

- We have a boatload of weekly, monthly, and quarterly options that expire today.

- The market has not moved an inch all week.

- Which has produced a huge accumulation of o.i. around the edges with nowhere to go.

And that means we may – just may – see a sudden jump today and I intend to take full advantage.

By the way if you wonder in which sector exactly we would be seeing the most action look no further than big tech which has been treading water after ripping everyone’s face off all summer.

Finance is holding the line but if I was a betting man I’d stick with tech stocks this Friday.

Anyway, so if you want to know how I plan on taking full advantage of this situation meet me below the fold:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.