With the next Bitcoin halving event less than a year away, we are seeing a sudden explosion in excitement for all things crypto. A major trigger event was the prospect of various spot Bitcoin exchange-traded fund (ETF) filings by several financial giants such as BlackRock, Fidelity, ARK Invest, Valkyrie, and others.

And let’s also not forget about MicroStrategy, which BTFD’d like a champ and now holds a total of 152,333 BTC acquired at an average price of $29,668 per Bitcoin.

Even more importantly, according to crypto analytics firm Block Scholes (no relation to the option pricing model), the correlation between Bitcoin and U.S. stocks, specifically the Nasdaq and S&P 500, has reached its lowest level since July 2021.

Meaning the chains are breaking and moving forward Bitcoin’s performance will no longer be closely tied to U.S. stock market sentiment (and its machinations).

IMO this is the best development yet and it’s becoming increasingly clear that institutional trust in Bitcoin has come full circle, especially since the aftermath of the 2020/2021 crypto winter and the dreaded FTX disaster.

What truly matters in the end of course is price, and I’m happy to report that Bitcoin just closed up 2 quarters in a row for the first time in 2 years.

Wow, how time flies when you’re being tarred, feathered, and carried around town on a rail.

The chart above shows how much the current price of BTC is down in comparison to exactly one year ago on the same day.

As you can see crypto bear markets on average have lasted just about one year plus minus.

However this time around we actually stayed under that market for 490 days, the longest ever!

It’s been a long wait and BTC finally recorded its first day of YoY gains again. All that paints an extremely bullish picture and a positive outlook for the remainder of 2023.

Purely technically speaking BTC is once again bumping its head against established overhead resistance at $30k.

It’s not unusual for round numbers to act as inflection points, for they shape our paradigms.

After all everyone wants to be a millionaire instead of ‘only’ getting to $999,999.

At the same time we pay $9.99 for a product that we may not buy at $10. Or at least that’s what several generations of marketing gurus will have you believe.

Anyway, the most likely scenario at this stage is one more shallow retest lower followed by a massive break out move that most likely should propel BTC to its $40k mark (yes another round number but look at the chart to find the next price cluster right there).

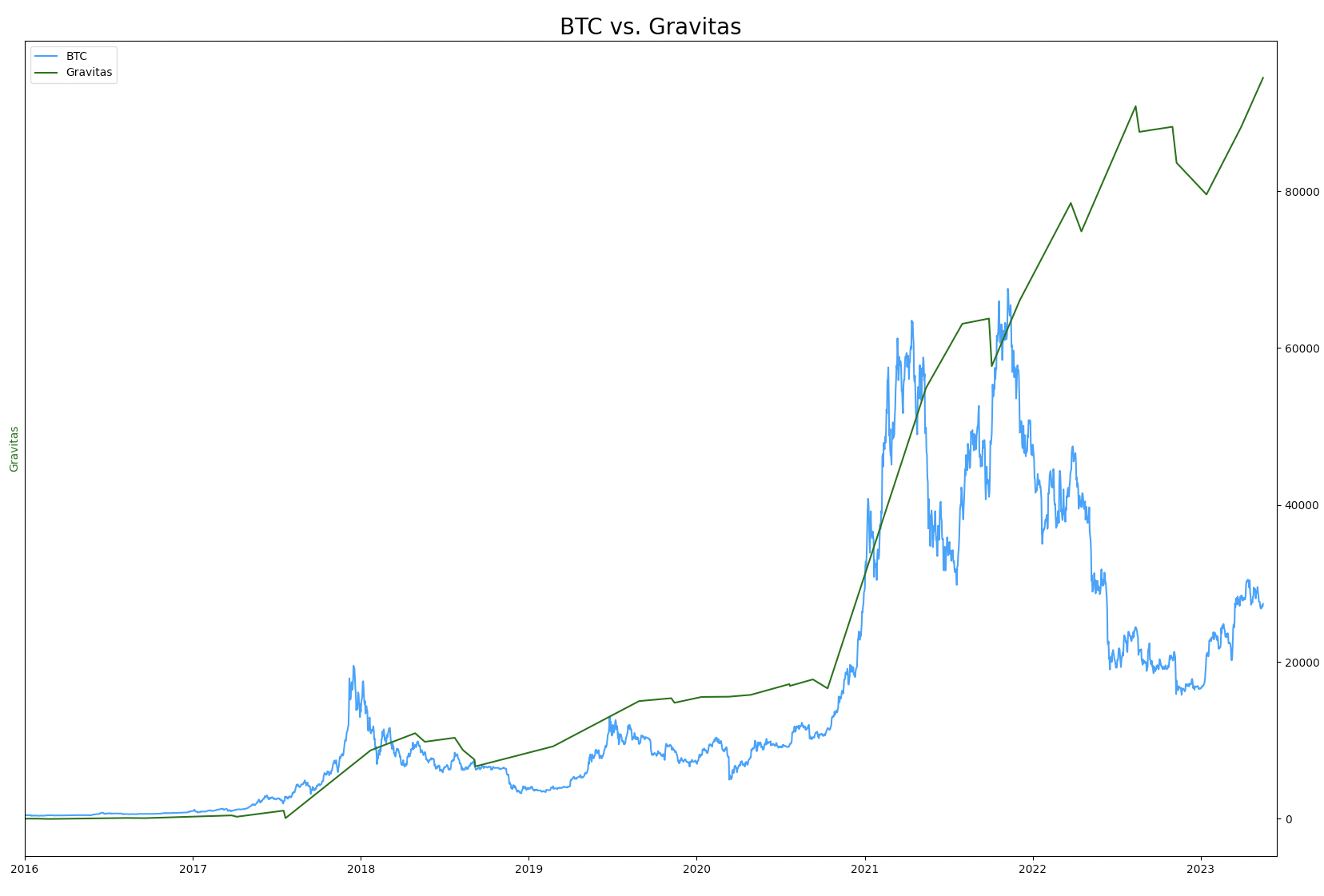

Now if you’ve been hemming and hawing about getting ‘back into the game’ with BTC or crypto in general then you may want to consider joining Gravitas – my most excellent long term trend trading signal.

Remember, the whole idea behind trading the greater trend isn’t to pick tops or bottoms. It’s about remaining on the right side of the tape when it matters the most.

And that’s what Gravitas is really good at. Plus it’s a long term signal, at the very most you take action once per month on average. Perfect for the lazy busy operator.

Besides, the results speak for themselves, so if you’re interested shoot us a message here and we’ll get you set up just in time before the next punch higher.