Make no mistake – the current surge across numerous U.S. asset classes has very little to dow with good old fashioned value generation and is simply a natural response to the systematic destruction of the U.S. Dollar. It’s also part of a narrative that strangely seems to be favored by both sides of the political isle – for different reasons. In other words, rapid loss of confidence in the greenback is pushing asset holders into whatever tangible they can get their hands on.

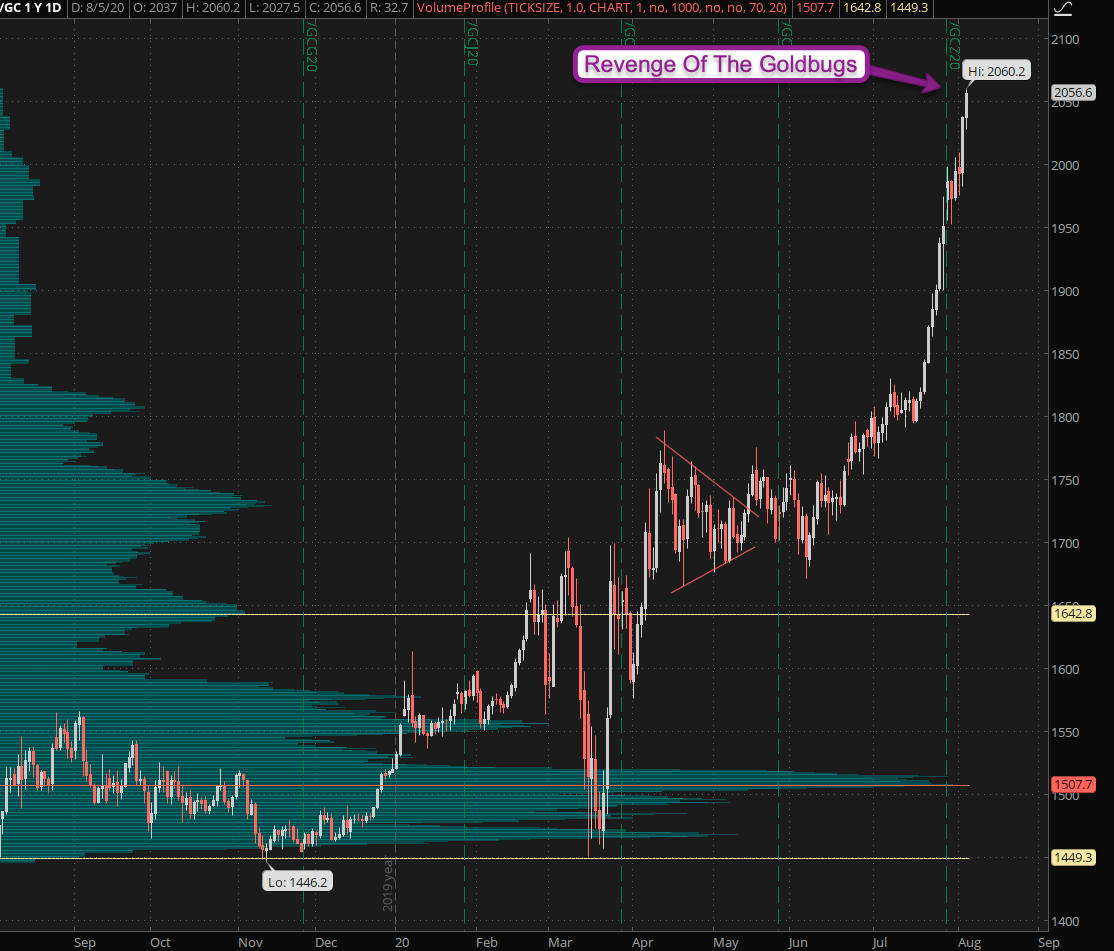

The goldbugs finally have their day in the sun after years of roasting in sideways purgatory. As you may recall the subs and I caught an almost perfect entry near GC 1740 and managed to get out around the 2k mark.

Do I regret cutting the cord there? Hell no – as the old saying goes: Bulls make money, bears lose money, and pigs get slaughtered. Alright, yes – I did modify that expression somewhat 😉

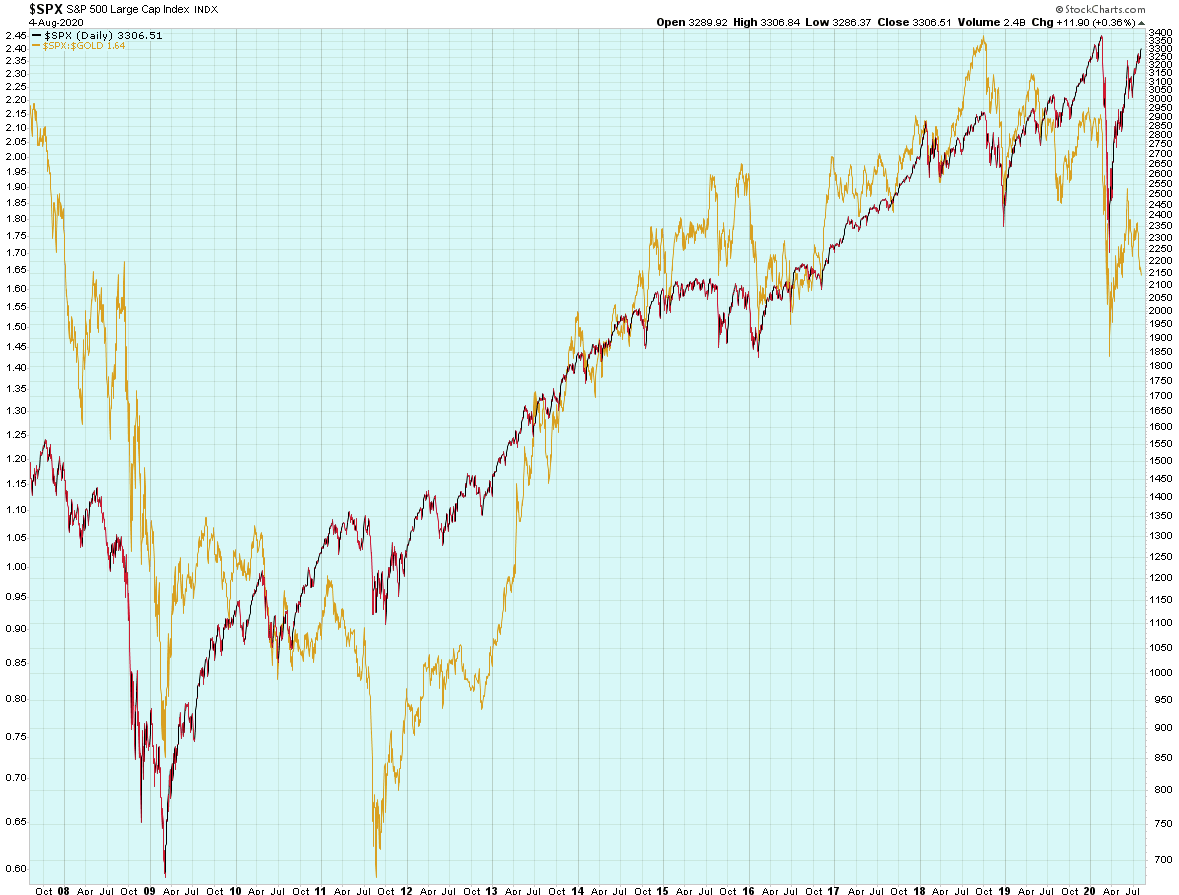

The chart above shows the SPX divided by the price of gold in comparison with just the SPX. Apparently gold is even outpacing equities at this point and that ought to make the gold bugs very happy.

Of course there’s one glaring problem with all that almost nobody seem to understand. At the end of the day – at some point in the future – you’ll have to make a payment to somebody. And odds have it that the other party won’t be accepting your gold bullions or your fancy American Eagle or Canadian Maple Leaf. Remember we all live in a digital economy now.

What they’ll ask for will be U.S. Dollars and guess what – massive inflation in Dollars causes prices to rise. So while our gold assets are on the rise, so are prices across the board.

Mrs. Evil keeps complaining about the literal doubling of food prices over here in Spain – at least when it comes to organic food. Those are in Euros by the way, so multiply this by 1.20 – a kilo is about 2.2 lbs. So that comes out to about $6 per pound for those kiwis. Insane….

I guess if you’re fine with chowing down Soylent Green you’ll still be able to find a bargain.

Silver had been lagging gold for a very long time but is now catching up quickly. To put things into context – silver has more than doubled over the course of the past six months.

But here’s something even more interesting:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

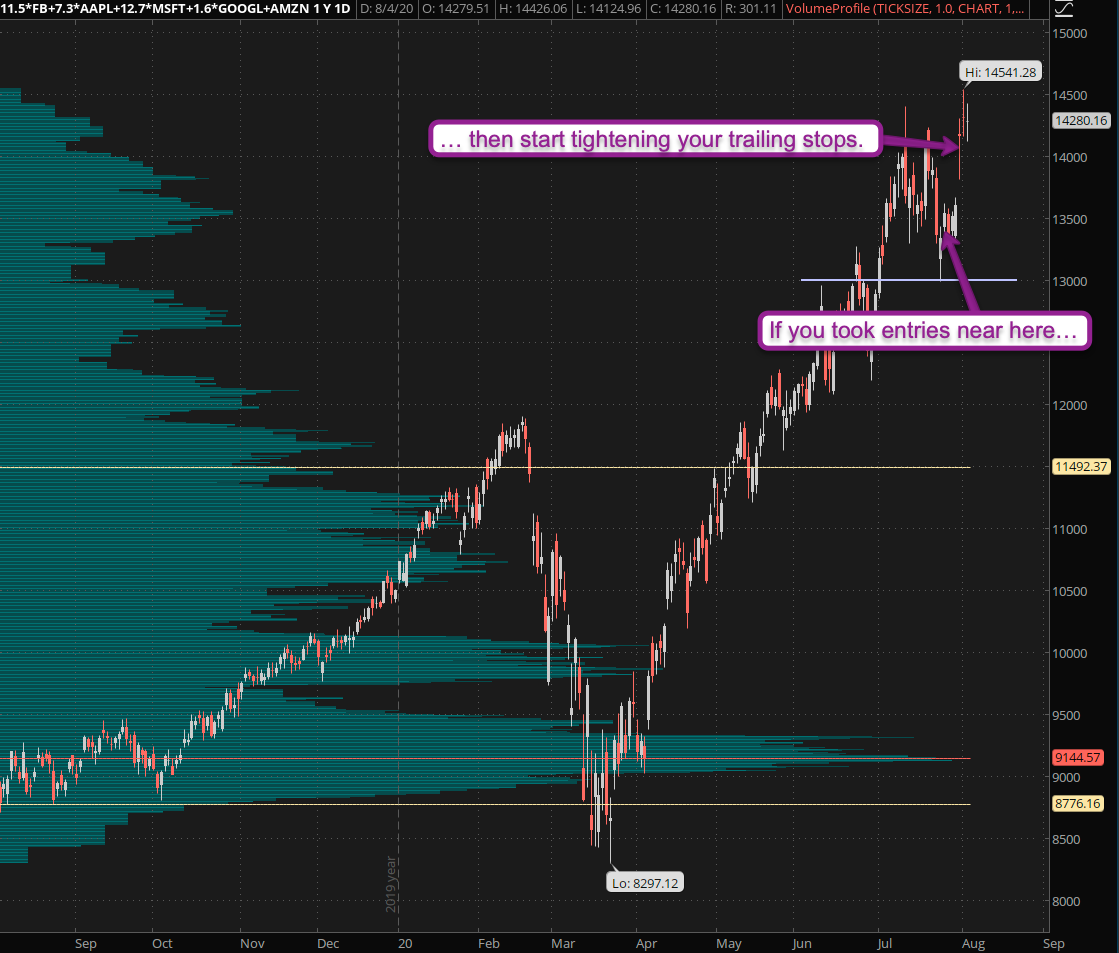

I almost forgot – if you grabbed a long position in any of the big tech symbols I was pimping a week ago then good for you but it’s time to starting tightening your trailing stops. Don’t get greedy and live to trade for another day.