If this market is freaking you out a little right now you are in very good company. Yes I’m talking about myself of course but my lack of modesty comes with a disclaimer: Unlike most of the muppets drawing lines on charts I have evidence to back it up whereas the retail brigade is eternally focused on the rear view mirror, a.k.a. historical price or volatility.

And frankly right now I wouldn’t blame you given that the SPX has now closed lower six sessions in a row with no floor in sight.

That has NOT happened in a very long time. I could run the stats but just off the cuff it must be at least a year or two.

The big question you ought to ask yourself of course is this: Does it really matter?

I mean the odds of six consecutive lower closes are pretty low but on the upside the odds of a seven is a LOT lower.

Meaning we could see a bounce as soon as today or tomorrow. That’s NOT what I’m worried about though.

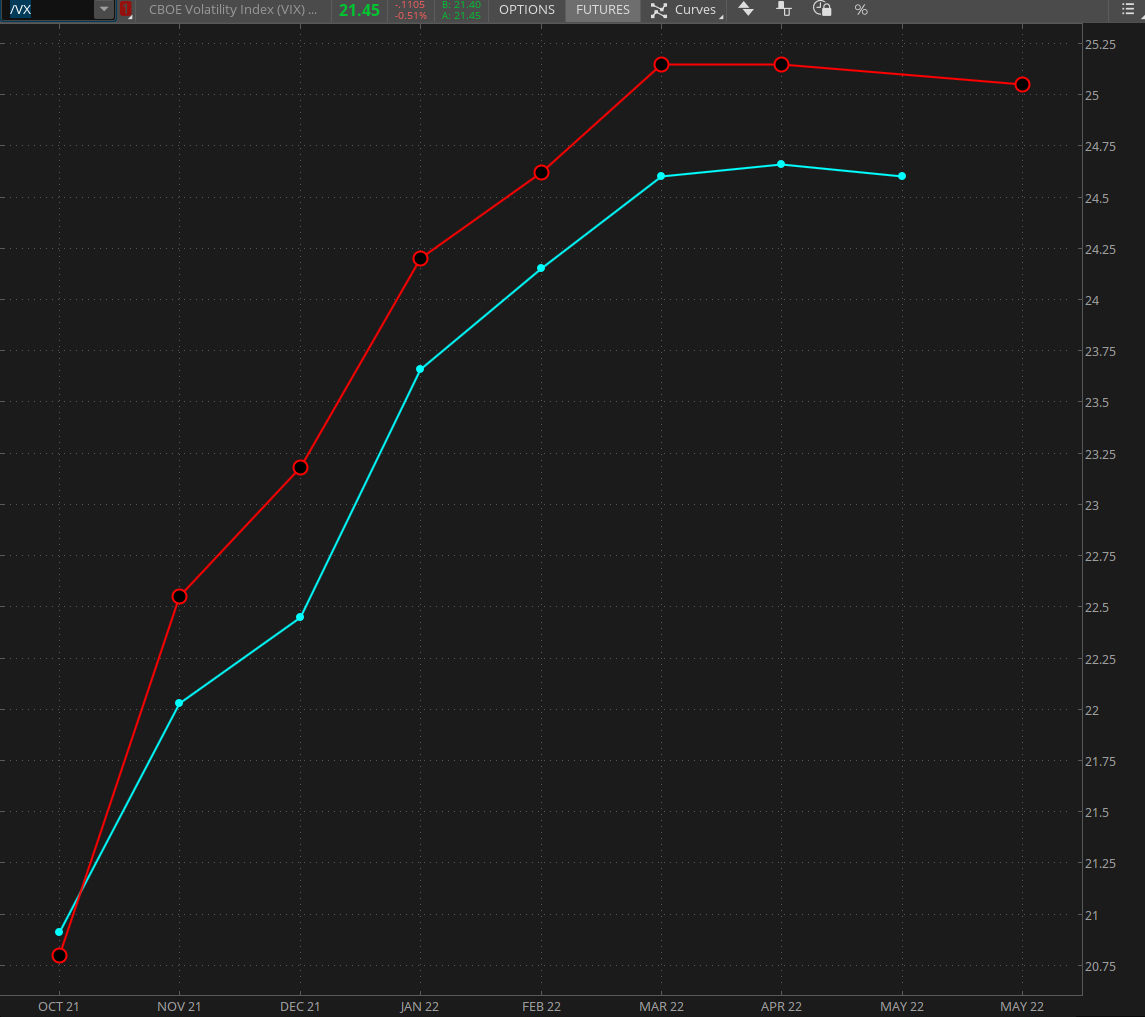

THIS is. In case you are not a sub (shame on you) what you are looking at is a graph of several VX futures contracts starting in October (the current front month) and extending all the way into next May.

Oh my, how I love May…. only eight months more to go.

Anyway, there is something very disturbing about this chart: The lack of bearish sentiment.

Yes you heard me right.

And if you happen to know how to read and interpret the Implied Volatility Term Structure (IVTS) then you are most likely in agreement.

Because what you ought to be seeing right now is something more akin to a horizontal line, perhaps even an inversion which is commonly referred to as backwardation.

But what we are seeing instead is contango, and not just regular vanilla flavored contango. I’m talking contango with jalapeño and pepper sauce sprinkled on top.

In case this doesn’t make much sense to you let me put it in very simple terms. The term structure in the VX futures shown above suggests that market participants are completely discounting the possibility of a large scale downside correction.

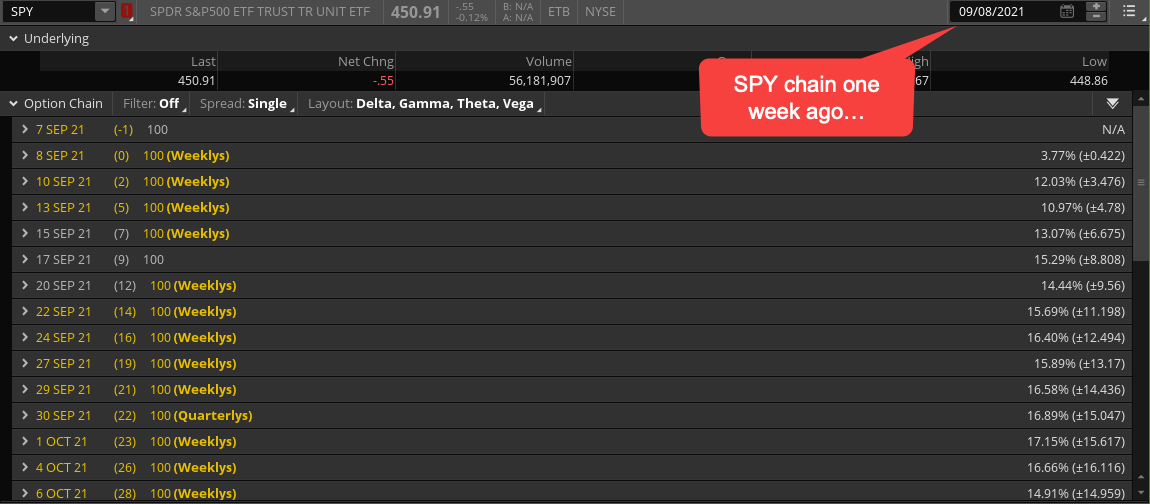

Options on the other hand are being priced with a higher premium compared with a week ago. This the SPY option chain from last Wednesday – note the IV percentages on the right.

Same chain today. A jump from e.g. 15.3% to 18.5% on e.g. the Sep 22nd contract may not sound like much but believe me, it’s significant.

To be frank: I don’t know WTF is going on here. I love to sell inflated premium but something really irks me about the stock market.

It’s sending mexed missages. Feels like dating back in high school again.

If we take a step back and just consider for a moment how far we have come in the past 18 months…

I mean it’s nothing short of mind boggling. I see two serious attempts at a correction and both failed. Since about a year ago the market has been on cruise control and there seems to be no end in sight. 5k by Christmas? Why not? Let’s just keep printing.

And it’s exactly that type of complacency that makes me nervous. Don’t get me wrong, I’m happy to participate and ride this turd higher but I don’t have to like doing it.

Which means I am keeping my exposure small and focus on charts that actually make sense to me. Say what you will about bitcoin and crypto in general but nobody is printing that one into oblivion.

Plus a coin that always falls on the same side side may be good for party tricks but everyone knows it’s crooked and nobody in their right mind would accept it as legal tender.

Happy trading but keep it frosty.