If there’s one salient lesson I have learned in my life it’s that most people are completely wrong most of the time, especially when it comes to assessing the importance and future outcome of current affairs. I know this may sound somewhat elitist but it’s an all encompassing observation I have made on numerous occasion in my life, and as such it has become a core tenet that in year’s past has saved me from financial ruin many times over.

So when I look at the firehose of histrionics and brinksmanship surrounding the military conflict in Ukraine I can’t help but take step back and pause. Far be it from me to offer any opinions on that particular train wreck. Instead let me propose an alternative perspective, which is to basically ignore it all and simply focus on the price action. As the old saying goes: Money talks, bullshit walks.

So let’s do just that. Irrespective of headlines galore suggesting valuable tips of how to survive the impending nuclear winter equities across the board have embarked on a sharp bounce – along with the USD by the way.

The take-away lesson for all of us apparently seems to be that a possible direct and potentially nuclear conflict with Russia is bullish for both the U.S. Dollar and equities at the same time. A notion I have a hard time wrapping my head around, but effectively that’s the entire point of this post: DON’T!

Attempting to guess and second-guess how any of the incessant crisis, turmoil, and growing chaos we have experienced over the past 20 years may affect our lives has been a giant exercise in futility. Case in point: Had I shown you a collection of this month’s headlines just a little over two years ago you would have probably told me to stop reading Alex Jones and get my head examined.

Rightly so but it just goes to show that the only way to survive and prosper in a period of growing societal and political upheaval is to be nimble and to take anything you may hear or read with a truckload full of salt.

Another key requirement to financial survival in volatile times is to focus on a time tested and highly reliable arbiter of truth which is PRICE. Yes it will often attempt to deceive and seduce you into making bad decisions but in the end the truth always always reveals itself.

Last Friday’s wipeout for example was quickly reversed for no real apparent reason whatsoever. From a purely technical perspective this can be positive but it can also be very negative in that early bear markets often are marked by violent snapback rallies.

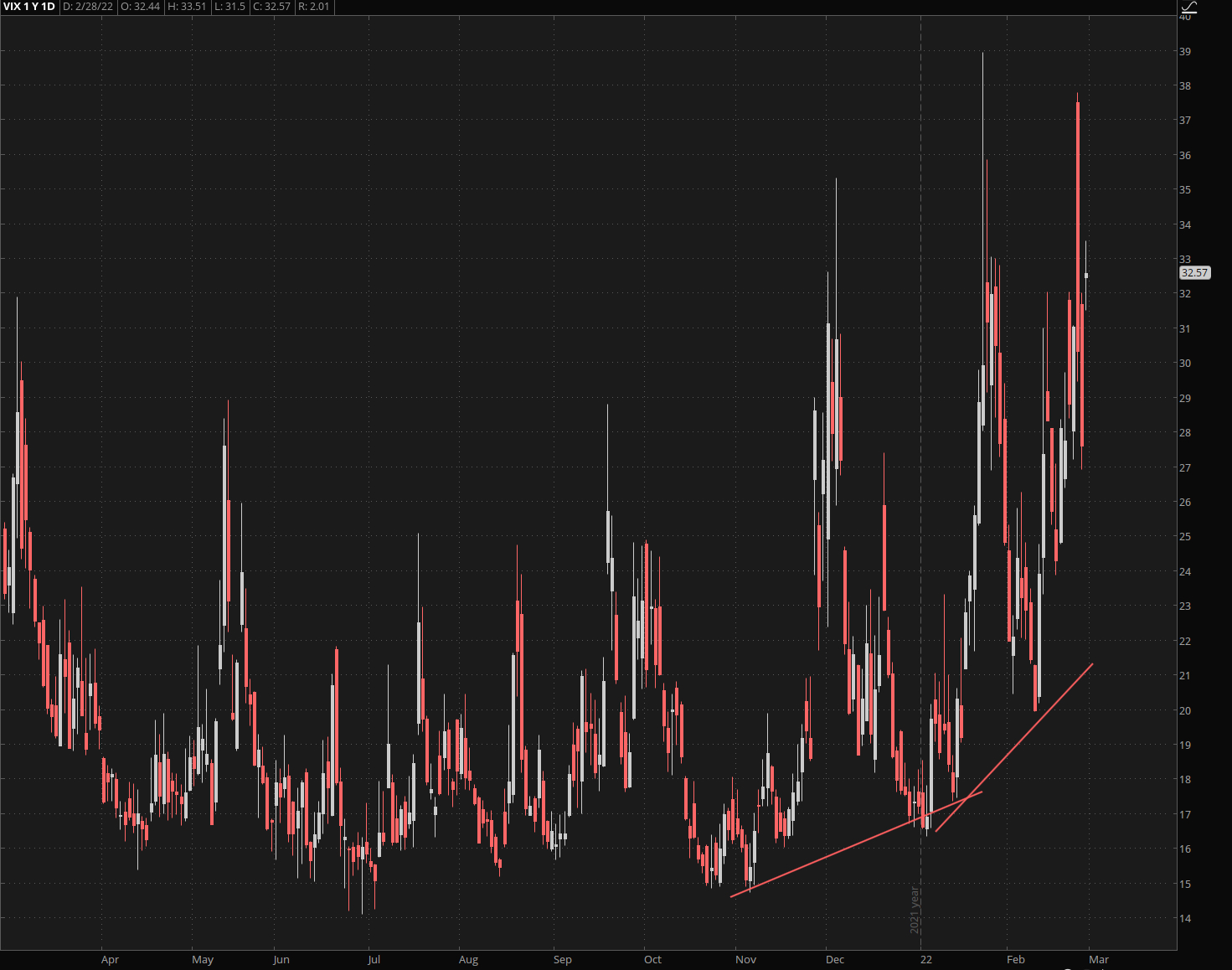

The trick lies in knowing how to separate the wheat from the chaff, so to say, which can easily be done by looking at implied volatility in its various incarnations. The VIX for example gives us a pretty good understanding of how risk is being priced. To that extend it acts like a fear index.

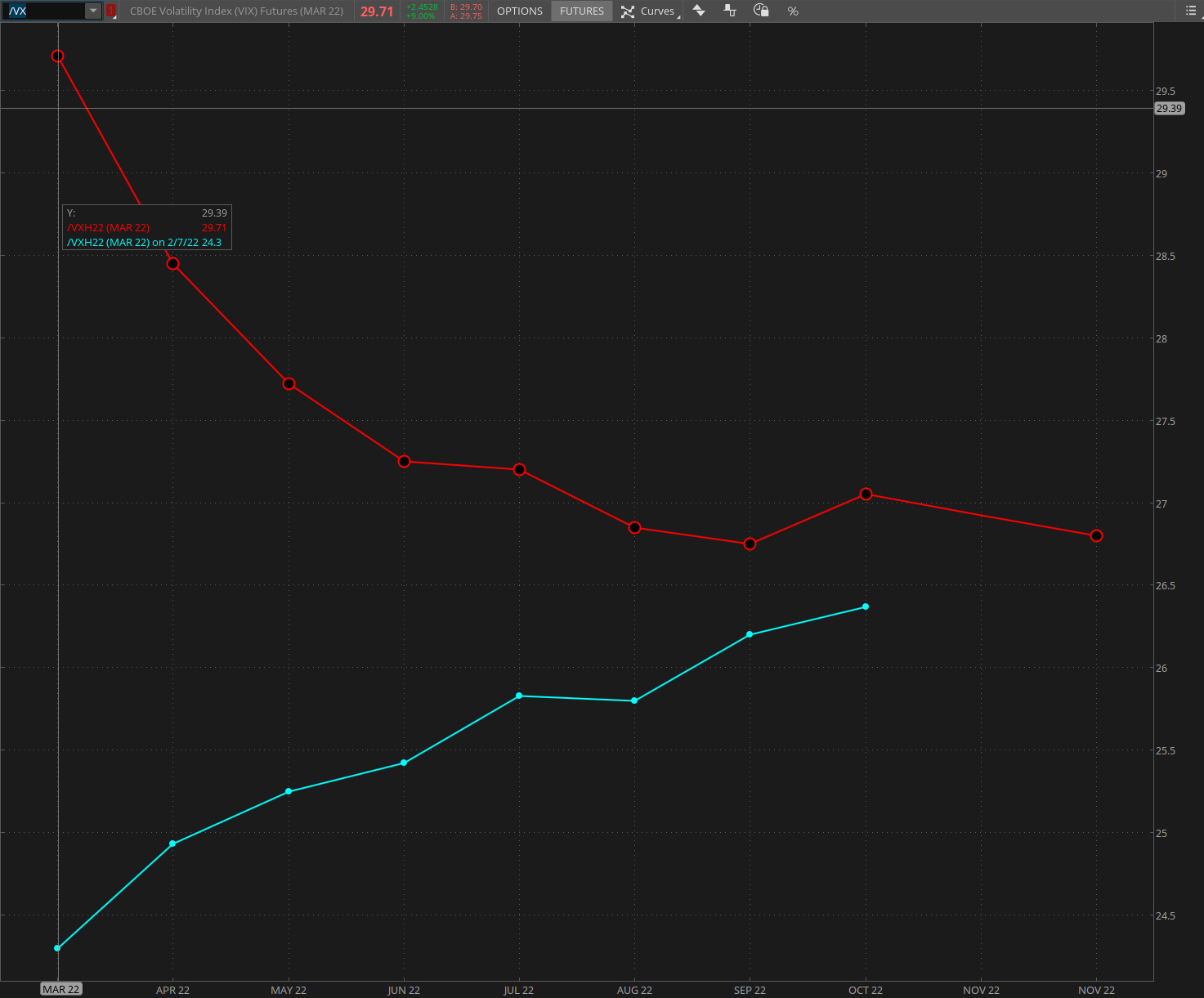

However it’s not a 2-dimensional measure as sentiment not only evolves over time but also projects forward in various ways. What I mean by that is that just by comparing by how risk is being priced today vs. how risk is being priced e.g. two or three months from now I can get a pretty good view as to the attitude of the market.

And despite the current bounce in equities option sellers are anticipating big trouble ahead, evidenced by the fact that VX product depth remains in very steep backwardation.

Nevertheless the VVIX – the volatility of implied volatility has dropped significantly and has now receded back to its current rising baseline. Perhaps that is one of the cases when fear is perceived as having peaked and a collective expectation of at least a dead cat bounce.

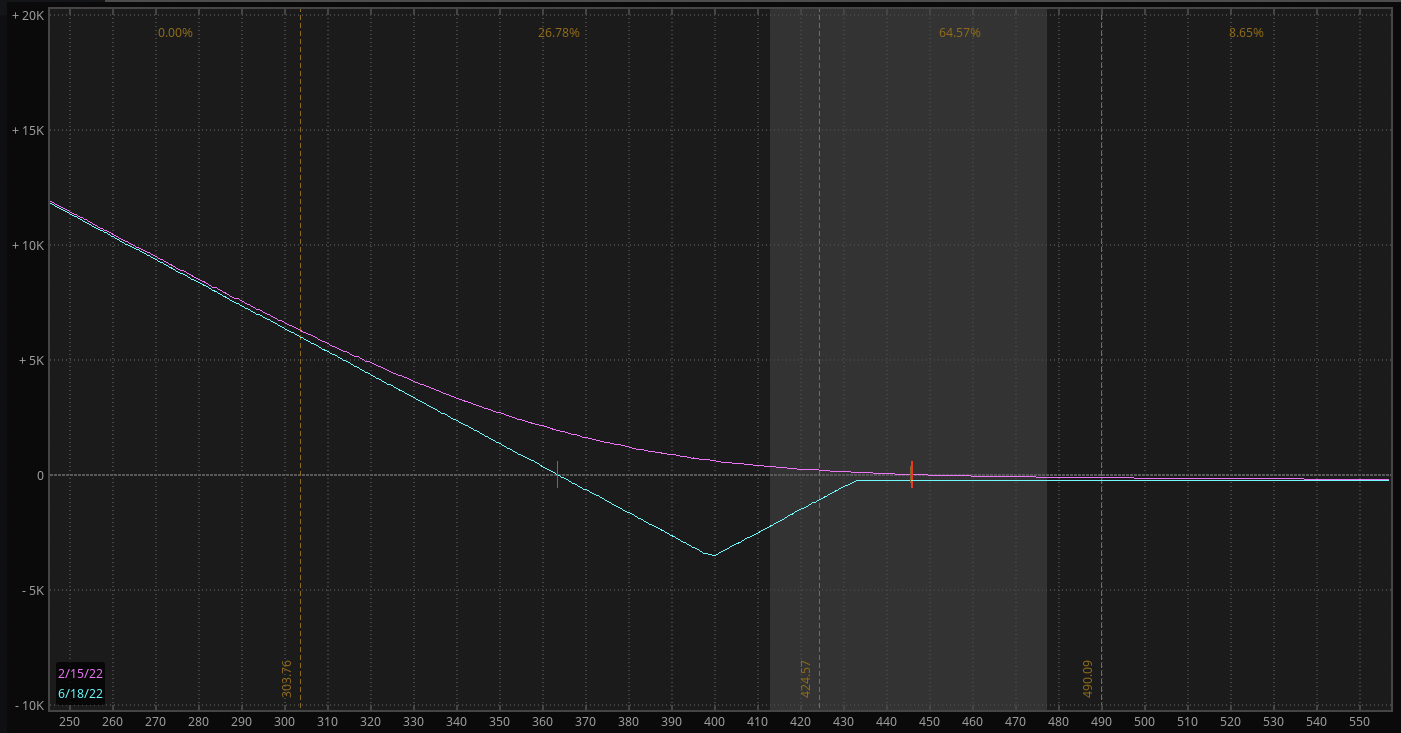

On Friday I expected a reversion to the mean last week and sold an ITM VXX spread in anticipation of a drop in IV throughout the current week.

However the current reading near the Monday open is significantly higher, which suggests that we may see yet more drama ahead.

In case you wonder – I am sufficiently hedged on the downside as I wisely accumulated longer term bearish options spreads over the course of February.

Wrapping things up with the situation over in cryptolandia. Well let’s not sugar-coat it – it’s been pretty ugly since late last year, although more serene over the course of last week. Which is very promising especially as it is also holding the $34,000 mark despite a ramp in the Dollar.

Nevertheless what I have said for weeks now still holds true today: Bitcoin needs to hold $30,000 at all cost or it may end up falling off the plate. Curiously I keep seeing massive accumulation on parts of the whales, and perhaps that is the reason we seem to be painting a floor above that $30k mark, albeit slowly and painfully.

Bottom line: We live in volatile times and that both spells risk but also opportunity. My modus operandi, as usual, is to fade public sentiment and focus on conservatively selling risk while fear runs high. Once the obligatory bounce has materialized continue to accumulate more downside protection.

Any attempts to trade on direction in the current environment is all about guaranteed to take you to the cleaners.