While the SPX has been retesting overhead resistance big tech (e.g. MSFT, AAPL, AMZN, GOOGL, FB) continues to linger near recent support levels. That’s a bit surprising given that the NDX immediately surged higher on Tuesday. Whether or not we are looking at sector rotation again, this retest offers us a short term entry opportunity with very defined risk. Just the way we like it.

Let me give you quick 10,000 feet perspective first. A week or two ago I quipped that anything above SPX 3235 was gravy in that this threshold delineates our final hurdle which is the big opening gap we recorded on February 24th.

It’s been a turbulent six months since that day and I have an inkling that the remainder of the year won’t be exactly tranquil either. In any case a push through SPX 3235 and above SPX 3330 puts us in earshot of our all time high at 3393.52. Failure here most likely drops us back toward SPX 3000 and possibly below. Since it’s summer I wouldn’t hazard making any directional predictions.

This is my own composite index comprised of the symbols I quoted in my intro. Since there are wide differences in price I’ve added an appropriate coefficient to each symbol to make sure everything is well balanced.

As you can see the current spike low is in the process of being retested and the outcome will most likely decide whether or not BT continues higher from here or if we are going to see a more thorough downside correction.

We are unable to trade my composite but what we can do is to assemble a mini portfolio by spreading our exposure across several symbols. In plain English – if you want to devote 1R to a long position in big tech than divide that amount by the number of issues you want to trade.

So let’s say your trading account commands roughly $100k and you decide to risk 2% on a bounce in BT. That’s $2,000 which you then divide by the number of issues you intent to buy. To bring the number of shares into alignment I suggest roughly the following distribution:

11 x FB

7 x AAPL

12 x MSFT

2 x GOOGL

1 x AMZN

Follow a similar approach if you are trading options.

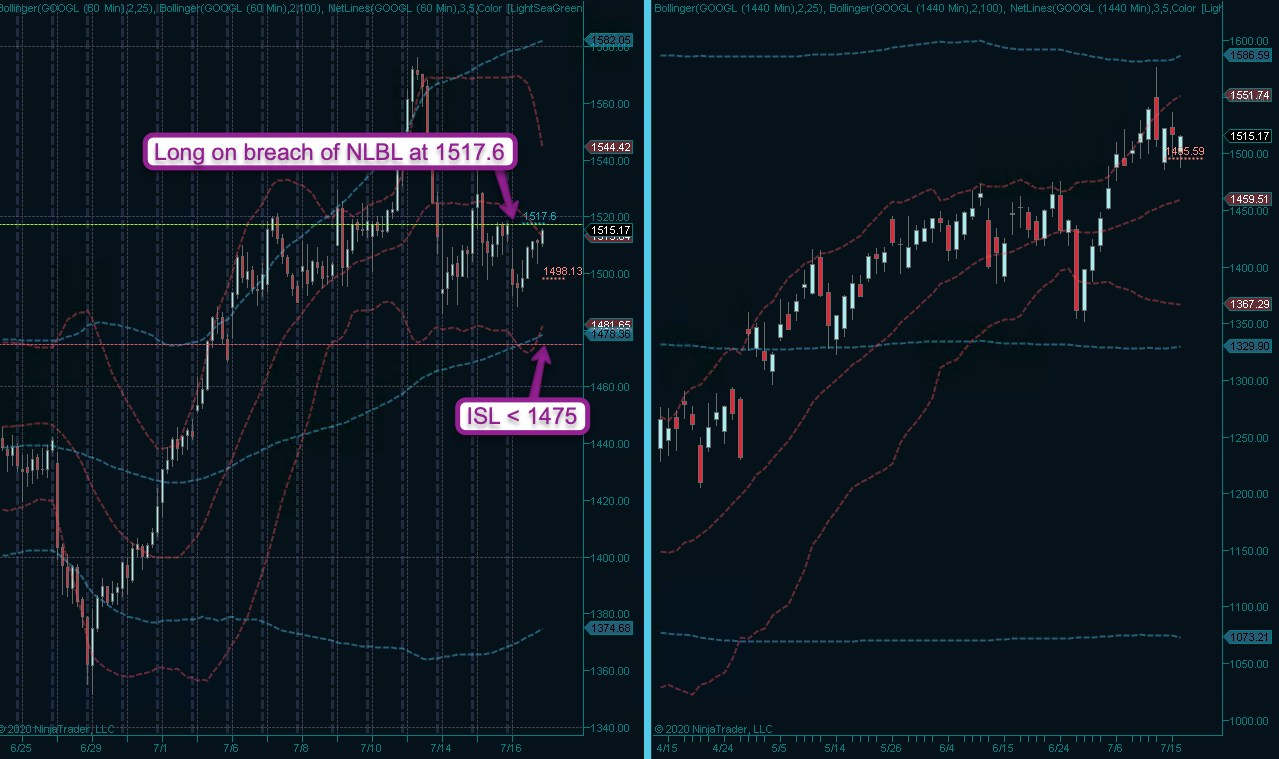

Now just like your friendly neighborhood drug dealer I’ll give you the first one for free. GOOGL is painting a very interesting formation and if it breaches 1517.6 I’ll be long with an ISL < 1475.

Again with options we obviously do not use stops – our R size is the entire debit we risk. If you go that route I caution you against buying naked calls and instead propose you use an In/Out spread instead, which gets you some theta for free.

If nothing else any type of vertical spread will insulate you from vega squeeze would most likely occur should GOOGL shoot higher.

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.