/unpopularopinion: Once again retail buys the top and sells the floor. There – I said it.

And believe me, I wish I was wrong. But unfortunately it’s a phenomenon I have covered repeatedly going all the way back to mid 2008, several months before Bitcoin was even created.

Meaning it’s not anything specifically related to crypto, stocks, real estate, or any other cyclical market where large amounts of money are involved.

It’s simply how most people’s brains are wired.

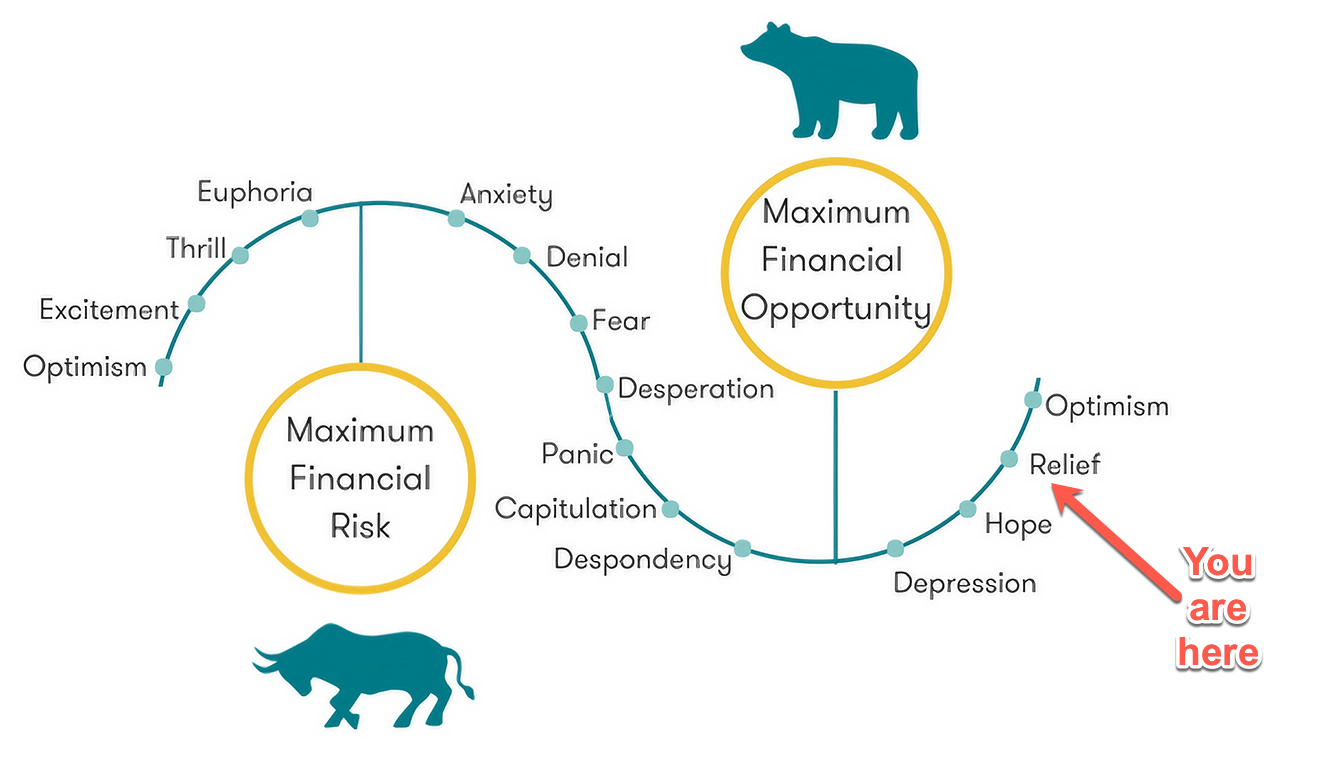

Case in point the market sentiment graph above which has been circulating out in the open since the Internet became a thing.

So it’s not exactly a secret only shared during elaborate rituals amongst a small cabal of market insiders.

Fact is: Large groups of people generally act collectively and shadow each other’s perspectives on a particular matter.

Oh you want actual evidence? Glad you asked!

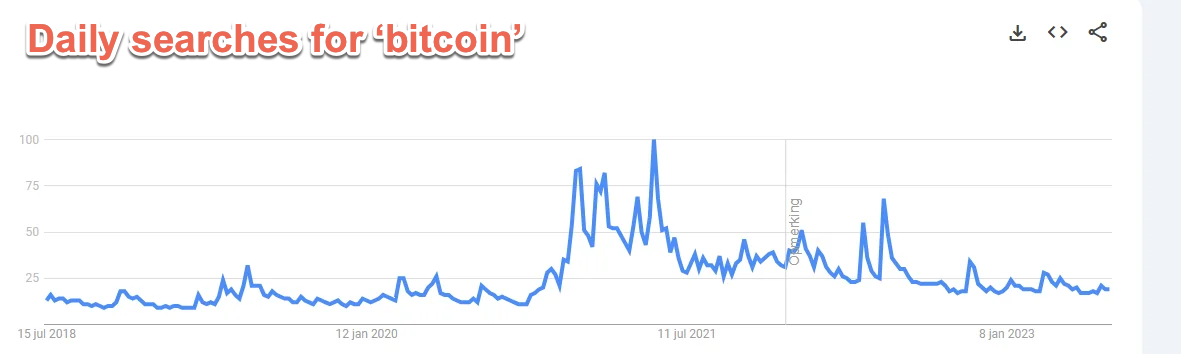

Exhibit A: Daily Google searches for ‘bitcoin’ between 2018 and the present.

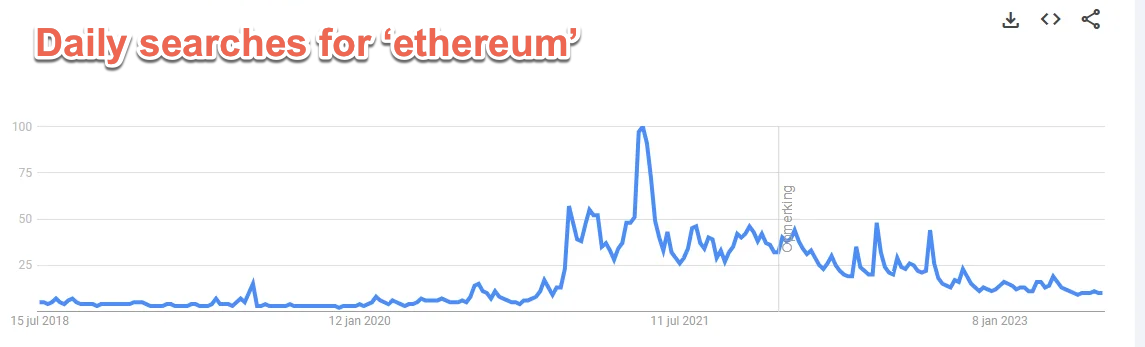

Exhibit B: Daily Google searches for ‘ethereum’ between 2018 and the present.

Clearly excitement for all things crypto amongst the general public exploded in mid 2020, peaked about one year later, and has slowly been eroding ever since.

And that’s exactly what I was hoping would happen. In fact I have been waiting for it.

Say WHAT??

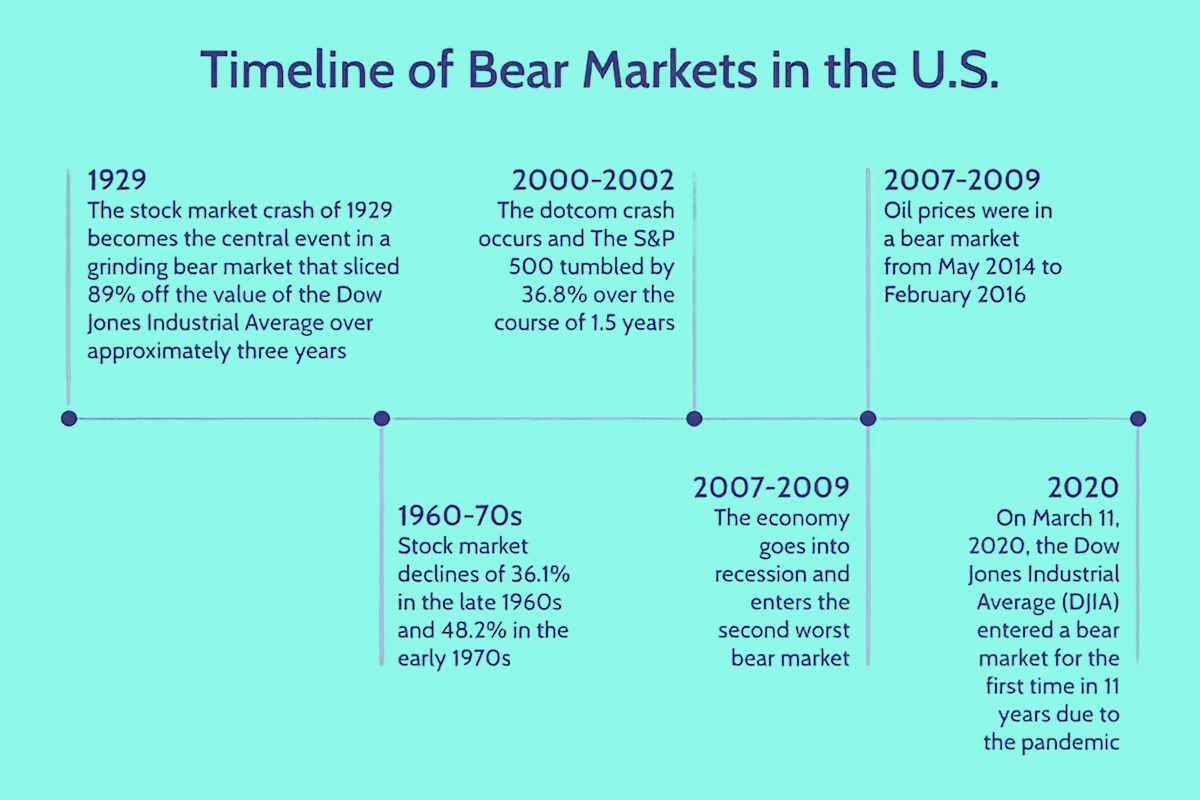

Well, it’s quite elementary, Holmes. For a secular bear market to find a final floor the vast majority of participants have to walk away in disgust.

There is no other way.

This has spelt true for well over century now and is evidenced by 14 minor and 6 major bear markets between 1929 and 2023.

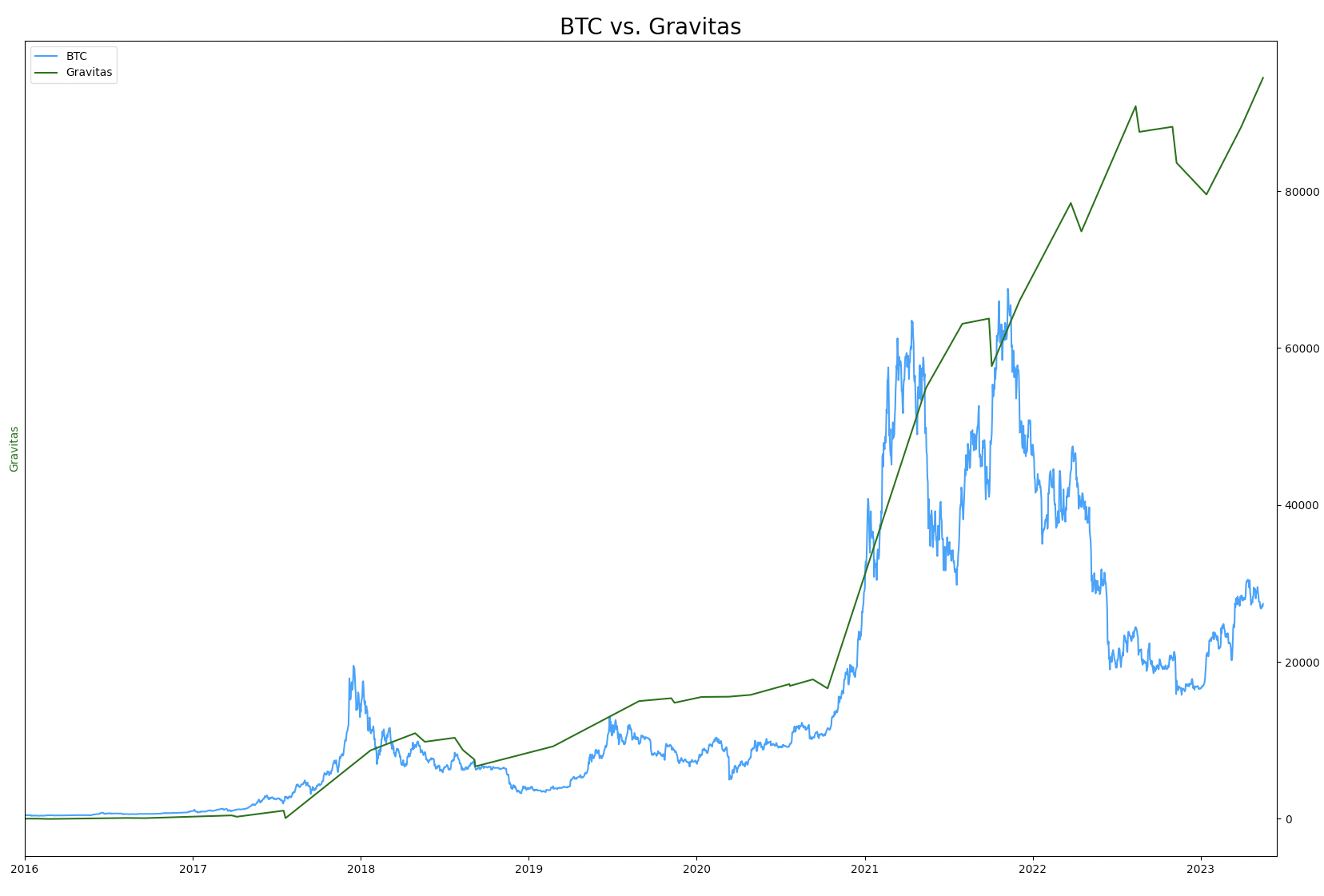

Now having set the stage let’s take a fresh look at our long term Bitcoin chart.

The area I have highlighted happens to be the last time public interest in bitcoin (and all crypto) was this low.

With that in mind, let me ask you a question:

Where in the sentiment cycle do YOU believe are we right now?

Yes, it’s a loaded question.

But it’s one every single one of you should be asking themselves

Reason being: Bitcoin already did a 2x since the lows in 2022 and Ethereum did a 2.4x.

The total crypto market cap did a 1.73x.

Not only did we bounce hard since 2022, there’s a mountain of bullish narratives brewing (which I have reported tirelessly). The next bitcoin halving in April of 2024 is just one of them.

Most notably, there’s been an explosion of institutional interest, as evidenced by new exchanges and ETF applications led by large financial institutions such as Blackrock, Fidelity, Citadel, BofA, Charles Schwab and many others.

Yet despite all that retail interest is almost nowhere to be found. Clearly the 2022 bear market and all the media narratives have scared most of them off.

It seems that once again retail is destined to miss out on the next jump higher, only to come in and end up buying the top.

Well, not on my watch, that’s for sure.

I don’t care if you sold the lows, bought the highs, or the inverse. That’s in the past and has no bearing on what happens moving forward.

Here’s a golden rule of mine: It doesn’t matter where it’s been. All that matters is where it’s going.

Now go back and read that again. Maybe one more time after that because if you want to succeed in this game it’s absolutely crucial that you change your programming.

I’m NOT saying the past doesn’t matter – in fact it does. The present is always a product of what has occurred in the past.

But you can’t let the past become your mental template for what happens in the future.

All signs now point to a massive explosion in the crypto market over the course of the next year.

I for one am well positioned for that.

Are you?

If not then here’s a great way for you to get back into the game, ahead of the crowd, and in time for the next leg higher.

You don’t need a perfect entry, all you need is a good enough one.

And that’s what Gravitas is really good at. Plus it’s a long term signal, at the very most you take action once per month on average. Perfect for the busy operator.

Besides, the results speak for themselves, so if you’re interested shoot us a message here today and we’ll get you set up just in time before the next leg higher.

Happy trading.