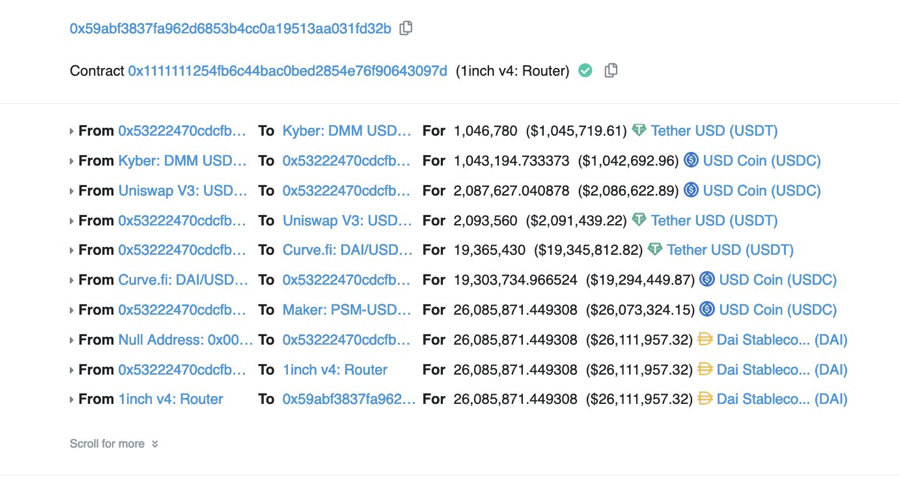

The RCC defines purgatory as a temporary place of “purification”, necessary to enter the joy of heaven. That is exactly where the crypto market finds itself right now. Top contender for the most punchable face of 2022, SBF (or someone on the inside with him) allegedly hacked the remaining half a billion worth of client funds over at FTX.

He then transferred the funds from both FTX and FTX.US, launched a trojan on the FTX app (important: do NOT update app if you get a request)… and immediately started washing those funds into coins that can’t be seized easily.

And it doesn’t end there. Internal investigations at FTX reveal that SBF apparently installed a “backdoor” in the company’s book-keeping system, allowing him to alter the company’s financial records without alerting external auditors.

That setup meant that the movement of $10 Billion in funds to Alameda did not trigger internal compliance or accounting red flags at FTX.

Frankly I cannot remember such a train wreck bankruptcy EVER including Enron, Madoff and Mt Gox. This truly and utterly takes the cake.

And frankly I just don’t get it.

With seed deals, insider information, everyone’s positions and stop losses and order flow to front run how the hell do you manage to LOSE money?

Seriously! HOW?

And then this mofo still pretends to be all about protecting the customers. Gag me with a spoon…

The internet is following his private jet as it literally flees to Argentina – you just can’t make this stuff up.

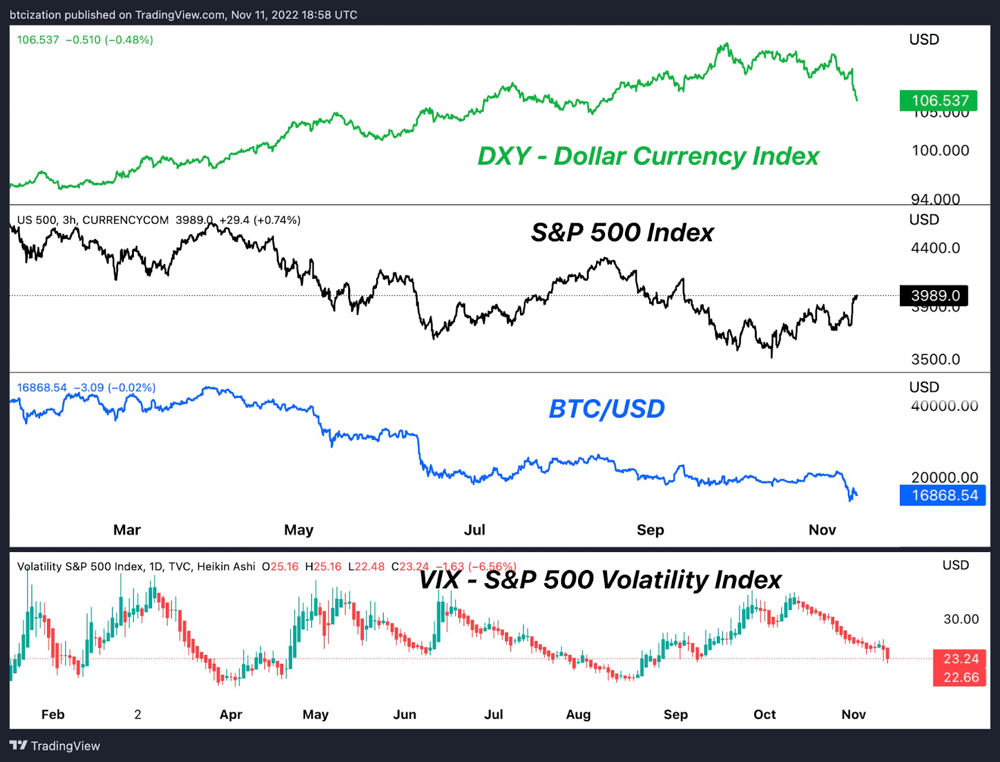

Meanwhile stocks are blasting higher, there are glimmers of hope on the inflation front, oil is cheaper again and the dollar has pulled back a bit.

What do you think is going to happen next time the TradFi markets crap the bed?

This crash is NOT OVER, we are just getting started.

There are no bailouts coming. Market makers are all broke.

Liquidity will be extremely thin… perfect conditions for a crash to lows nobody thought possible.

Fun fact. 19.6% of Crypto.com’s reserves are in Shiba Inu.

But NFT’s are holding up surprisingly well (say WHAT?)

Anyway, enough of that… let me get to what I really wanted to talk about today.

For our Thursday Wealth Creation Summit we have gathered some of the finest trading minds on earth to talk about the challenges and opportunities we face over the next decade.

It is my hope that we give you some of our slam dunk trades for the next few years and I’d like to dive a little deeper into HOW I COME UP WITH A LONG TERM TRADE THESIS.

Here’s how I think about it.

We have several possible macroeconomic scenarios that could play out.

I’m looking for a story that makes logical sense… and more than that…

I’m looking for an industry that’s been utterly beaten down for years and years.

Something that’s been through a devastating bear market and THEN a period of such profound boringness that it has been completely overlooked.

Something not hated, but now forgotten.

And then I’m looking for a CAPITULATION EVENT… a short sharp move down (like what is happening in crypto right now)…

And a strong move off the lows to give me strong evidence that all the sellers are shaken out and the bull market can resume.

This is MY method for finding trades you can hold for 5 or 10 years, and I’ll be showing it all this Thursday at our Wealth Creation Summit

The good news is that it’s not just my opinions and my methods.

We have assembled some of the giants of trading to come and share their wisdom…

Laurent Bernut is one of my idols and I’m thrilled to be in the same zoom room as him. He’s a brilliant author, hugely charismatic and funny, regular speaker at Quantcon and with one of the best long term track records in the Japanese Hedge Fund world.

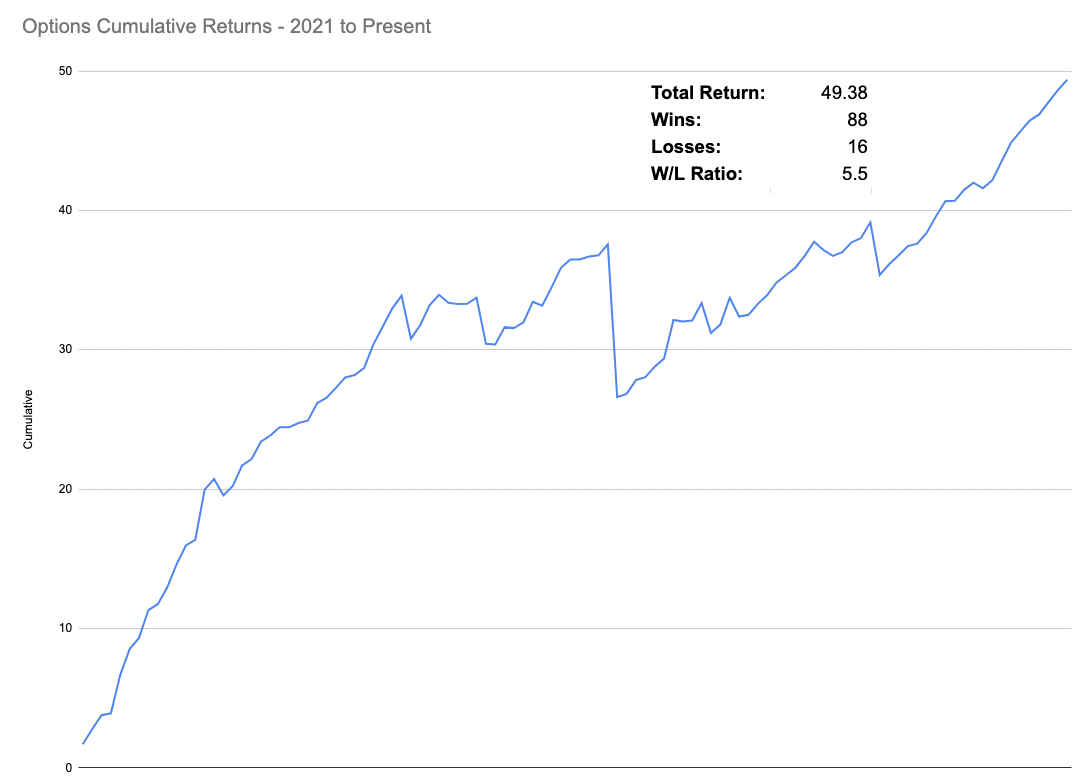

Scott Phillips is one of the best quant traders I know. I’ve collaborated with him for well over a decade and watched him transform from a semi-pro to one of top system traders in the space.

Antoine Rousseauxi s the best Altcoin researcher I know. Consistently unearthing gems for the next cycle, he hasn’t stopped working through the whole bear market and I’m thrilled to see what he thinks are the opportunities for next cycle (hint: the big plays are going to be in DeFi)

Last addition to the rat pack would be yours truly of course.

Many of you know me only as a crypto trader, but nothing could be further from the truth. My background actually is in trading stocks, options, futures, as well as forex.

Above I posted the YTD cumulative returns of my options campaigns – the public spreadsheet can be viewed here.

All of us together we will be discussing the enormous opportunities that this regime change toward a multi-polar economy is expected to bring.

Make sure you register HERE

P.s. If you want a sneaky-peek of our New Economy Bootcamp program… you can’t buy it yet (I’m going to release it for Black Friday with a huge discount) but reply to mikesneweconomybootcamp@gmail.com and I’ll give you a sneak preview.