With both Nord Stream 1 and 2 blown to smithereens Europe is frantically preparing for a winter without enough food or heat and the real prospect of a full scale economic depression.

On the plus side a large swath of the continent is finally going to reach its zero emission targets by next spring after ~40% of its industrial base will have been wiped out for good. Well done!

By the way NS 1 and NS 2 aren’t the only ones that have been blowing up. For some mysterious reason the currency markets do not seem to be particularly pleased with the glorious prospect of a de-industrialized Europe.

Just to give you a bit of historical context, the last time the EUR was trading below 96c to the Dollar was over 20 years ago.

What this means to natgas (i.e. heating and industrial production) and energy cost in general should be fairly clear.

This morning TTF (Dutch natgas futures) is already trading at > $200 and I wouldn’t be surprised to see it > $300 by Christmas.

It’s going to be a cold winter for a lot of Europeans. Not for me though – this is only half of the firewood I just had delivered plus my 1000 liter (264 gallon) diesel tank is filled to the brim. Oh, and I live in the middle of a forest 😉

Like Andy Grove (founder of Intel Corp) used to say: “Only the paranoid survive.”

Literally speaking come winter.

Over on the Western front the SPX finally dipped through its June lows and unless J-Pow and his crew are pulling the emergency brakes we could easily be seeing a 3k print by Thanksgiving.

That right here, boys and girls, is how ‘demand destruction’ looks like in the real world.

Of course as I keep saying – nothing in the markets ever moves in a straight line.

The VIX is now scraping the 36 mark and that means any rumor resembling good news is bound to act as a pressure valve and unleash a counter rip, just to stick it to the bears one last time.

Tough time to be in the market if you ask me.

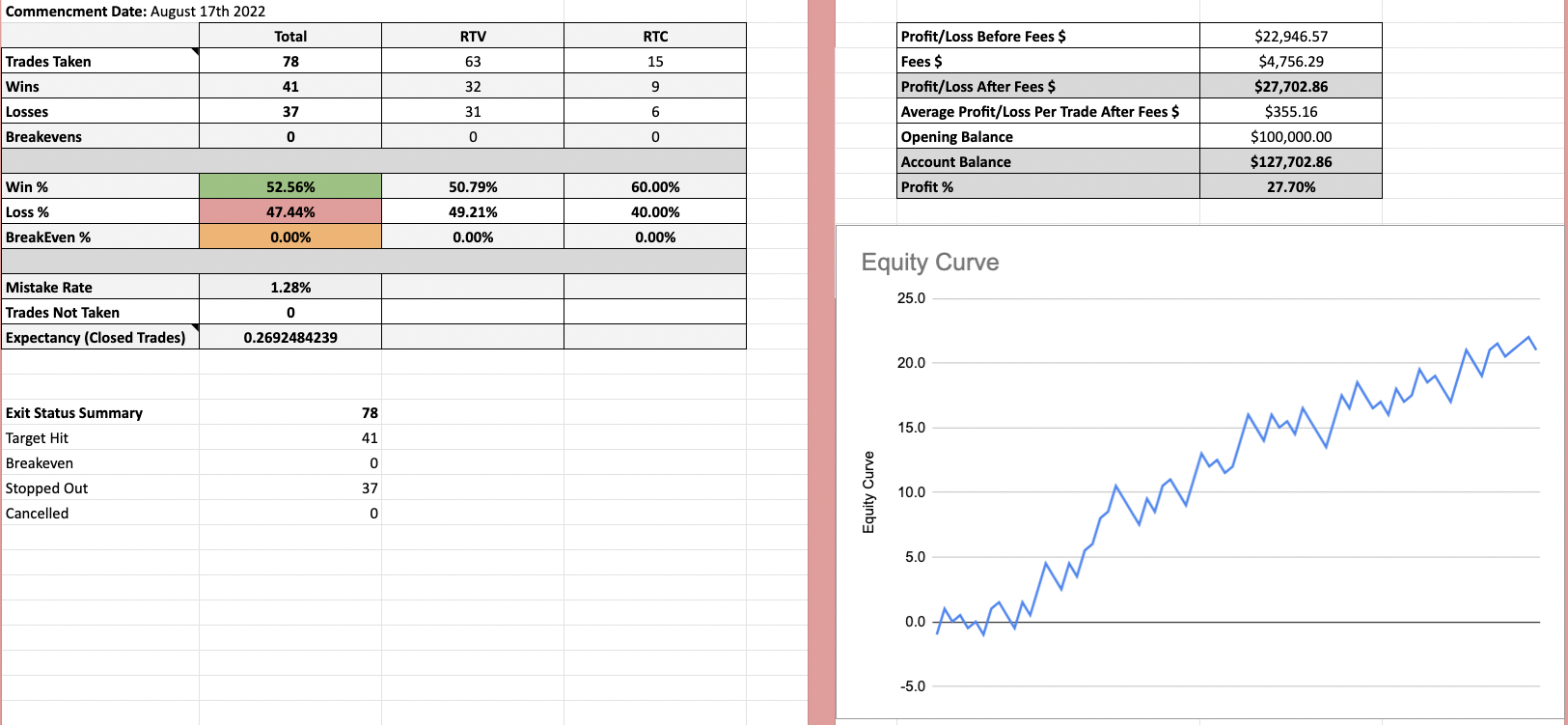

In the meantime the Crypto Salary System continues to be a huge success – as it has been since we launched it live over a month ago.

It now stands at 21R and a P&L curve that looks like it was drawn with a ruler.

Yesterday the market was effectively crashing while the webinar was on so I got to demonstrate how the rules of the system keep us out of trouble on these terrible days.

Pretty satisfying to have everyone else losing money but us to be honest.

Anyway, if you missed it, the recording is HERE

And here’s a 1-pager with everything you need to know

And if you’d like to join us in the upcoming intake, I’d be thrilled to be in your corner and help you build out a successful side hustle income.

CLICK HERE to learn more