I promised you a turbulent trading week and at least on that front the market did not disappoint. Once it was done punching itself in the face a few brave bulls valiantly stormed into the ring and began to smash the referee with folding chairs. In all the chaos and commotion buyers with deep pockets somehow managed to stage a last hour stick save, pushing the SPX back toward 4,420.

I just checked the ES futures and apparently not much ground has been relinquished in overnight trading. And with EOM candle painting looming today there will be a lot of pressure on institutional firms to defend key support levels, lest gamma risk forces massive short buying in the ES futures.

That support level of course is the 4,200 mark – plus 50 handles or so. If that one gives Kansas is by all means going bye bye.

The highest probability scenario right now supports a massive squeeze higher which should encounter brisk resistance once it touches the 4,500 cluster. If an advance peters out around there I’ll be actively looking for some downside protection.

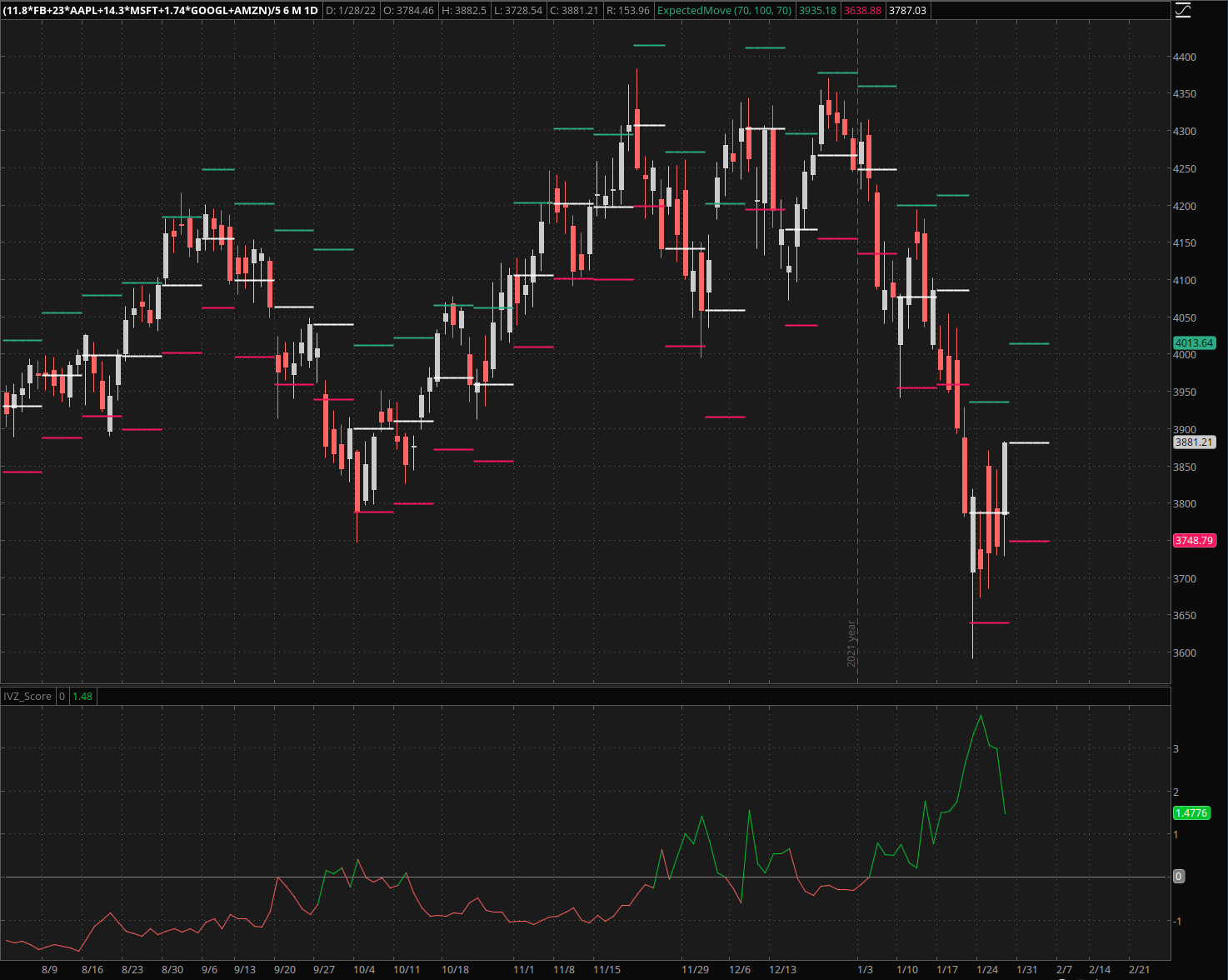

Big tech led the advance, so it seems that Dollar strengthening and a drop in bonds encouraged traders to once again rotate into the big names. AAPL in particular snapped back like a rubber band, so did MSFT – AMZN and FB not so much.

So those latter two are the ones I would be looking for possible short opportunities in the near future, more specifically once a dead cat bounce has reached upside resistance.

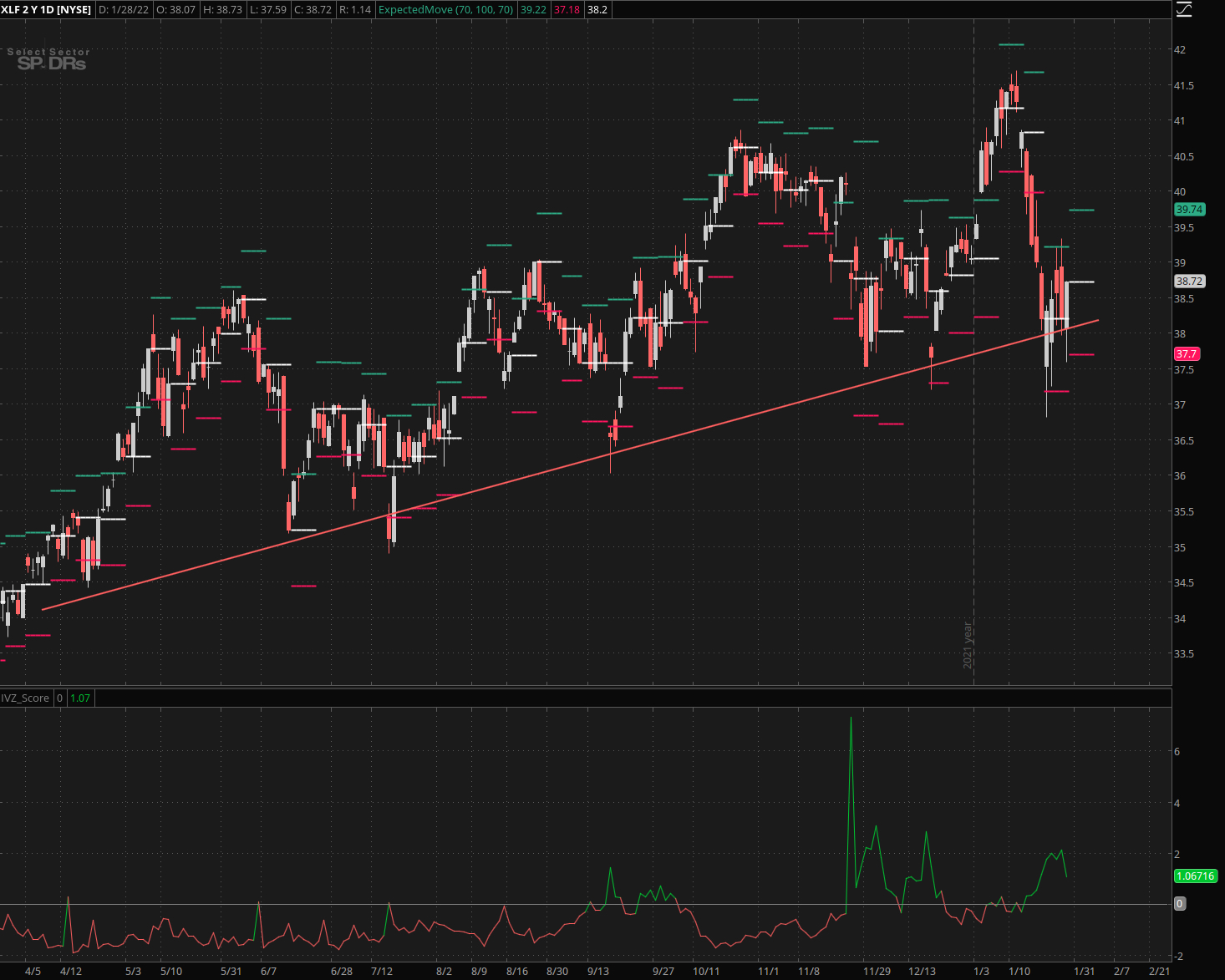

Finance not looking very peachy right now but it’s been pretty resilient over the past three months compared with tech stocks, so here we better choose our short victims wisely.

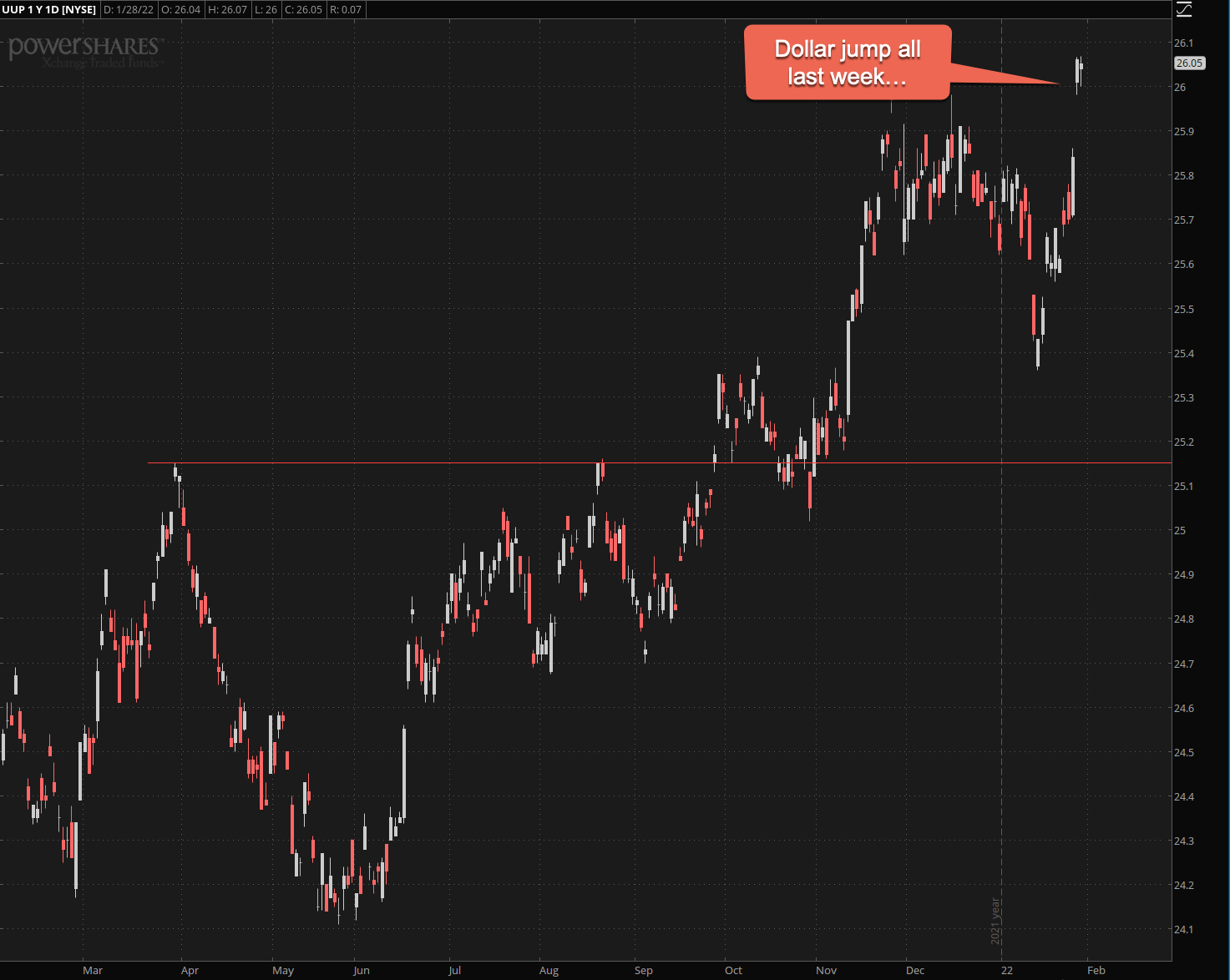

I had mentioned a bounce in the Dollar and because my DXY chart is somehow screwed up on TOS I’m showing you UUP. That’s a massive jump and gaps higher like these usually have a tendency to continue running a while longer.

About bloody time by the way, my last month’s heating bill came out to €570 as natgas prices have gone completely out of control over here in Europe. So every tick higher in the Dollar helps soften the impact.

The 10-year bond futures seem to have found at least temporary LT support, so maybe that’s why we see tech stocks catching a bid again. I should however point out that this support cluster is fairly weak and if it gives way there’s nothing but air below until 124 and change.

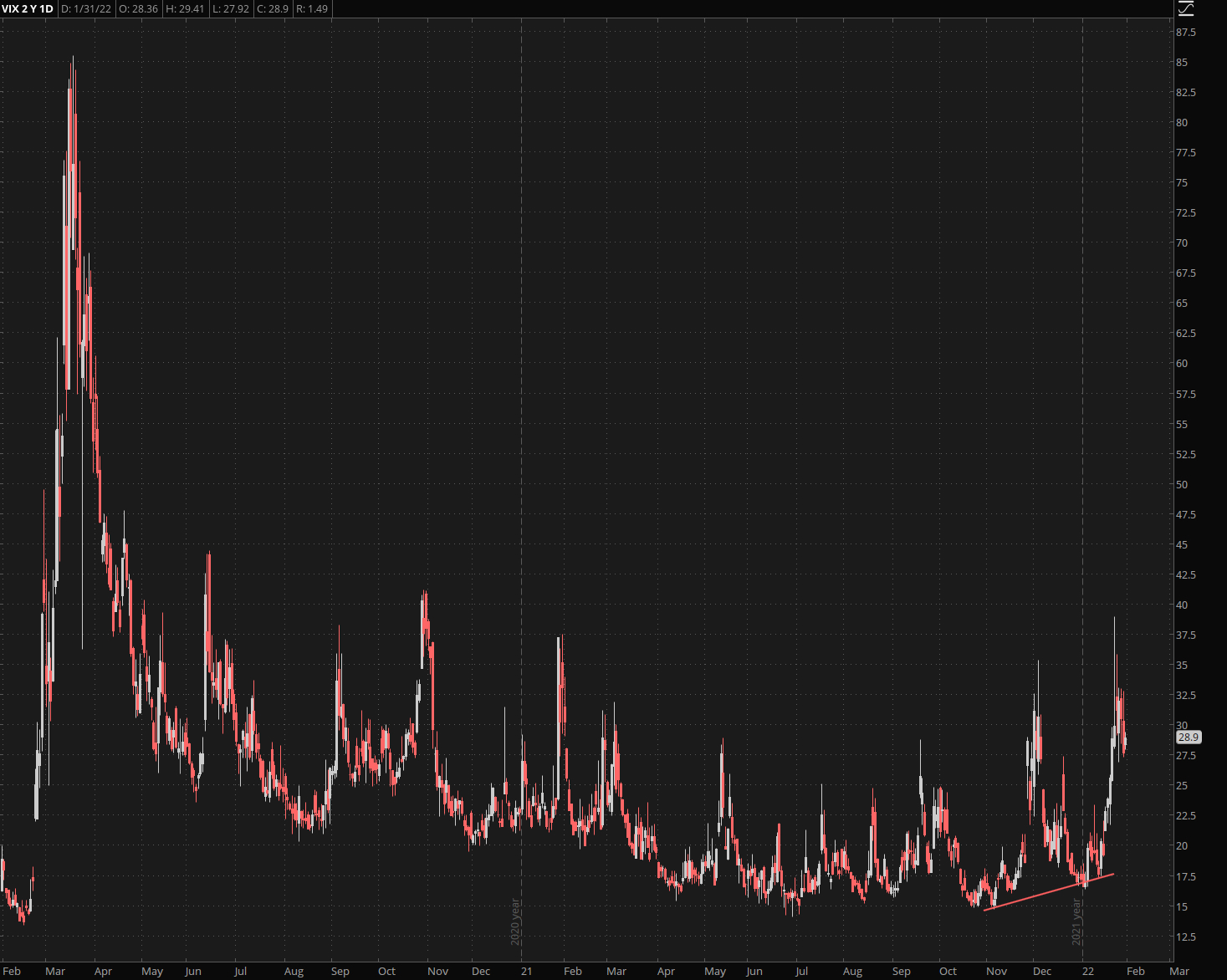

Now the most interesting chart right now is the VIX. I don’t need to slap a 20-day BB on this to see that we may get a VIX buy signal today (relative to equities – so it suggests a bounce). This is also supported by the implied volatility term structure, which rarely disappoints:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.