The weekend fears of a many retail bag holders turned into reality yesterday when last Friday’s sell off was amplified by continuation at the tail end of a lackluster low participation session. The main thought circling around in everyone’s inflamed amygdala right now is whether or not we have reached selling exhaustion or if there will be more follow through in the days and perhaps weeks to come. The short answer to that is – yes, and no.

The long answer is a bit more complicated but let me try to lay it all out for you:

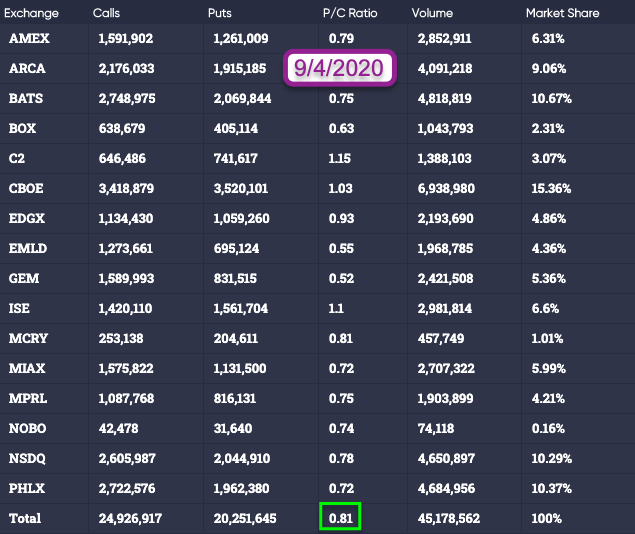

For starters here’s the put/call ratio for equities on Sept. 4th – last Friday – courtesy of the Options Clearing Corporation (OCC). Despite a rather significant sell off that hit big tech pretty hard in particular it ended up at 0.81.

I did actually check various tech related symbols, e.g. AAPL, MSFT, AMZN, etc. and the p/c ratio was a LOT more amplified, which was in line with the fact that that sector had been hit particularly hard.

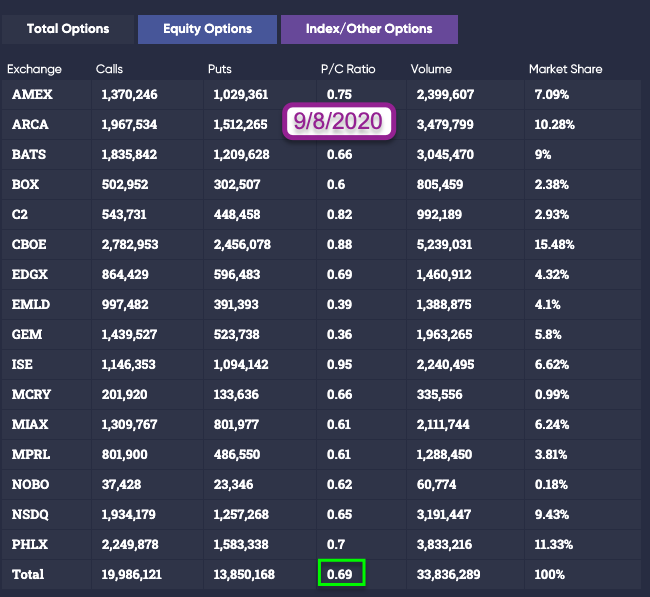

Now contrast that with the p/c ratio recorded for yesterday. Nearly 1/3 more call activity than put activity.

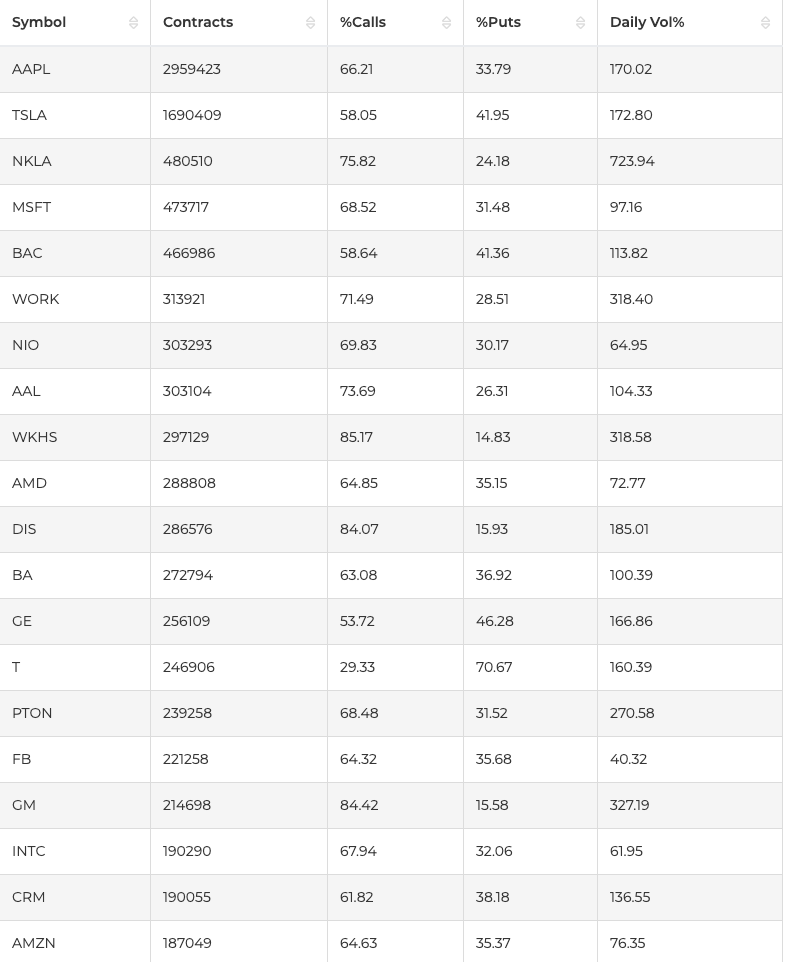

If we look at the most active symbols traded then call activity FAR outweighs put activity. Which is interesting in that almost none of these symbols have recovered. MSFT for one was closing at new lows after doubling last Friday’s losses. So what gives?

SECTOR ROTATION – that’s what. At least a blatant attempt to do so. Which may succeed, we probably know a lot more today (my old ‘follow up to the first follow up’ theory). What I do know is that less demand for put reduces the pressure on market makers (forced to provide them) to sell stock in order to offset their positive delta exposure.

If it succeeds we should see a meaningful bounce materialize either today or tomorrow. If it fails then strap on your helmets as the ensuing delta covering would trigger a veritable selling avalanche.

Now let’s look at a few interesting charts:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.