Well that didn’t take very long. Much to the collective chagrin of the perma-bears (i.e. the majority of retail traders) this effervescent equities market seems to always have another trick up its sleeve. In actuality it’s the same old trick over and over again, but per the time tested maxim: if it ain’t broken don’t fix it.

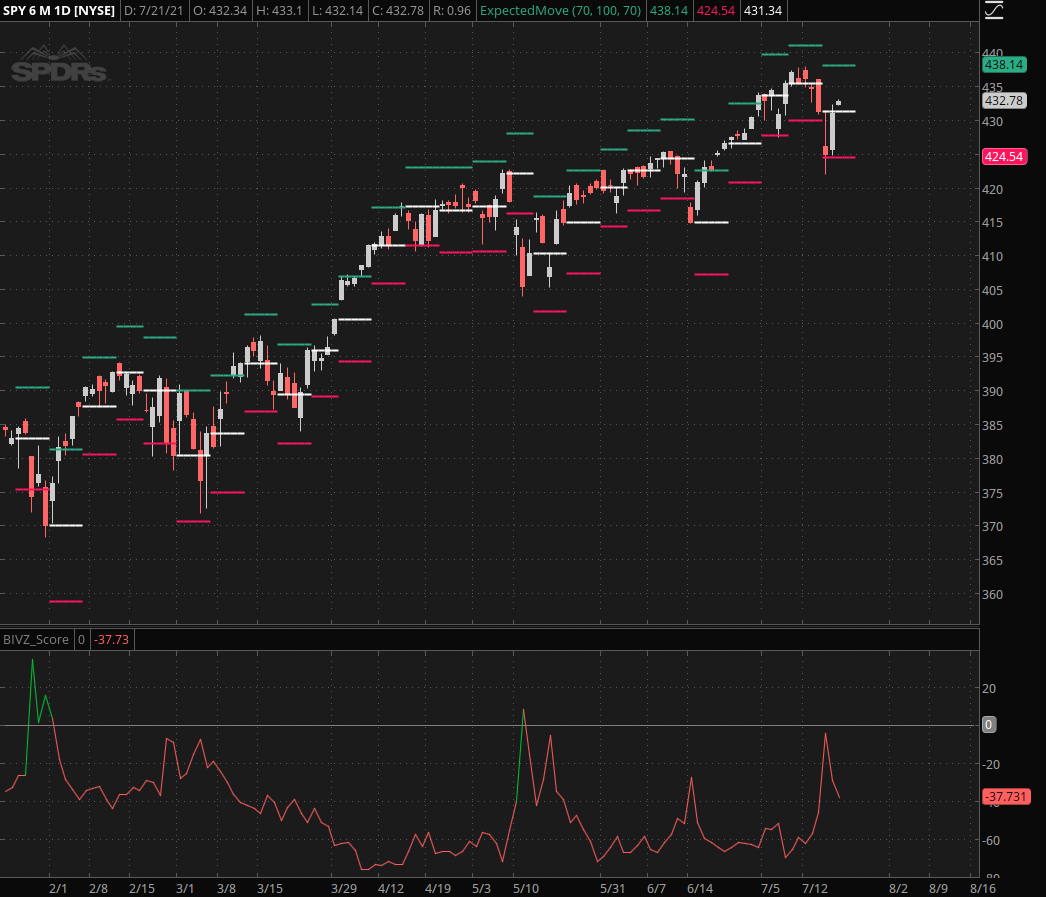

Once again the weekly expected move threshold was instantly defended, which was to be expected but more about that a bit later.

First let’s talk about how the game is currently being played and how it has been played for the past six months minimum.

And the answer to that is: Sector rotation.

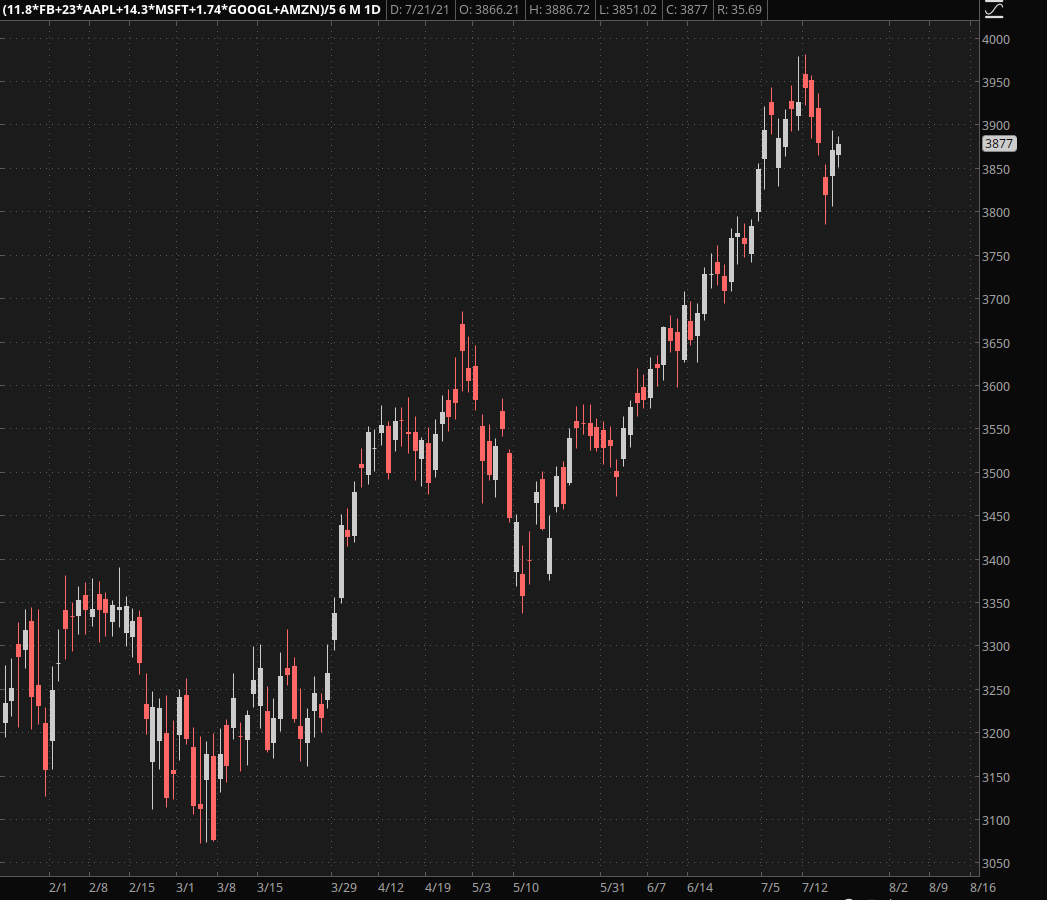

Remember not too long ago when big tech was cruising a wave of buying pressure all the way into new ATHs and beyond?

Well that has come to a halt and the baton has now been handed back to…

You guessed it – finance of course, as shown here via the XLF. Despite being in the proverbial dumpster for the most of the summer thus far it suddenly started to outrun the tech sector.

But why and how?

Meet me below the fold for the answer and valuable tips on how to recognize bear traps like these from a mile away:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.