Remember this quote? “FEAR is the path to the DARK SIDE….. FEAR leads to ANGER….. ANGER leads to HATE…. HATE leads to SUFFERING…. And SUFFERING leads to stupid ass trading decisions you’ll regret later down the line.”

Okay I made up that last part but if Yoda was an investor I’m sure he would have included it.

Take Dark Sidious on the other hand. He’s a smooth operator and sitting through a market correction is basic Sith Lord 101 for a guy who’s able to shoot lightning strikes from his finger tips.

I mean, I’m on board with Baby Yoda and all but I can’t be the only one rooting for Palpatine here, right?

Anyway, in case you haven’t caught on by now: the point I’m trying to make here is about fear. And in particular how to act under pressure when everyone’s running around with their hair on fire.

Exhibit A: Retail rat jacked up on cortisol is attempting to rationalize an emotional decision.

I’m sure you’ve heard of the fight or flight response. Well you can’t really fight the market, so that only leaves us with what?

That’s right: flight.

And it’s flight that happens when investors or traders feel like there’s an imminent threat to their trading accounts.

Emphasis being on ‘feel like’ because once fear finally sets in most of the damage usually has already been inflicted.

But the pain has become too unbearable and they ‘feel like’ they’ve got to do something. Take action. Find relief.

If you ever sense that feeling boiling up in your chest – and I bet you have if you’ve been holding crypto recently – then here’s what you do:

Do NOTHING.

Your feelings are wrong. It’s fear that is drawing you into making stupid trading decisions.

How do I know that? Here’s another crucial lesson for you:

Because the crowd is almost always RIGHT during the final phase of a bull market. But they are almost always WRONG during the final phases of a bear market or bearish phase.

The difference lies in the emotions present at the time. Excessive greed can be maintained for weeks or even months on end. Fear cannot. Hence you often get v-shaped bottoms.

In fact bearish bull market corrections stir up more emotions than the type of sentiment present during the final stage of a secular bear market. By then most people have turned away in disgust or are mentally checked out.

Bull market corrections are more stressful due to hindsight bias. Think about it: Anyone who was thinking about selling was going to puke out on Tuesday, or not at all.

I basically spent most of my day talking people down from the ledge of liquidating everything.

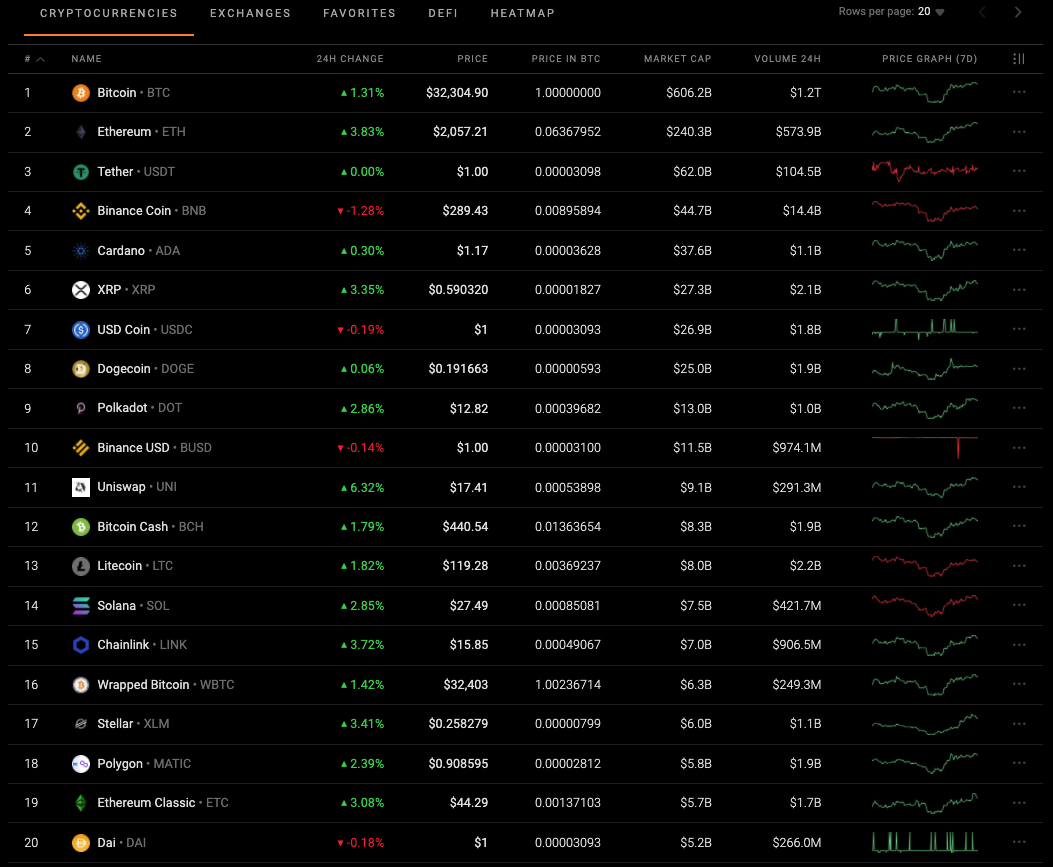

And many are writing to thank me today as the entire board is flashing green again.

Had you followed your emotions and cashed out on Tuesday or Wednesday you would have marked the exact bottom.

And believe me when I tell you that a ton of people did just that and are kicking themselves today.

Learn from this. You only get a couple of these types of experience per decade and you do not want to waste this opportunity to grow and become a better trader. No matter if you are trading crypto, stocks, futures, or what have you.

If you have any skin in the game, take a moment or two to remember and internalize everything about how the last few months felt.

How did you feel a few months ago at the top? Not a cloud in the sky, right?

Happy thoughts. Happy thoughts everywhere!

And how did you feel about crypto on Tuesday? FUBAR and about to get a whole lot worse, right?

If you ever want to make it as a trader you need learn how to recognize these extremes. If you can do that you’re are ahead of 99% of traders who have ever played the game.

You know how we will know the crypto bull market is over? Because you will think that it’s somehow a new paradigm and it could 100x again from wherever we are.

People will be throwing around targets of multiple millions for bitcoin.

It will feel like you got hold of Amazon stock in 2001 and you’d be crazy to part with it and it’s going to provide generational wealth for your grandkids.

Many people you know will be quitting their jobs to be crypto traders.

And you will NOT want to sell.

That’s what a mania top feels like. That’s what it felt like in 2000.

It’s what it felt like in January 2018.

The bull market is ON. It never stopped being on, actually.

And if you want to make the power move of your life, now is the time.

Nobody wants to invest in crypto now. But there might be one of you, who has larger than average balls and who understands that a mighty reward can’t happen without risk.

My system absolutely maximizes profits from crypto when the market is going crazy. It’s proven that again and again.

Unfortunately I’ve reached the 100 seat limit and for now the doors are closed until further notice.

However there is a waiting list and if you want to be on it then email me and I’ll add your name to the bottom.

Happy hunting but keep it frosty.