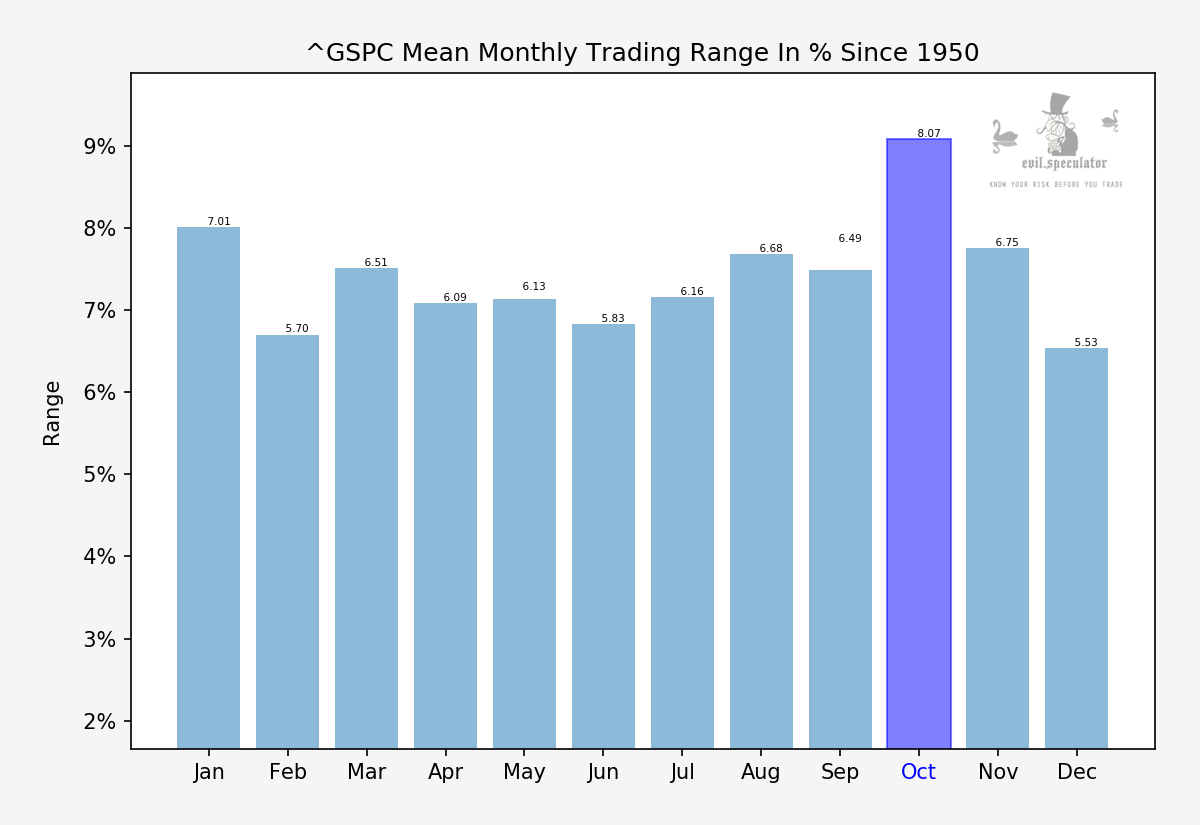

The equities market has been flailing around like a nudist bee keeper chasing hapless hedgers from one side of the EM range to the next. Of course we had anticipated an increase in (realized) volatility as the historical stats advised us that we had entered the most volatile trading period of the year.

This chart was posted on Monday and although crashes are actually pretty rare in October (see my Monday post) volatility most decisively is not. And we are just getting started.

As you can see three consecutive up days have lowered implied volatility back to the current baseline we have been observing since early August.

The VIX is back near 18 and while that’s quite a drop from the peak near 25 I would prefer to see it touch at least 17 before I entertain the mere thought of taking on short positions.

Next week will be extremely interesting, in fact it may be the most pivotal week of the entire year. More about that on Monday. See you guys then.