Buckle your seatbelt Dorothy, cause this market is going bye-bye! Look, this is not very complicated and you don’t need an advanced degree in economics to figure out what comes next. Forget about all the fancy charts and all the technical analysis I’ve been posting here for a minute. I’ll break it down for you in 30 seconds flat.

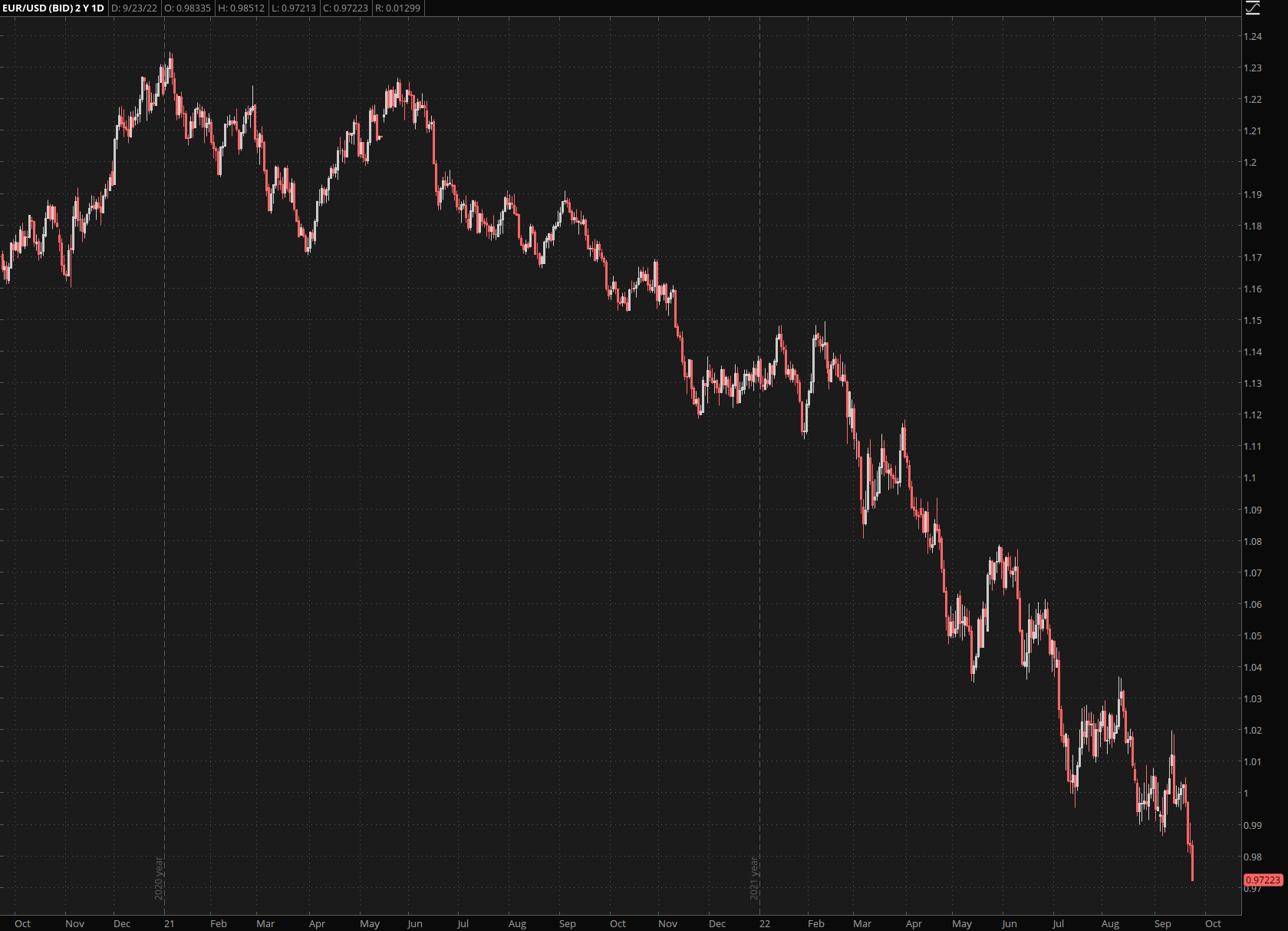

Just LOOK at it. Compare the price action until late 2021 with the mind numbing gyrations we had to put up with all year.

Now look at the U.S. Dollar. Everyone and their grandmother are pounding into the greenback right now and I expect this trend to continue as long as I keep reading news about the Dollar’s instant demise in the financial MSM.

Yes we’ll cross that particular Rubicon eventually, but not today, and not next week, and probably not even this year. Let’s cross that bridge when we get there, for now cash is king.

Unless you’re in Europe – then you’re effed.

Like ‘proper effed’ as they say up in the magic kingdom.

Bitcorn meanwhile is still on suicide watch, but strangely it’s not following equities down into Hades.

This may change however if the SPX drops through 3,635, then all bets are off and it’s every man for himself.

Understand this.

With the exception of energy and commodities anything Dollar denominated is going be dragged down.

The Fed is attempting to make this process as painless as possible but after 14 years of unmitigated money printing the chicken have finally come home to roost.

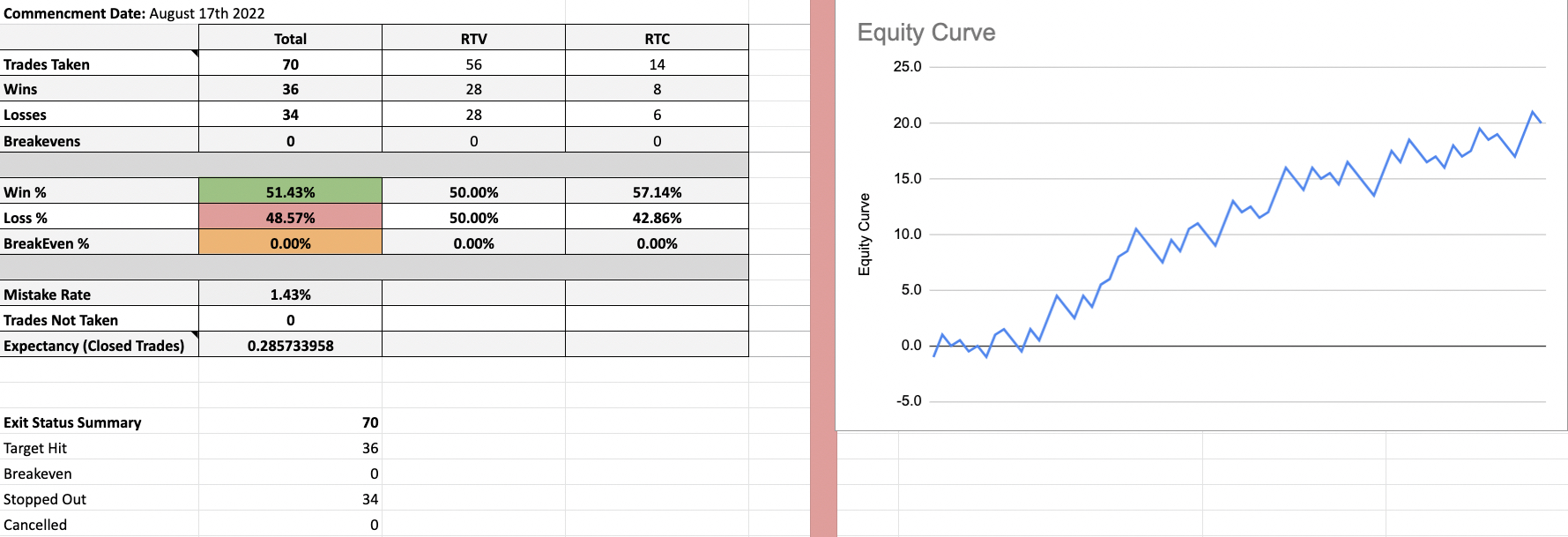

But frankly I don’t have a dog (or rabbit) in this fight. While everything is heading into melt-down mode my intrepid crew of beta testers and yours truly have been busy trading our Crypto Salary System (CSS).

I hate rubbing in the P&L above (not really), but this is the first time I launched a system and it took off like a rocket from day one.

This almost never happens. Like never ever.

It’s almost too boring – but if you want excitement and drama I recommend you head to Vegas or Macao. At least there you’ll be served tasty drinks with umbrellas by scantily clad ladies with flexible moral values.

I’m way too old (and married) for that, so I’ll stick with what works.

If you’re interested in tagging along, here’s a video showing my daily trading routine.

If you haven’t already make sure to reserve your spot for the FREE webinar I’ll be hosting on Tuesday the 27th.

That day I will show you the ENTIRE system top to bottom – no holds barred. Looking forward to seeing you there.