The concerted U.S. crypto smack down seems to be picking up steam. Which is always a great time to start loading up on some coin, assuming of course you’ve got the brass needed to fade the blood in the water and take a dive.

Anyway, a lot is going on, so let me nutshell it for you:

First up a recent shift in the composition of the stablecoin pool is causing concern over a possible USDT depeg.

Turns out some whale borrowed a large sum of USDT and swapped it for USDC, leading to an imbalance in the 3pool structure.

Tether CTO, Paolo Ardoino, quick assured the community that Tether is ready to redeem the token at any time.

Of course this follows on the heels of the March USDC depeg and serves a reminder to exercise caution dealing with stablecoins.

In fact I just swapped my last Tether for BTC a few days ago (yes, before the drop) but I rather take a small loss than having to worry about the whole booty.

In response to that and yesterday’s Byzantine ‘dovish hike / bullish skip’ speech by our esteemed Fed chairman J-Pow, BTC has descended a bit further and is now attempting to defend its $25k mark:

Which incidentally completes the formation I had originally outlined in mid March.

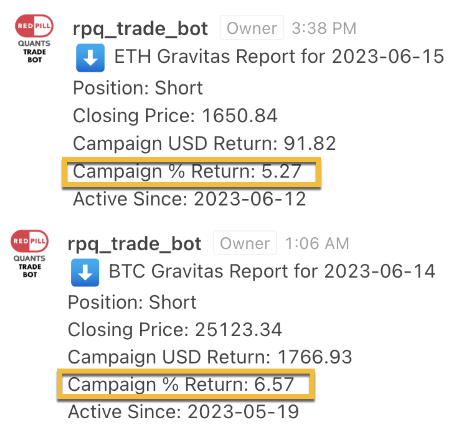

Plus Gravitas has once again a bang job keeping us on the right side of the tape.

If you’re not a member yet, then you may want to remedy this situation post haste. Simply shoot us an email and we’ll have you set up in no time. If you have questions, we’re here to help.

Meanwhile ‘analysts’ predict further downward movement for Bitcoin due to regulatory hostility in the US and the likelihood of additional rate increases by the Federal Reserve.

In their defense: IV on BTC and ETH options chain reinforces this outlook, but even on Deribit it’s thinly traded plus that’s rarely a predictor of what’s to come.

My experience over the past 20 years is that analysts usually look at the market by looking in the rear view mirror. If it’s bullish they expect more bullish tape, and if it’s bearish then they expect more of the same.

My personal take is that we are now pushing into our previous churn zone, and although it’s possible that we are descending even lower the trip shouldn’t be as easy/quick as it has been over the past two months.

Now before you consider ritual seppuku you should know that there are also some positive development happening in the rest of the world.

The Hong Kong Monetary Authority (HKMA) has reportedly pressured major banks such as HSBC, Standard Chartered, and Bank of China to accept cryptocurrency exchanges as clients.

Yes, you read that right. They are actually pressuring banks to adopt crypto.

In a May meeting, the HKMA questioned these banks and apparently gave them shit about their reluctance to work with crypto exchanges.

Kinda strange given the prior FTX debacle if you ask me, but I like how they roll. Maybe I should consider a visit to Hong Kong.

The HKMA had previously issued a circular urging banking institutions to adopt a more proactive approach to new sectors, including cryptocurrencies.

While some lawmakers in Hong Kong are supportive of crypto firms, the resistance from traditional banks remains.

Hong Kong also recently implemented new regulations allowing locally-licensed crypto firms to operate and serve retail investors.

And there you have it folks. While the rest of the world is increasingly embracing crypto currencies and blockchain based technologies/services the U.S. is hell bent on wiping it out.

I wonder which side history will remember as having come out on top.