BlackRock CEO Larry Fink recently pulled what I often refer to as an ‘Adenauer’ **. Previously known as a prolific skeptic on all things crypto, Mr. Fink stated in an interview with Fox Business that Bitcoin had the potential to “revolutionize” the financial system.

He not only called it an “international asset” but also believes that tokenization of assets and securities, (which happens to be the essence of bitcoin), could transform the way finance operates.

But he didn’t stop there. Fink suggested that instead of using gold as a hedge against inflation or currency devaluation, people could turn to bitcoin as an international asset that provides an alternative.

Say what??

Seriously now – I’ve been called a crypto shill for less!

Of course this probably has absolutely nothing to do with BlackRock’s recent filing for a spot bitcoin ETF with the SEC.

After being rejected and resubmitted last week Fink couldn’t provide a timeline for the application’s approval.

Seems to me like a bit more ‘strategic lobbying’ may be required.

And as I’ve always maintained since I got into this game many years ago: Self interest is the mother of all rationalization.

Consider that next time you are listening to some pundit endorse a particular stock, commodity, or asset class.

Anyway, I’m curious – do you agree or disagree with Larry Fink? Is this perhaps some elaborate scheme to pull out the rug underneath all of those crypto bugs?

Or do you think it’s simple jawboning to promote Blackrock’s latest favorite asset class?

I for one long decided in favor of a long term future for Bitcoin and other major crypto assets (ETH in particular). I did not change my outlook in 2014, in 2017, or during the 2022 crypto winter.

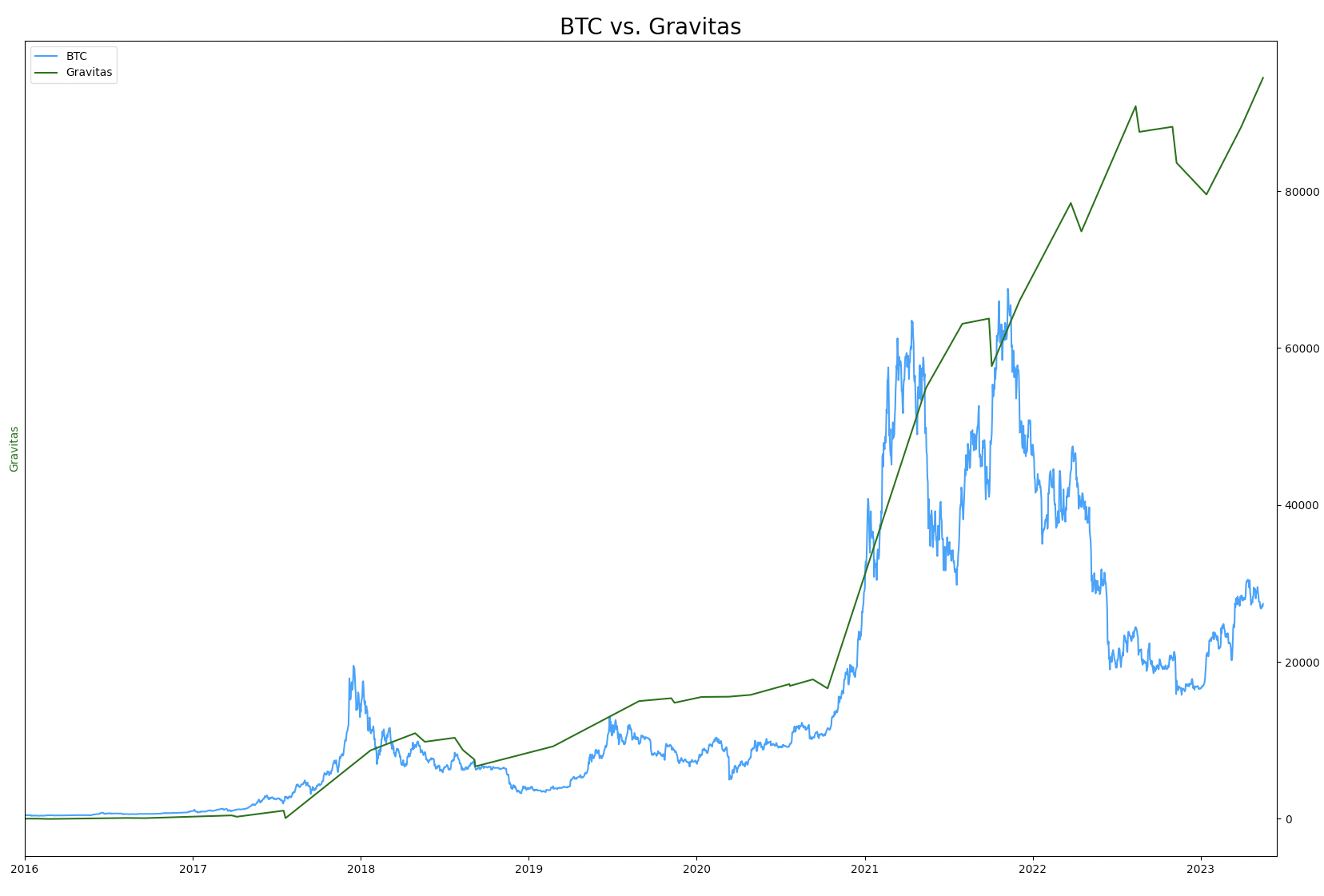

Which is why I built a long term trend trading signal that is impervious to market cycles and continues to keep me on the right side of the tape.

Remember, the whole idea behind trading the greater trend isn’t to pick tops or bottoms. It’s about remaining on the right side of the tape when it matters the most.

And that’s what Gravitas is really good at. Plus it’s a long term signal, at the very most you take action once per month on average. Perfect for the busy operator.

Besides, the results speak for themselves, so if you’re interested shoot us a message today and we’ll get you set up just in time before the next leg higher.

** During a heated debate Adenauer once famously stated: “Was interessiert mich mein Geschwätz von gestern?” – Translation: What do I care about the [the b.s. I spewed] yesterday?