I felt a little bit like Julius Cesar today, getting stabbed and prodded all over the place in preparation for my ‘procedure’ on Wednesday. Unlike Julius however I survived the experience and at least thus far it appears that my rapid COVID test has come out negative as I was told I would receive a phone call otherwise. Anyway, with enough time left before the opening bell I decided to quickly put together a post for you guys:

All eyes are on the Fed this week and how it will respond to the bond vigilantes who have effectively thrown down the gauntlet and are now waiting for the FOMC to respond in kind. First up let me be clear that the ZB trading near 155 is not that unusual which should be quickly apparent when pulling up a long term chart.

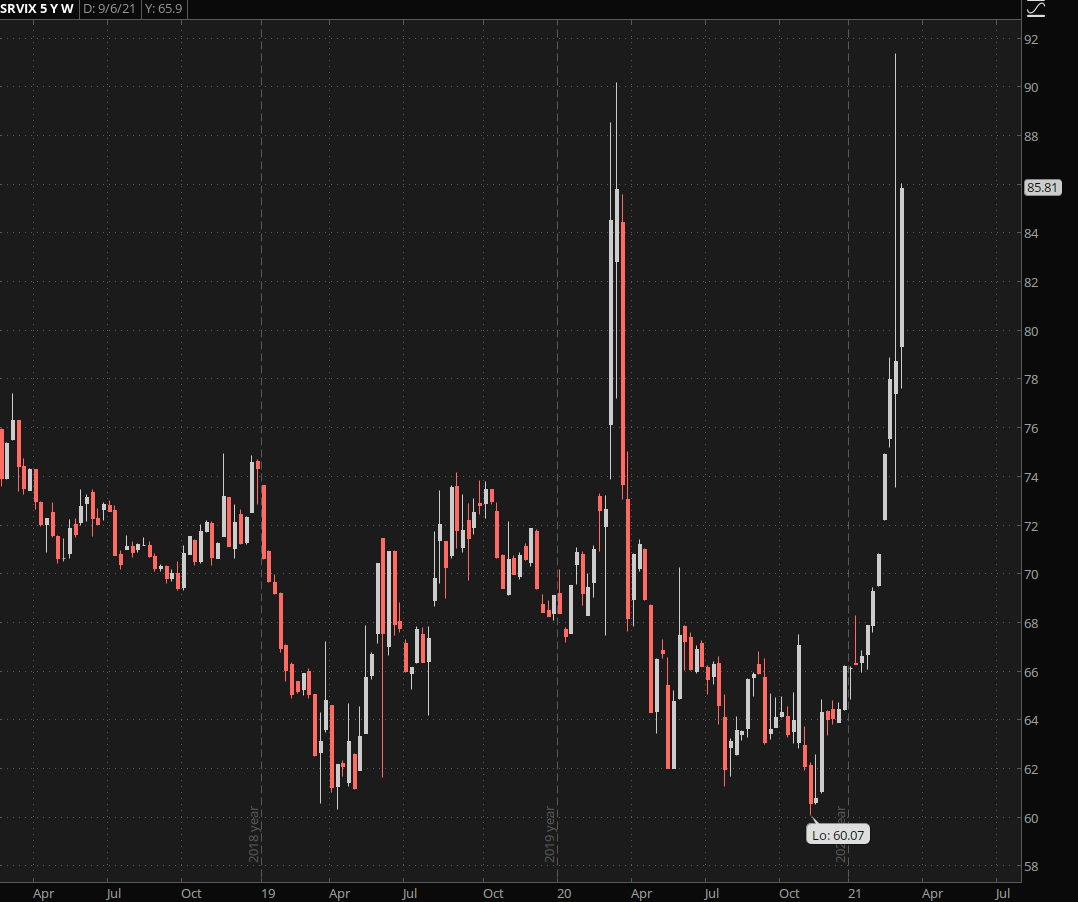

What’s worrisome is velocity of the current sell off and in particular the context in which it’s happening. The swap rate index which you are now are familiar with continues to climb higher by the day.

Nobody really knows what exactly this means as the OTC swap rate market is not something us mere mortals will ever be given access to. But clearly something extraordinary is going on and it can’t be good.

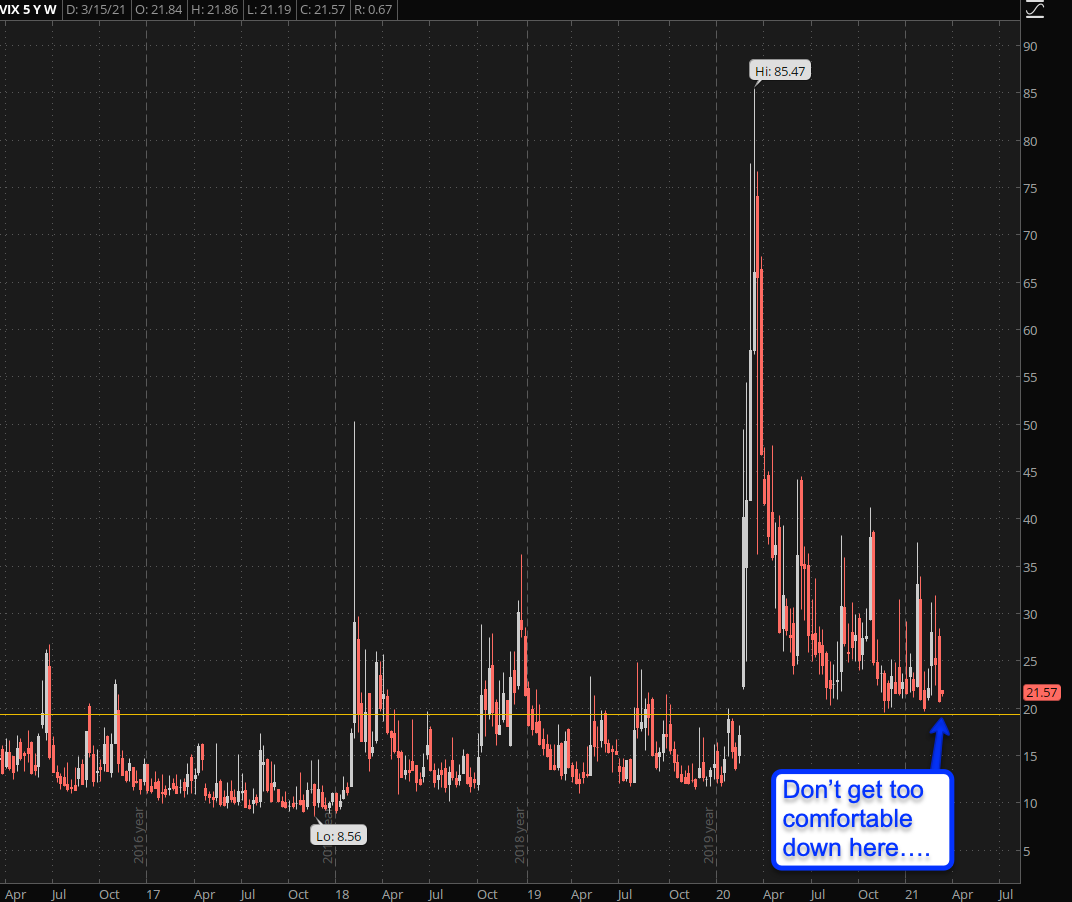

Meanwhile the VIX has descended back toward its new old baseline, but I for one won’t be getting too comfortable down here as this situation appears to be temporary. Let me show you why…

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.