Last week turned into a complete and utter roller coaster which traversed not only the entire weekly expected move but did so in both directions. Moves like these usually serve to confuse the average retail participant but they often present unique profit opportunities to savvy option traders. In fact what transpired once again confirms what I have been preaching here over the past year as well as the trading approach I outlined in my RPQ options courses.

So let’s set the stage here. It’s Wednesday afternoon (on my end) and I looked at the Spiders which at that time had been mostly treading water over the previous two and a half sessions. With about two and half more to go I looked at the March 26 expiration and saw the 396 strike already being heavily discounted as the odds of touching that mark appeared remote.

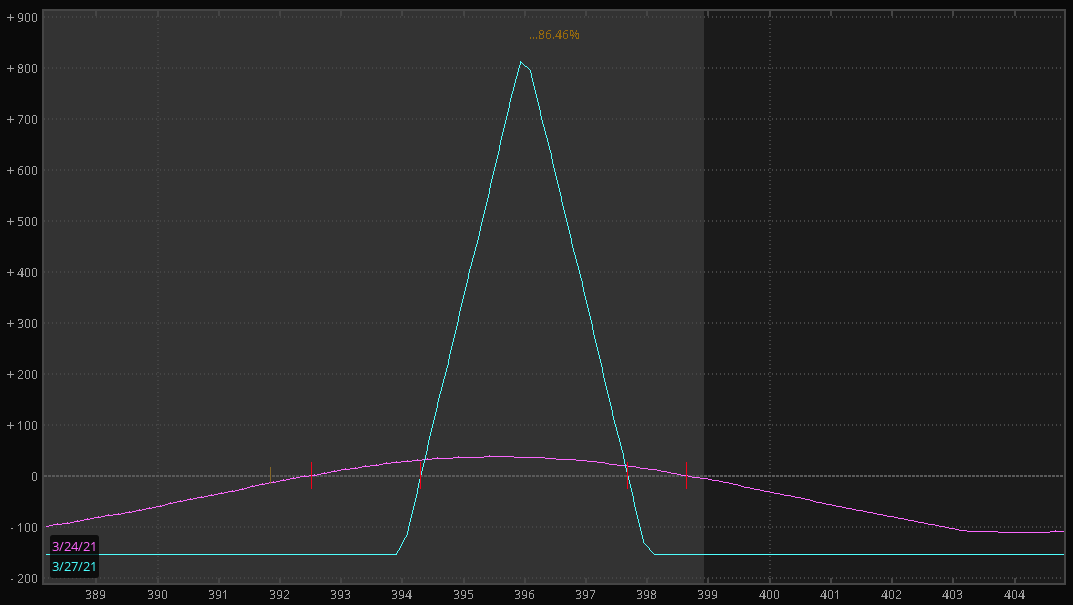

For a bit of background, the 396 strike basically marked the weekly expected move to the upside and understanding the probabilities involved based on my research I decided to take out a 394/396/398 butterfly for a whopping 28c. This is what I posted verbatim over in my RocketChat trading room:

BUY +5 BUTTERFLY SPY 100 (Weeklys) 26 MAR 21 394/396/398 CALL @.28 LMT DEBIT

Filled at .28

Here’s the profit graph posted at the same time. Of course the odds of hitting the center dead on were remote at the time. But a heck of a lot better than what they were on Thursday afternoon when the Spiders kissed not the upper but the LOWER expected move.

At that point I thought to myself: “Well, the upside made more sense at the time, but you can’t win them all.” I completely expected the entire spread to expire worthless. But then Friday came around and late in the session the SPY made a last minute run for the finish line once again confirming the time tested gamma squeeze theory. Here’s my exit order:

SELL -5 BUTTERFLY SPY 100 (Weeklys) 26 MAR 21 394/396/398 CALL @1.65 LMT CREDIT

That campaign ended up being one for the ages and I hope some of you subs tagged along. Better yet, it was executed by the script based on an establishes system, one I have been preaching here on a continuous basis. Only to see most of it being ignored but I’m more than happy with banking coin all on my lonely own, thank you very much 😉

Okay so per the title of this post we’ve got to talk about what I call ‘the wall’ and it’s one we are approaching rapidly. At least as of the time of this writing bonds have continued their downside trajectory and unless we see a decisive breach of the 159 mark I expect this to continue until….

… until the Fed finally steps in and that’s really the entire premise of what follows below. Not one to be missed as I see a huge trading opportunity here with all key players already present and accounted for:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.