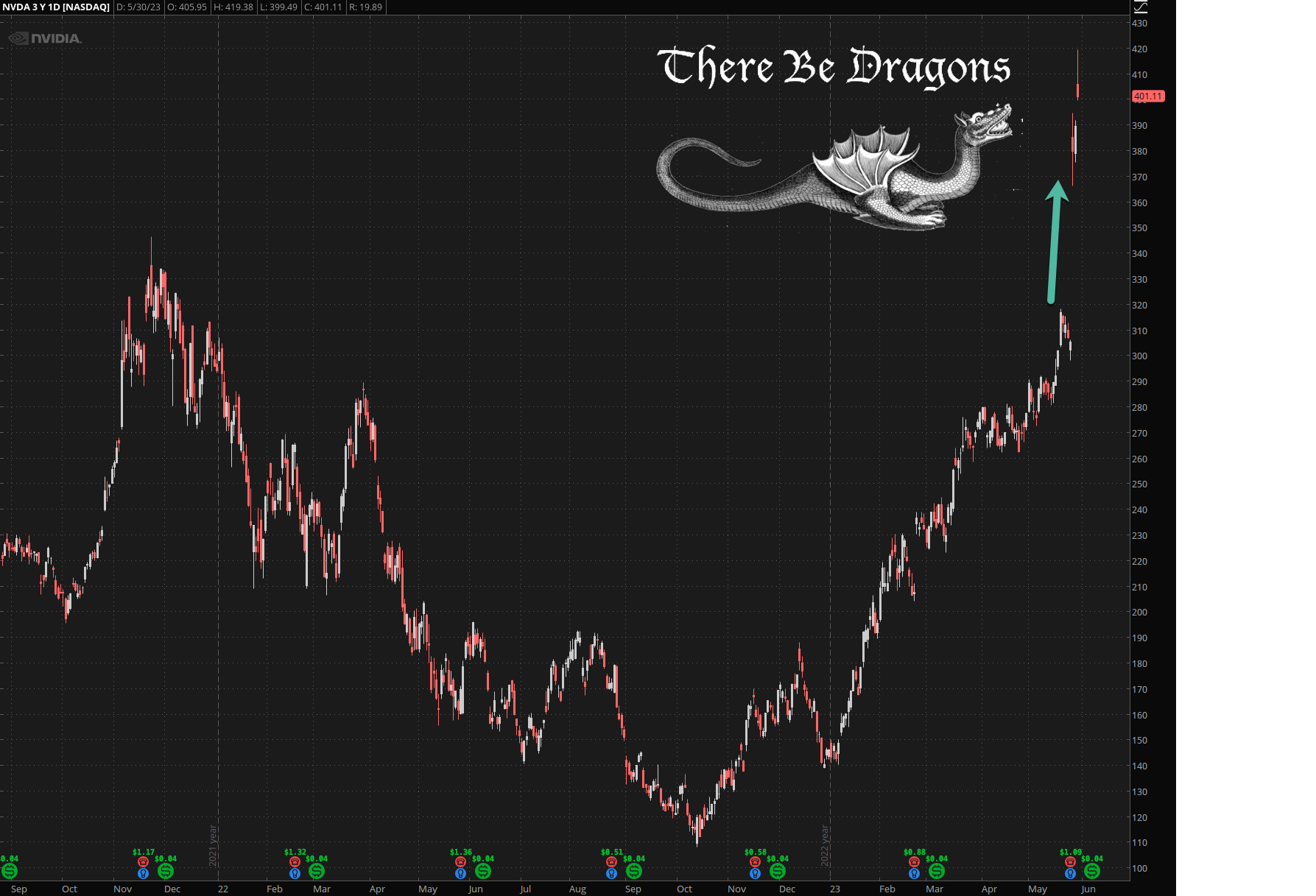

Last Friday NVDA managed to single handedly crush the hobby bears, collectively driving them out their positions, and taking much delight in their anguished lamentations.

Profit taking encouraged.

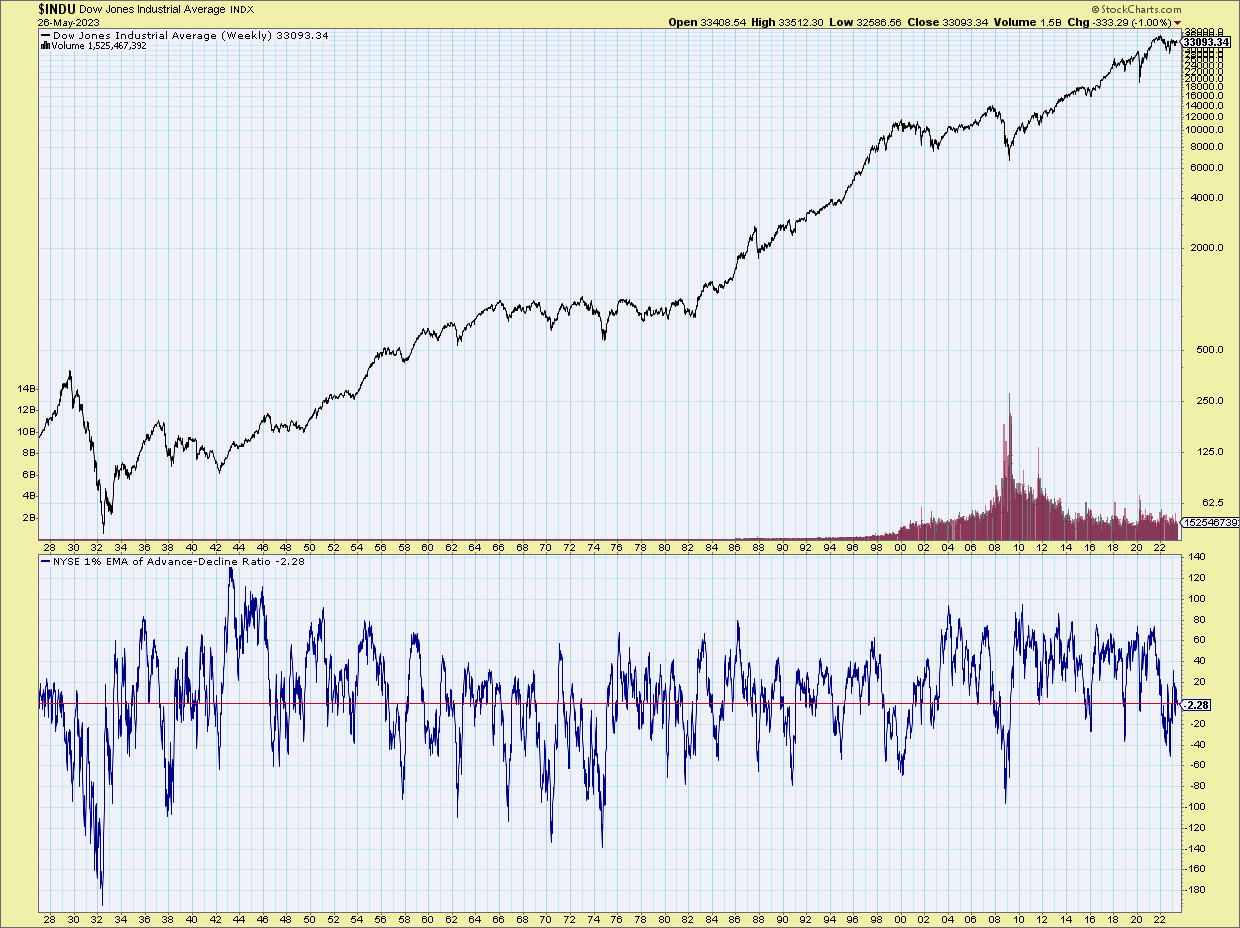

The big lesson learned – once again – is to never find yourself taking on excessive gamma risk in a market with falling market breadth held up solely by a handful of outlier performers.

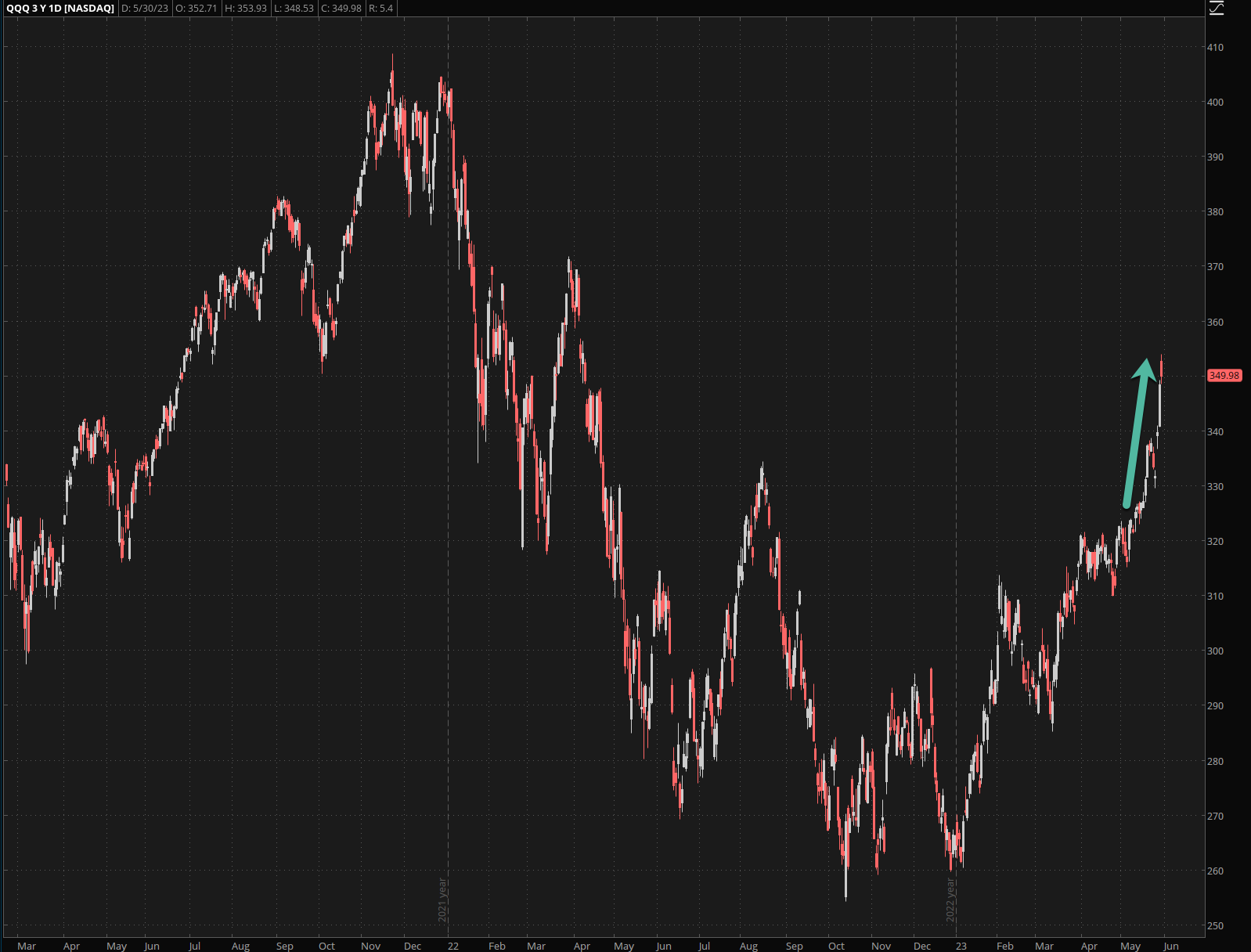

The Tuesday session added insult to injury by propelling the cubes toward the 350 mark with some profit taking to be expected.

Remember, nothing ever moves in a straight line in the financial markets.

Except when it does and then without mercy and much to the detriment of anyone relying on alien traits such as common sense or a long term economic perspective to muddy one’s trading activities.

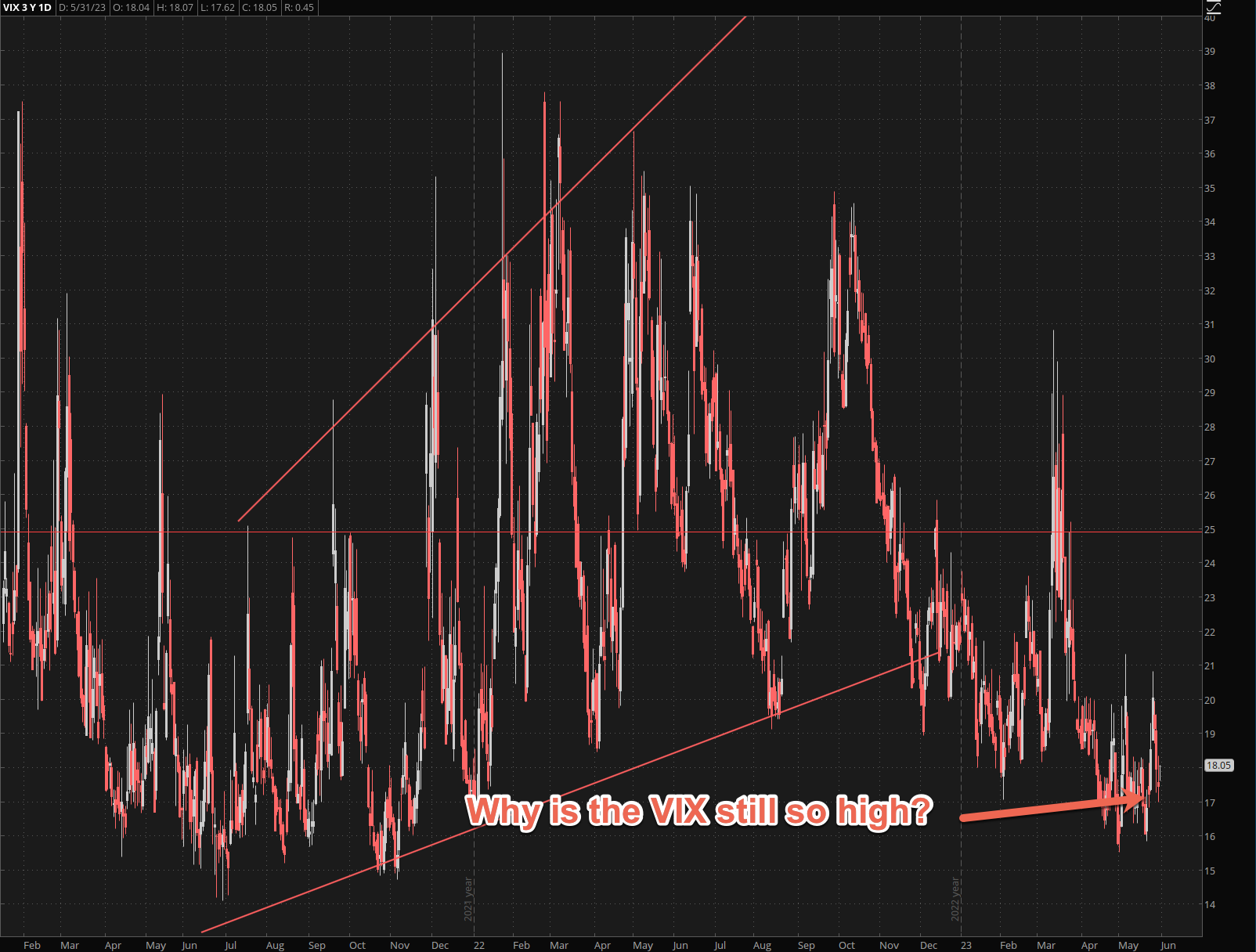

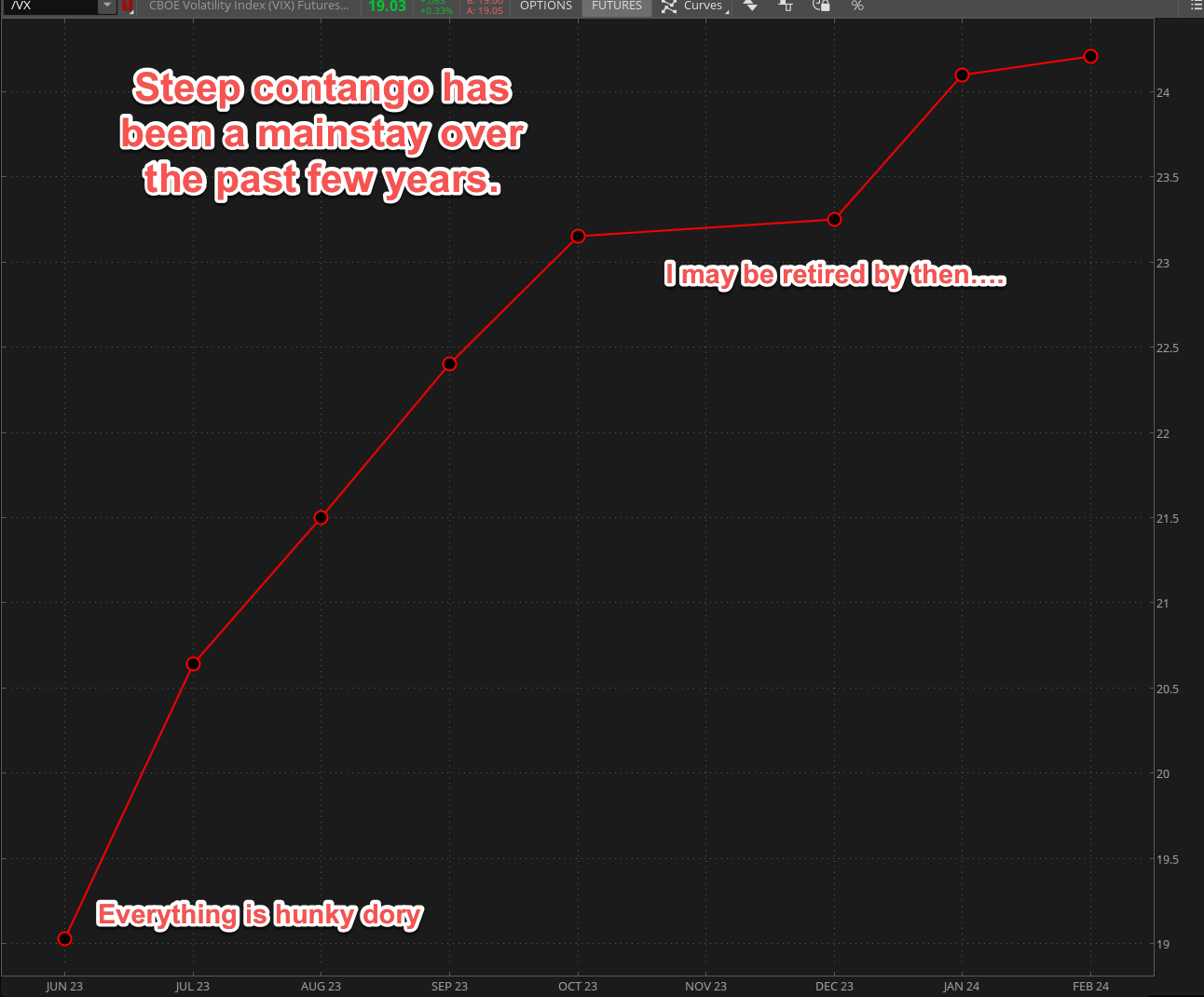

But fine, I’ll be your Huckleberry. So please riddle me this. With markets range bound for going on two months and the recent advance in tech, how come the VIX is still ranking so high?

Whatever do you mean, you ask?

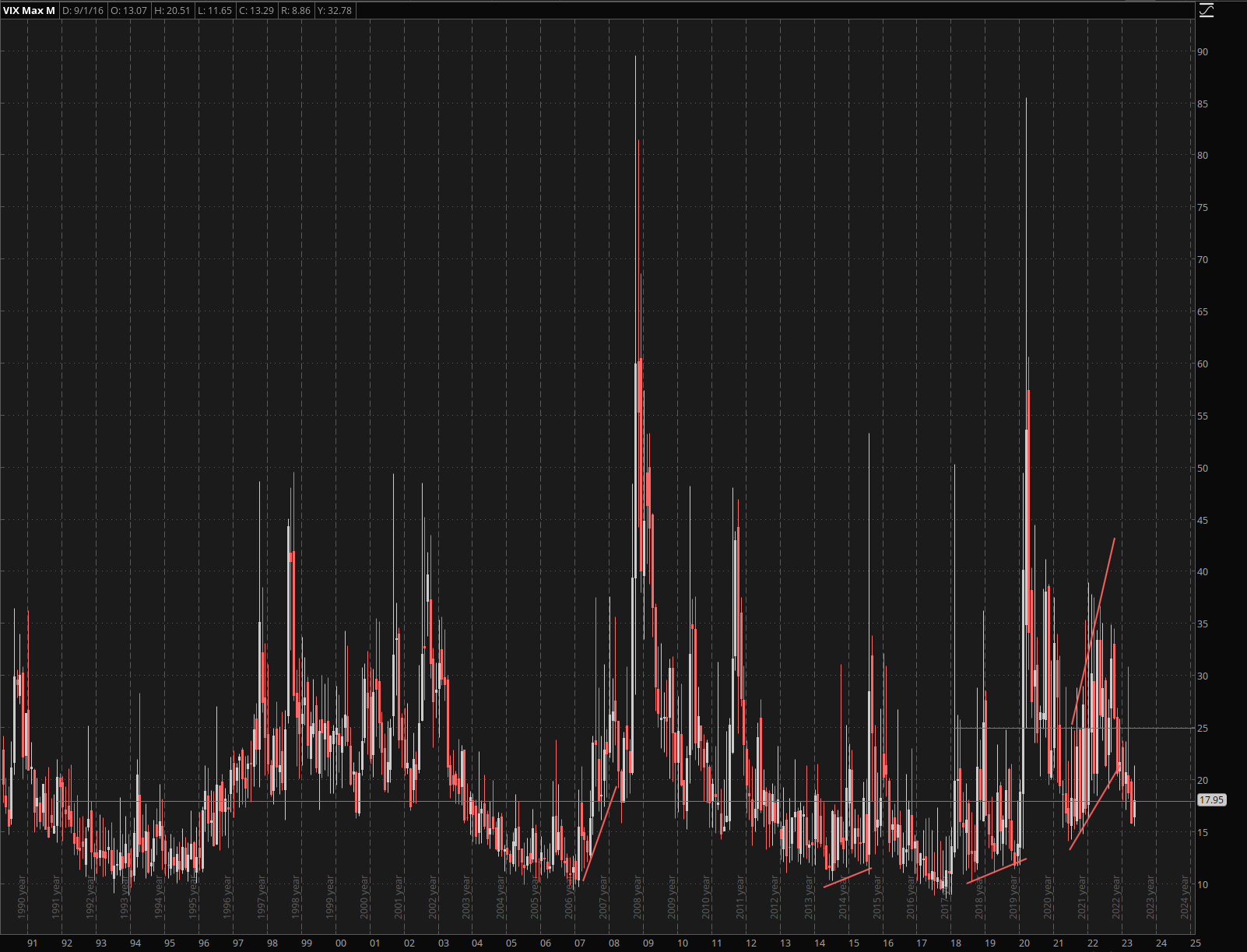

Historically speaking – and not considering the post 2008 and 2020 periods the VIX remains to be quite elevated.

But of course we all know why. A difference between a 19 reading in June and one of 23 in December may not sound much to the uninitiated but it’s actually a world and much LT gamma risk apart.

So basically everyone has decided to just ride the flaming dumpster into what hopefully will be early retirement by the time the proverbial excrement truly hits the wind tunnel.

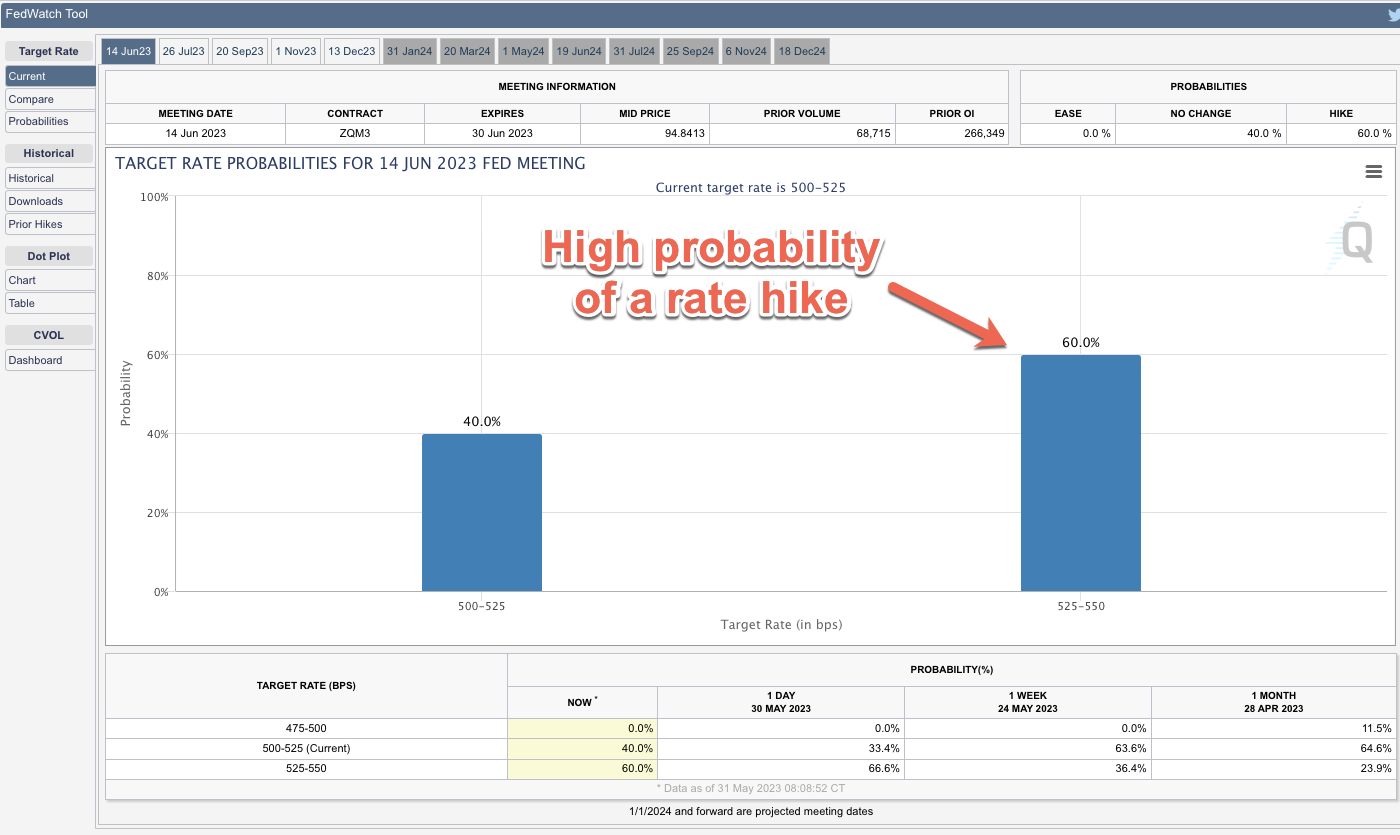

I mean it’s not like the Fed itself is pretty much predicting that another rate hike is around the corner, right? I mean that may just fly in the face of the small handful of stocks that just kicked the entire NYSE into hyperdrive.

Especially with tech leading the charge I may add. Fortunately we aren’t anywhere near the 4% mark on the TNX, which would surely dampen whatever bullish exuberance (i.e. low volume tape banging) has propelled big tech to YoY highs.

Oh wait – we are already at 3.7% – trend toward the upside? Oh well, après moi, le déluge – as the old saying goes.

Bottom Line: Although I exude cynicism in my market updates there’s a battle tested pragmatist lurking underneath this online persona.

Translation: Keep your powder dry and wait for instructions. Because if this market keeps this s…t up there will be fortunes to be made in the invariable – and painful – mean reversion that’s guaranteed to follow. Stay tuned for more.

Stay tuned for more.