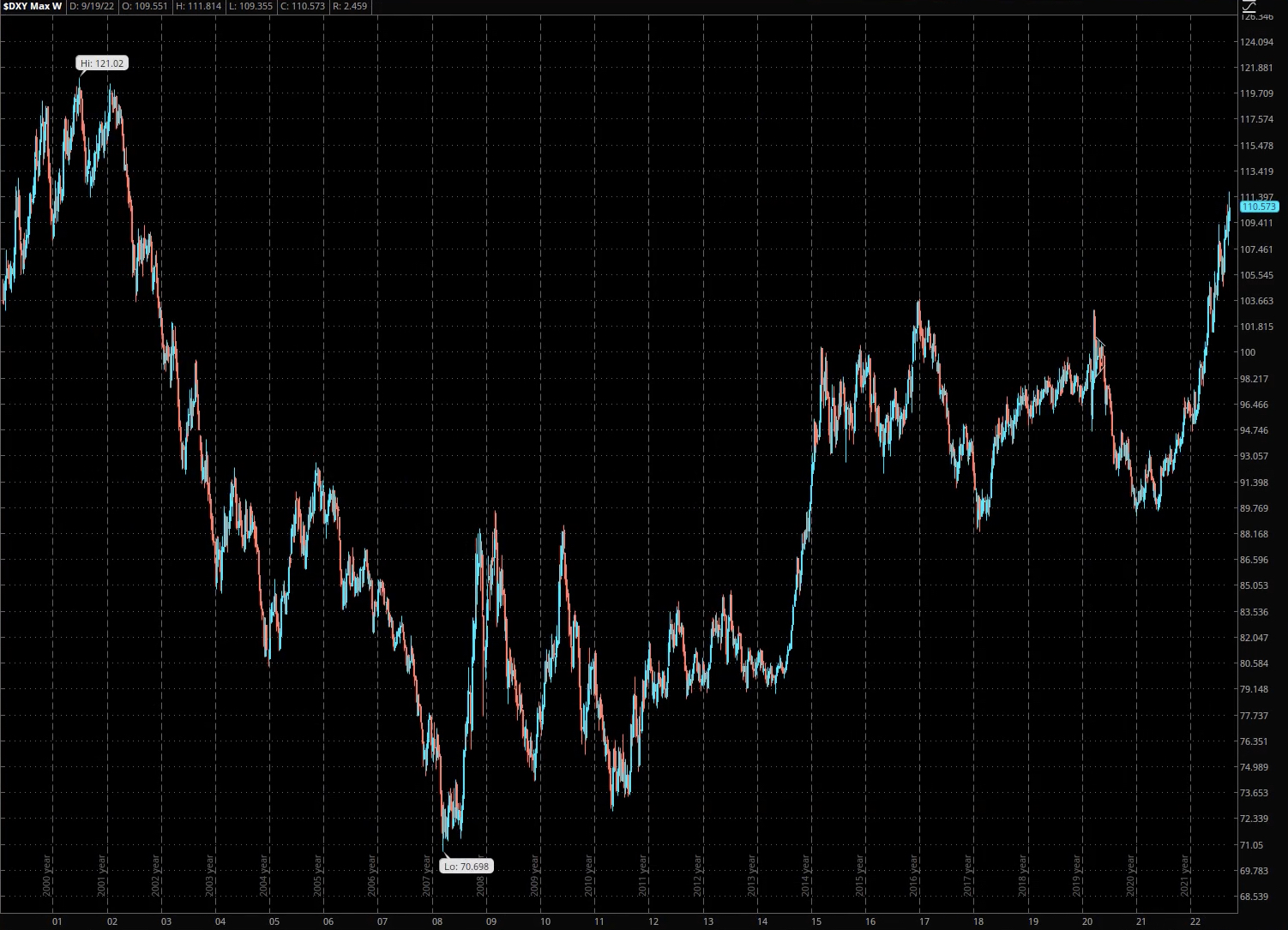

The U.S. Dollar continues its unstoppable march higher with no technical hurdle in sight. To give you an idea of the overall context and significance, the least time the DXY was scraping 110 was all the way back in 2002 – twenty years ago.

Earlier that year it had concluded a massive double top right around the time Steve Jobs (may he RIP) introduced the top of the line personal computer of its time, the eMac:

Yup, now you may get it – THAT long ago.

Back to the future – the EUR is now making a b-line to the 0.98 mark. That’s going to leave a mark when Europe will be forced to buy energy supplies from non-Russian suppliers for top Euro, while it keeps shedding value quicker than an NFT of my bare rearside.

Nope, not a pretty picture.

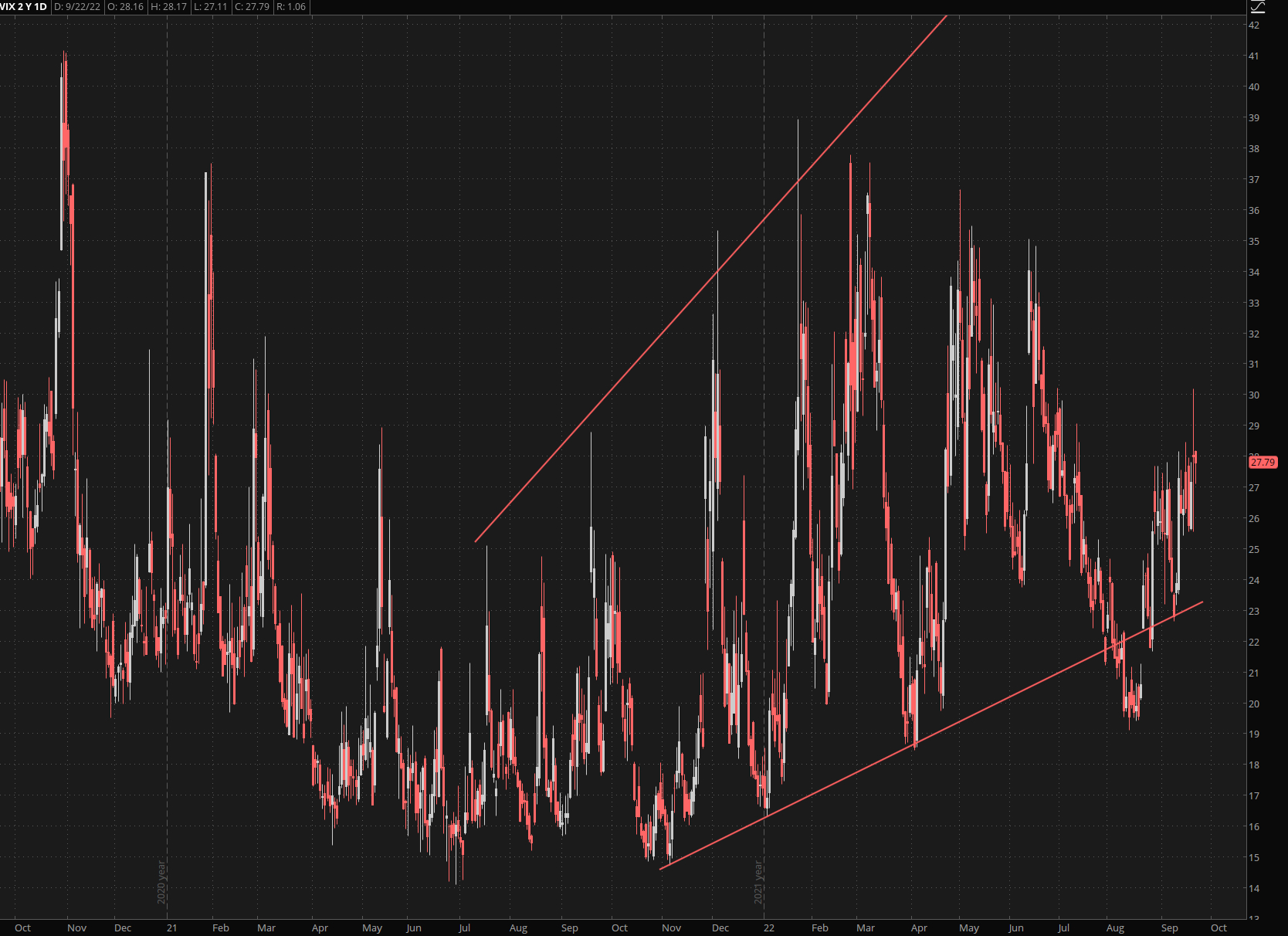

Of course as I said the other day, nothing in the financial markets ever moves in a straight line.

That indicator on the bottom is a z-score on implied volatility.

That probably means nothing to you but in a nutshell it shows us how expensive implied volatility is priced in terms of standard deviations.

As you can see from the vertical lines a jump above the upper BB usually is followed by a snapback, which in bear markets can be very violent.

So be ready for that. You’re welcome.

Maybe that’s the reason why the VIX is still hovering below its 30 mark.

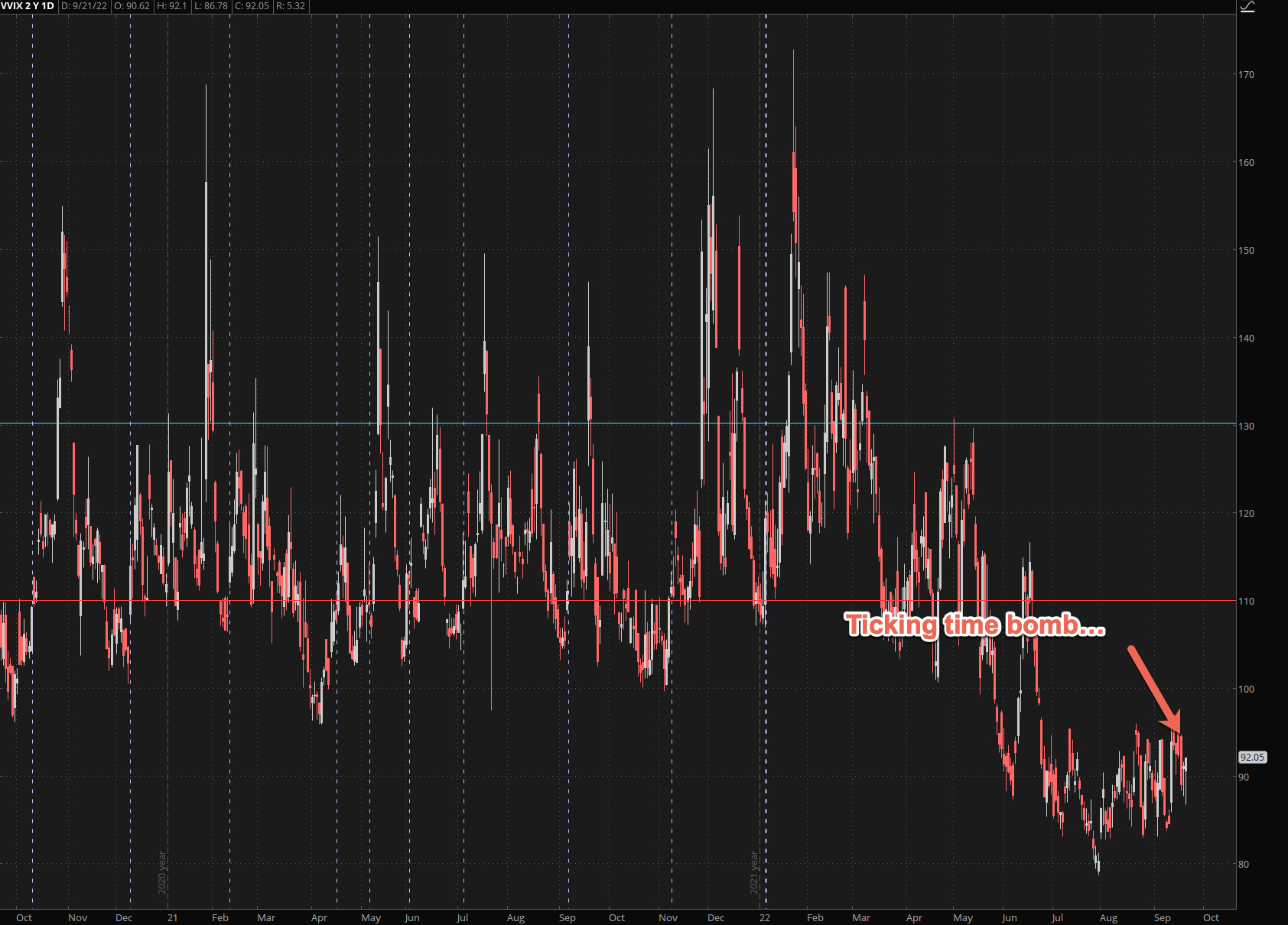

And why the VVIX is coiled up like a rattler before delivering a lethal bite.

All I see here is a ticking time bomb and the impending political drama mixed with bi-lateral brinksmanship on the war front promises to deliver us a volatile fall season.

Now consider this.

For the last 5 months bulls have been cautiously optimistic that the bottom was in.

They’ve been buying the dip and congratulating themselves about how smart they are.

Every month that goes past the complacency increases. See my exhibits above for ample proof.

Of course, we haven’t had the level of despair and truly awful days which we need to call an end to the bear market.

Know this.

Bull markets end on euphoria.

Bear markets end on despair.

We still haven’t had the dark days where you really question what you’ve been doing with years of your life…

So UNTIL THEN, it’s safest to assume that we remain in a bear market.

But that’s a good thing.

A generational buying opportunity will be upon us at some point. But not just yet, so keep your powder dry, grasshopper.

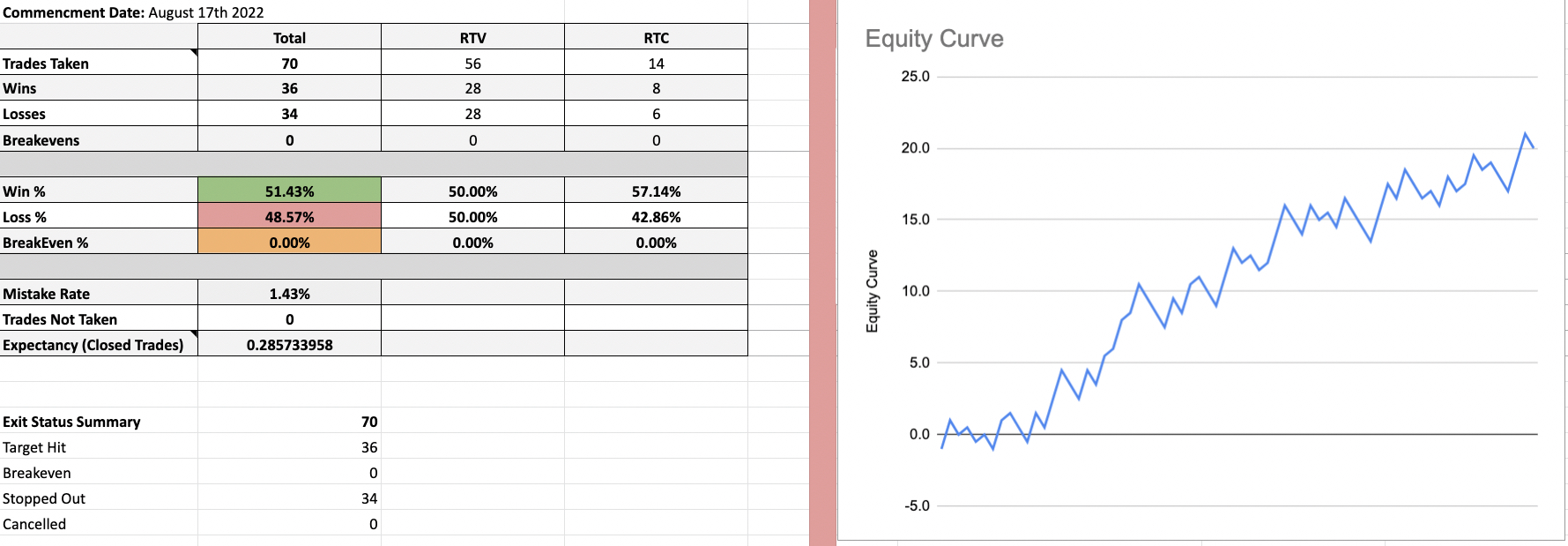

And until then, might I suggest learning the Crypto Salary System (CSS).

Updated live traded results shown above.

20R in a little over a month is nothing short of spectacular and all our beta testers are loving it.

Here’s a 2 minute read with everything you need to know

And if you are ready to join us – CLICK HERE

If you’d like to see me teach the whole thing again, live… I gotcha..

Tuesday 12pm EST I’ll be showing you the fine details in exhaustive fashion.

Bring your questions, It’s my pleasure to help.

Register HERE