If you’ve been missing my weekly updates as of late then you’re not alone. As much as I enjoy to whinge about long hours and a chronic lack of personal time the truth of the matter is that I really enjoy writing these posts. After 13 plus years you’d think I’d eventually run out of material but given the crazy times we all live in not a day passes by that does not warrant a bit of commentary occasionally infused with my notorious teutonic humor. Expressing my views here also helps me to hone and sharpen my own perspective on the market and the approaches I take to stay ahead of the market’s giant slam hammer.

Much to my chagrin however my long established posting routine had increasingly been compromised over the past month courtesy of a series of ‘unfortunate events’ caused by – shall we say – ‘the unique work ethic exhibited by several Spanish moving companies we had contracted.’

Or in other not so politically correct words – we got ‘spained’ four times in a row which didn’t just throw our entire move up North to Catalonia into turmoil, worse yet – it flung my entire operation into disarray during what by all intents and purposes is one of the most important and profitable trading period of the year.

We tried to muddle through as best as we could but obviously I’ve been slipping which may have given some of you old regulars the impression that I had been losing interest or focus when it comes to keeping you guys on the forefront of the market’s machinations.

Of course nothing could be further from the truth. In fact whilst living out of boxes and operating via a meager provisional setup involving shoeboxes pinned below my laptop I have been laboring like a mad monkey to get several new services up and running over at RPQ.

Many new services have already been put in place and others are in the making with many more in the planning phases. But admittedly it all has been taking a toll and I’m increasingly starting to feel the squeeze.

So you can imagine that the prospect of finally getting things squared away is something I’ve been looking forward to. Well, that moment may finally have arrived as we are departing new home in the not-so-frosty North one final time today to venture down to Valencia in order to complete our move.

If everything pans out as anticipated – and the odds of that over here in Spain probably range around 1% to 2% – the fully loaded truck should be on its way tomorrow to complete our big move by Friday evening. I’m keeping my fingers and toes crossed and if you can spare a few on your end the wife and I would very much appreciate it.

But then again – it’s just a five hour ride up North – what could possibly go wrong, right? 😉

Okay with the jinxing squared away let’s talk market. The FOMC’s sudden bout of hawkishness yesterday came at a bit of a surprise but given that John Williams over at shadowstats has been pinning real inflation (and not the fudged numbers the Fed leaks out) at 10% plus (and I deem that to be conservative) it’s been a long long time coming.

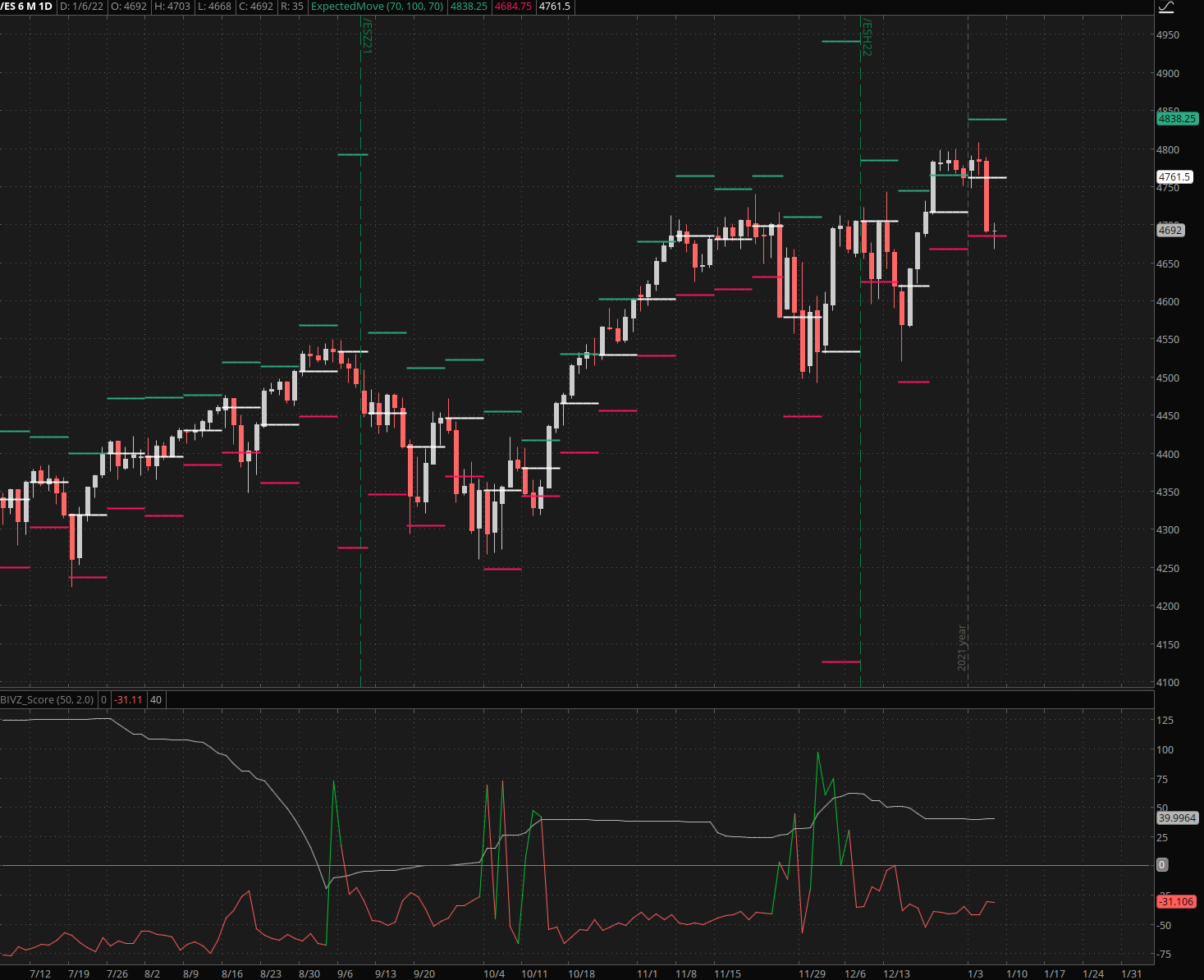

The current tumble on the SPX puts as almost exactly on the lower threshold of the weekly expected move (EM). The auto-EM seen on the chart is actually slightly incorrect as the real weekly EM is 63 handles down and up. So we are basically sitting right on top of it and that means we are effectively standing at the gates of hades.

A bit lower and the hedge bots are going to kick in en masse which invariably will trigger a cascade of stops, once again drawing price even lower, and so on. Before you know it we could find ourselves at the important 4500 threshold where I am certain some attempt to paint a floor would be made.

The bullish scenario is what is currently being attempted on the futures panel above. As you can see the ES drove lower overnight but bounced back and I expect us to open near yesterday’s close at the sound of the bell.

This opens up a juicy sell the news BTFD opportunity – it’s a long shot but it it works out it pays off handsomely. Although I am traveling today I plan on placing a few lottery ticket butterflies starting at SPY 475 and above. Although IV has jumped it hasn’t jumped as much as one would anticipate given the prospect of a more hawkish Fed.

Perhaps deep inside the market already suspects that most of what has been announced may just be jawboning in the face of run away inflation? Whether or not the Fed will actually follow through this year is yet another story. After all we’ve been through this song and dance in 2018, 2019 and 2020.

One parting word to all of you – bulls and bears alike: IF we actually continue higher from here it would in my mind actually be a medium term bearish signal, as strange as that may sound. The best thing that can happen to the bulls here is a VIX jump to 30 or higher – basically the money shot followed by a crawl back higher.

The more bearish scenario is an instant reversal which however has not fully cleared out the deck and which leaves the potential for a second breach lower which would be a lot more violent. I understand that this may sound a bit counter intuitive but that’s just how the market operates. Nothing is every what it seems.

Happy hunting but keep it frosty.