Navigating this week is going to take some finesse as the market is giving us more conflicting signals than a teenage girl on her first date. First up the main key to survival and – better yet – prospering in high volatility market environments is to not attempting to find order where there is chaos, to not fill in a gaping chasm of confusion with your own personal opinion. If you have the mental discipline to do that then – congrats, you’re already way ahead of over 90% of all market participants.

As I love to be a tease let me first show you where we’re at and what the inconsistencies are, and then help you sort it all out and make it work for you (assuming you’re a sub that is – sorry pal, I don’t work for free).

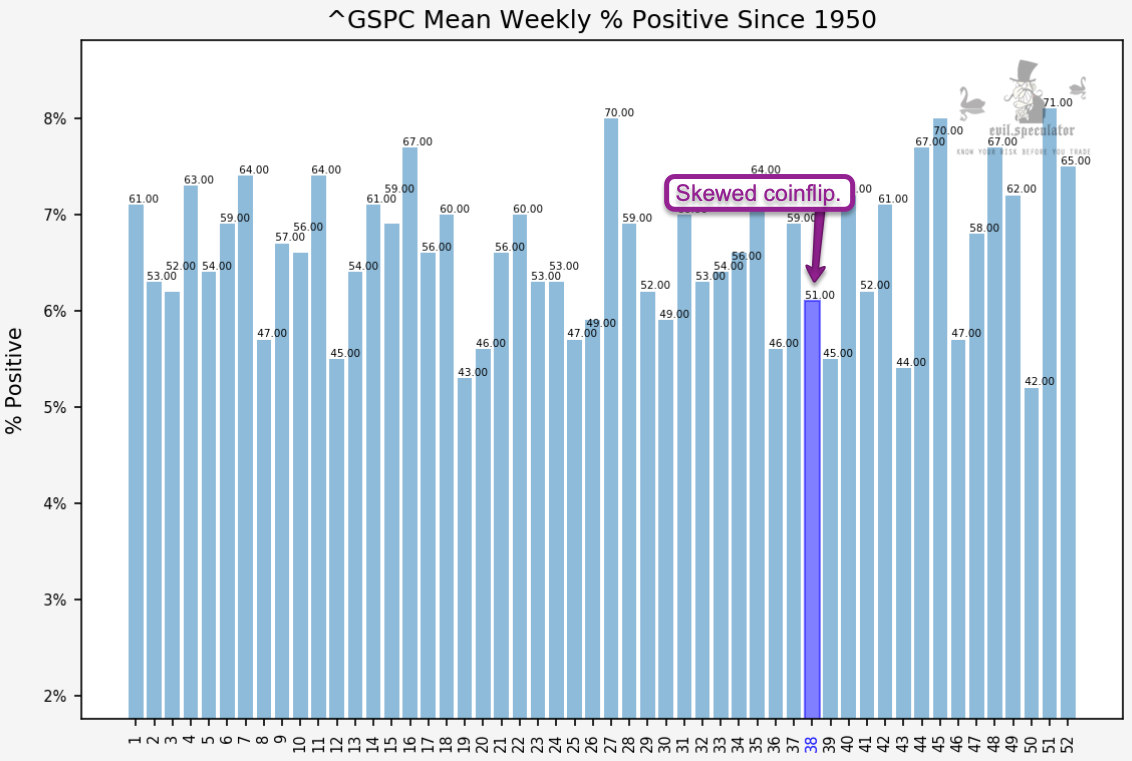

On the surface we are dealing with a coin flip week in that the historical odds have us at 51% on the weekly % positive.

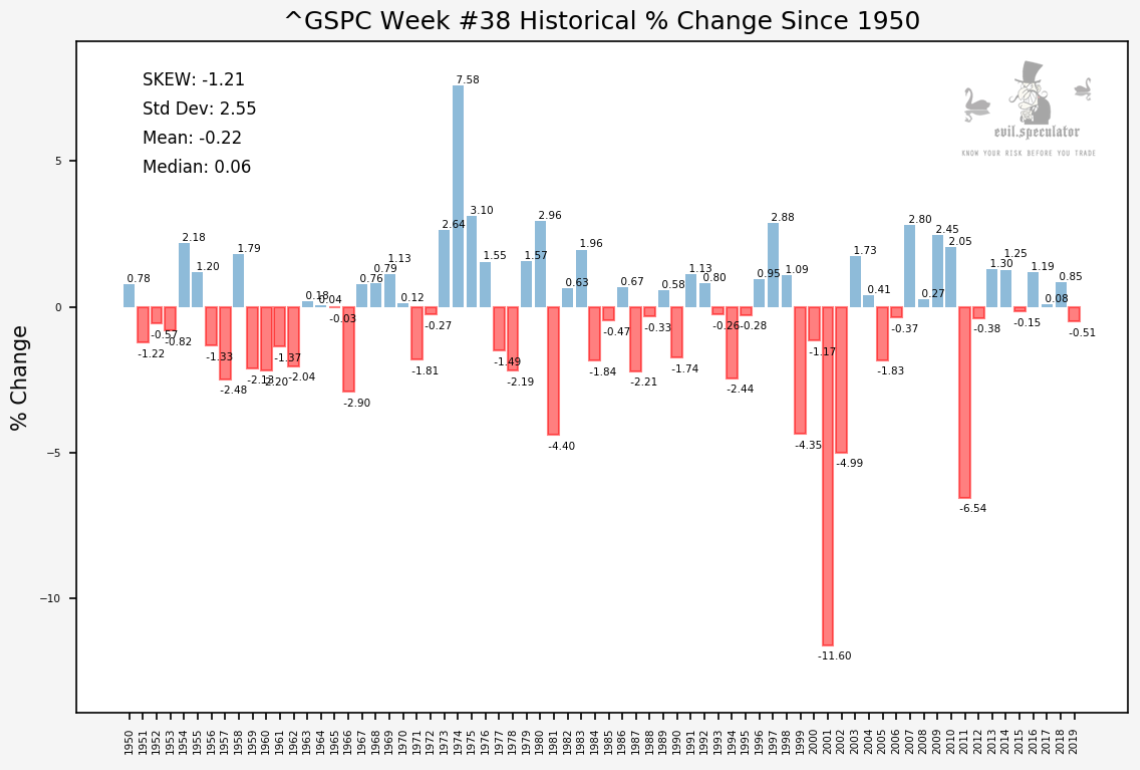

That however does not tell us much about the actual distribution of winners and losers, does it now? And it’s not looking good at all. I could explain the stats above but all you really need to do is to look at the negative outliers and compare them to all the winning weeks which aren’t even in the same weight class.

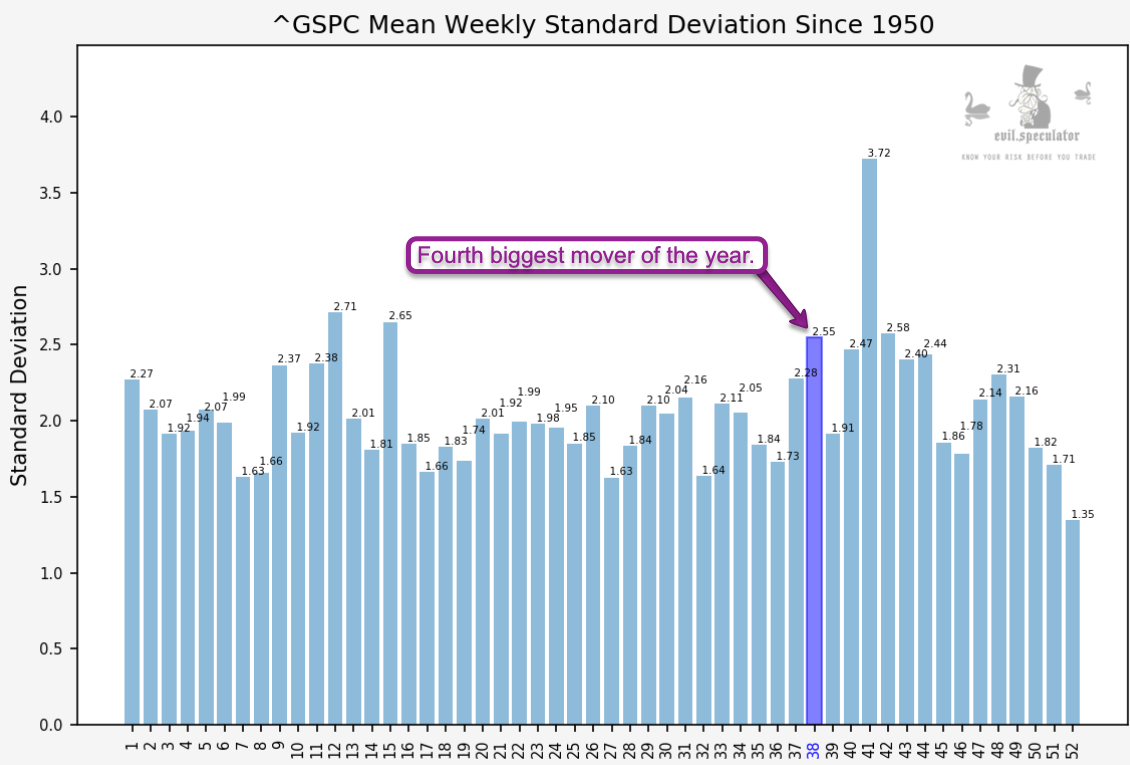

To add insult to injury we also are heading straight into the fourth biggest moving week of the year. And per the previous stats the big movers favor the bears.

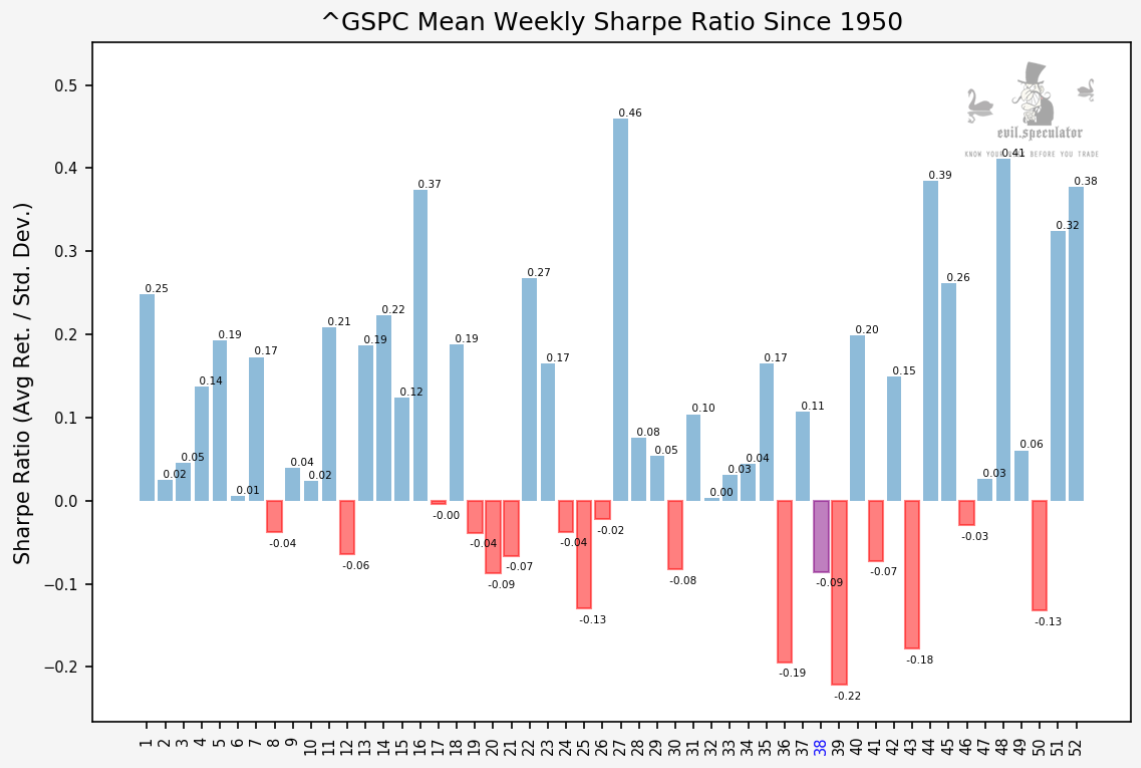

Not surprisingly this all adds up to a negative Sharpe ratio of -.09 for week #38, which isn’t horrible but let’s not forget that’s averaged out. The take away message for us here is that if the market slides in week #38 it tends to swing for the fences.

But as always, and in particular in the year 2020, there’s a lot more to this story. Here’s how we take advantage:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.