This is going to be a brief post as we are running low on technical context that would provide any meaningful edge to our respective trading activities. The market has been going up – it continues to go up – and it’ll go up until that famous last sucker finally has been found. Based on historical statistics (see my Monday post) and the ongoing trend we knew this week would most likely end in the plus but few of us expected the ferocity of buying pressure we’ve witnessed all week.

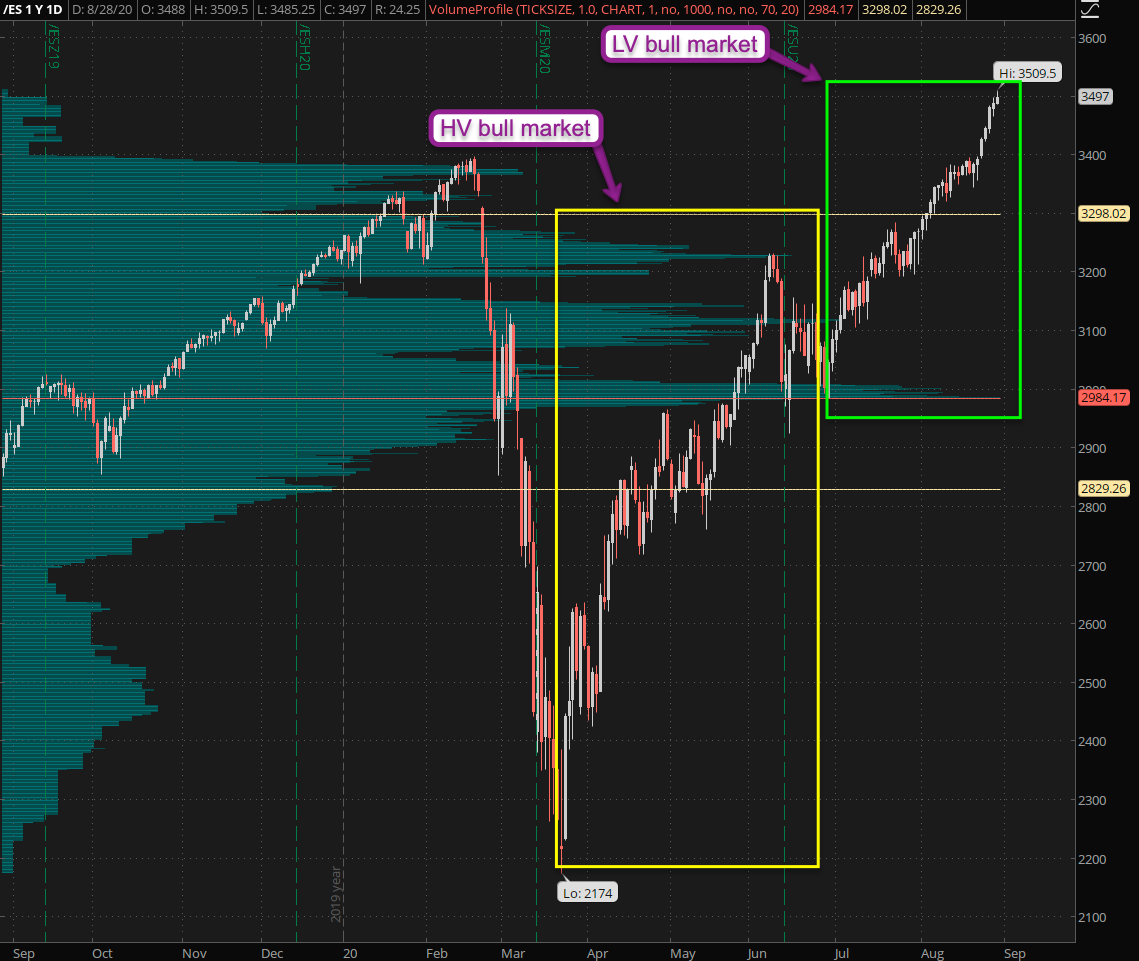

Per the old expression ‘not seeing the forest for all the trees’ – I had a bit of an epiphany this morning looking at the daily E-Mini panel. If you’ve watched my Price Action Masterclass then you probably recall the part on how bull markets usually unfold.

In most cases bull markets begin with a HV bounce back that eventually evolves into a medium to low volatility phase which either fizzles out or terminates after transition into a HV blow off top. Given the current formation it appears that we are deep in the acceleration leg of that second phase.

Which leads us to conclude that the probability of a long term reversal here is pretty low. At minimum we will have to see either a blow off top (after another HV phase) or a distribution phase after a things have started to slow down.

That said, the odds of a short term reversal are increasing especially given that big tech effectively has effectively gone vertical over the past few sessions. Of course this can go on for quite a few more days but most likely a shake out of the weak hands is already on the roster.

Implied volatility courtesy of the VIX suggests that option traders are getting a wee bit more nervous despite new all time highs and investors chasing big tech into the stratosphere. Let me be on record by stating that I never seen consecutive all time highs in equities while the VIX was hovering around 25.

Strange times in an already very strange year.