Okay, so I guess you want to talk about crypto now… <sigh>

Alright, I’ll be your Huckleberry.

You probably remember a few months back I had decided that reporting on the 2-year long crypto water torture had become an exercise in futility.

Not because there wasn’t any opportunity to load up on discounted coin near the lows.

I actually had encouraged everyone to do so.

On several occasions. Go back in my posting history and check on that.

But of course none of you retail rats did. The ‘evil institutionals’ did, but no matter, retail was done with crypto for good.

In fact I judging by the average response rate I’d dare to say that 99% of the people reading this post didn’t load up anywhere near the lows.

More than half never bought any and are still waiting for the magic moment.

So you’re in good company, because that is exactly what is supposed to happen at the tail end of a secular bear.

Everyone trader knows that of course, but somehow they always keep forgetting it when it matters the most.

Why? Beats me… Fear is a powerful powerful emotion, I guess.

Either way, the bottom line is that writing about anything crypto was a losing proposition, clearly evidenced by the open rate for posts even remotely smelling like it.

Realizing that you can bring a horse to water but that you can’t make it drink (has nobody ever heard of a clean water pump??) I decided to hold off until….

Yup, right there. I wanted to see Bitcoin reach the $35k mark. AND STAY THERE.

Well, we’ll see about that….

Incidentally, those lines you see on the chart were drawn in early March and I haven’t touched them since.

Clearly the exact formation was difficult to predict but I think I nailed the range like a BOSS.

You are welcome, ladies and leeches.

Now I know what you’re thinking: WTF is going to happen next?

With the Blackrock ETF now firmly in play will we see BTC push into $40k and beyond?

Short answer – yes, probably, but not right away.

Long answer:

Patience grasshopper.

You can’t have a crypto bull market based on BTC alone. And clearly the rest of the coin universe is still testing the waters here.

ETH for example has not even heaved its sorry carcass above the $2k mark and I don’t see crypto really get is groove on until ETH starts to really rock and roll.

Here’s the entire crypto market combined – you’ll find it as ‘TOTAL’ in tradingview.

BTW, screw them for reducing their free features recently. Bait and switch cun…..

It’s not looking shappy BUT it needs to bust higher right here and right now.

Get with the damn program, ETH!

Alright now I kept the best for last.

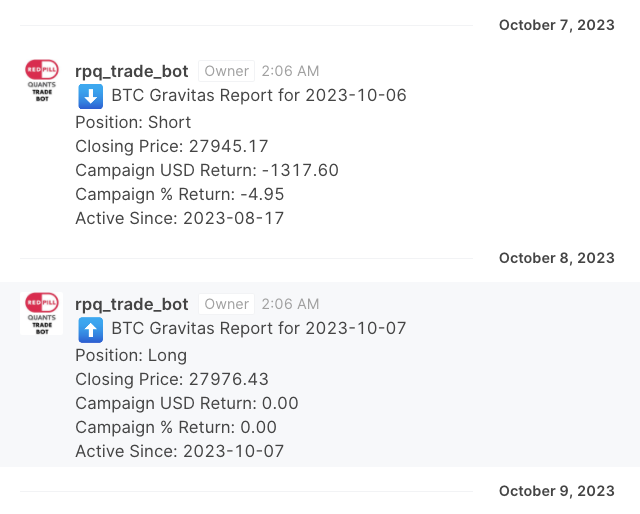

Many of you probably wondered how Gravitas performed during the whipsaw from hell of the past few months.

Let’s see – it was SHORT until October 6th when it flipped for a LONG position. That position was closed out at a 4.95% loss.

Bohoooo…..

Since then the LONG position has produced a juicy profit of 21.5% and we’re just getting warmed up.

NICE 🙂

Oh and then there’s Gravitas running against ETH. It’s still SHORT actually but is sitting on a 2.28% profit as it had gone short months ago.

All in all a stellar return during what I would consider one of the most difficult trading periods in the crypto market.

And these are LIVE traded results by the way, posted every single day to our intrepid subs in our trading forum.

Who by the way have been awesome. Not a single complaint or impatient email over the past few months. You guys rock and I hope you all made out like bandits.

For everyone else:

Please remember this if you are suddenly receiving jubilant newsletters from other crypto publishers accompanied by various outlandish claims.

While others were producing noise we were producing profits.

Because that’s how we roll here at Red Pill Quants.

Peace.