If you plan on surviving for more than a year as a trader then there is one enduring quote by Winston Churchill that you should ingrain into your cerebral cortex and remind yourself of every single day:

Case in point:

Clearly Larry Fink must have been mistaken back in 2017, otherwise BlackRock would have effectively just filed for an exchange traded fund (ETF) with a money laundering index as it’s underlying asset.

Winston Churchill is regularly quoted but here’s a good one by Germany’s first post war chancellor, Konrad Adenauer:

“Was interessiert mich mein Geschwätz von gestern?”

Translation: “Why would I care about my babble from yesterday?”

Seems Larry is in good company…

As expected BlackRock’s filing has sparked a mix of reactions across the crypto industry.

Galaxy Digital CEO Mike Novogratz expressed excitement, believing it could be the best development for Bitcoin.

Others cautioned against potential detrimental implications on retail investors.

James Edwards, a cryptocurrency analyst, suggested that BlackRock’s filing during a period of regulatory scrutiny demonstrates confidence in Bitcoin’s classification as a commodity rather than a security.

Which in turn could benefit Coinbase in its legal battle with the SEC, as BlackRock’s allegedly plans to use Coinbase custody.

So I’m not sure if this is a red herring, but if it is then it’s an expensive one.

Either way, critics argue that the entry of traditional investment giants like BlackRock may compromise the decentralized ethos of cryptocurrencies and enable them to profit from retail investors.

Yes that would be bad. And given the sophistication of the average crypto trader it could also be very very profitable.

Meanwhile Goldman Sachs is being investigated by the Fed and the SEC regarding its involvement in the purchase of Silicon Valley Bank’s securities portfolio prior to the bank’s collapse, according to The Wall Street Journal.

Of particular interest are documents related to Goldman Sachs’ dual role as the buyer of SVB’s securities portfolio and the adviser for the bank’s capital raise.

Nice gig if you can get it.

There also may have been ‘improper communications’ between Goldman’s investment banking division and its trading division.

Goldman Sachs stated that it is cooperating with the investigations….

… and plans on settling out of court for pennies on the Dollar.

Yeah okay, I made that last part up. I’m sure GS is completely and absolutely innocent and will come out of this smelling like roses.

On the trading front BTC briefly dropped below $25k but has recovered back to $25.5k overnight.

Based on the ongoing formation a final descend into $24k has pretty decent odds, especially given the slow pace of this correction.

A quick snap lower may have produced seller exhaustion and emboldened the dip buyers, however these types of slow motions corrections are tantamount to Chinese water torture in that they may not look scary on a chart but often are the most traitorous to retail investors.

It’s easy to fall prey to repeatedly losing a little more each week – in contrast to losing it all in one day or two and getting scared out of your position.

The key to avoiding this of course is to have a system that makes the right decision for you. Or should I rather say ‘despite of you’?

And let me assure you that I am by no means the exception, which is why I became a systemic trader in the first place.

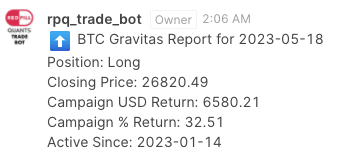

Speaking of which, Gravitas – my long term trend trading signal – on both BTC and ETH has been picking the swings like a runny nose.

Here’s a bit more context:

Gravitas took a profit of 32.51% in BTC on May 19th and then went short.

Similarly it took profits of 20.76% on ETH on June 11th and then went short.

How has been performing since?

Not bad and although I don’t expect every single trade to be profitable it’s been spot on since last June when we started to forward trade it LIVE:

If you’re interested in joining as a member then let us know and we’ll send you our easy 24-page questionnaire to evaluate adding you to our waiting list.

Just kidding – if you shoot us a quick message we can get you set up today. Your first win should more than make up the cost of the license.