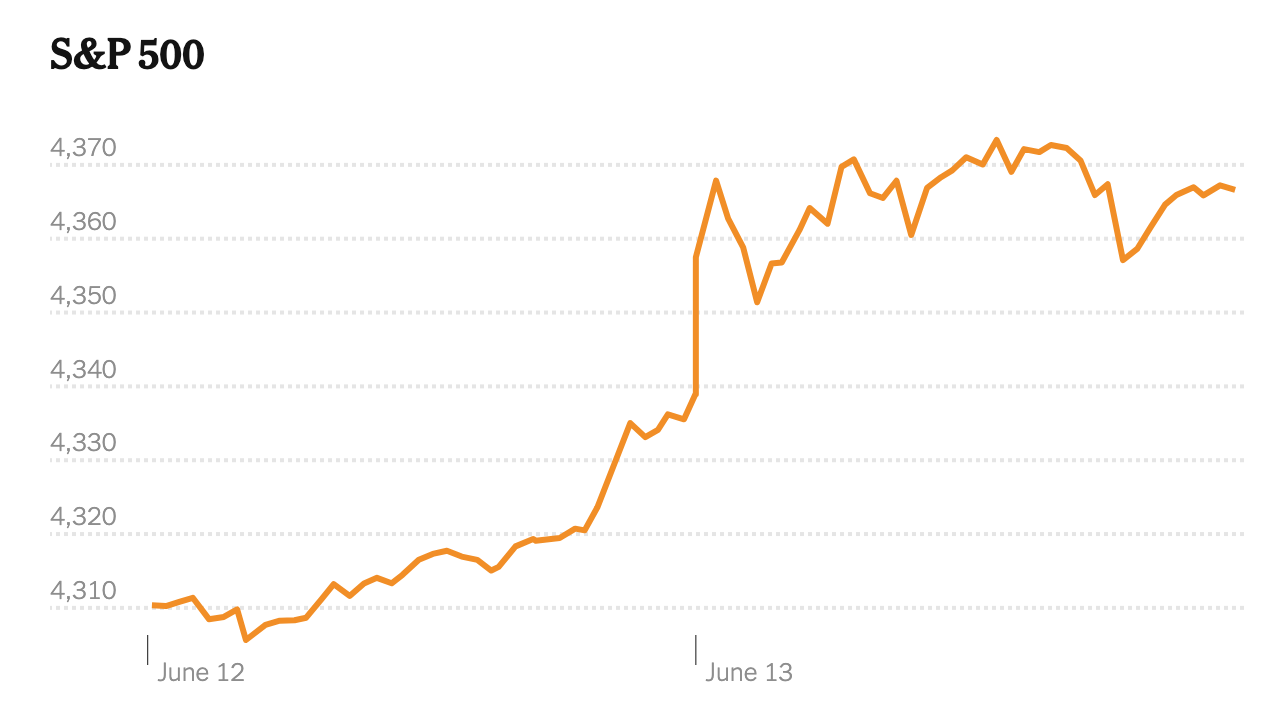

Stocks on Wall Street continued their upward trajectory, moving further into bull market territory, as newly cooked up data revealed a slowdown in inflation. Which will probably be revised upward next month, but I digress 😉

The SPX jumped 7 percent and managed to reach its highest level since January 2022.

More notably this marks a gain of over 20 percent from the low point in October 2022, thus meeting the definition of a new bull market.

Yeah sure, more of a silly goat market if you ask me.

Call me an old cynic but the alien invasion stories that were peddled across the MSM over the past few weeks seem a lot more plausible to me.

Of course all this b.s. boils down to this:

At least for the moment the Fed is off the hook to raise interest rates, which is what’s been driving the market lower over the past few months.

Now that the pressure is off big players are back to their favorite game – sector rotation and squeezing hapless retail shorts.

This is most obviously reflected in the Russell 2000 – until most recently it couldn’t get a bid in a prison holding a hand full of pardons but then suddenly turned on a dime and rallied more than 8 percent this month.

Now this is the narrative you’ll start seeing over the next few days and weeks:

You’ll be told that the stock market is showing resilience, that inflation has cooled, and that the economy remains strong despite concerns about higher interest rates.

Along with the good news institutional players are expected to bang the tape all the way into SPY 450 and then get ready for the inexorable retail rug-pull.

What To Do?

What you should NOT be doing right now is back up the truck on puts. I’ve grabbed a single CYA spread the other day but have kept my powder dry for the time being.

The current advance may be based on nothing but hopium, cooked inflation stats, and increasing political pressure, but that doesn’t mean it’s not real.

This is happening, so act accordingly.

Remember, trying to be right in the financial markets is a sure recipe for getting your account taken to the woodshed.

Like all bear market rallies, even this one will at some point catch up with reality.

BTW, I’m not saying that because I’m talking my book (my RPQ crew knows my book) but because there is no defying the laws of physics and economics.

Once reality sets in we’ll be there to take full advantage, no worries.

Meanwhile watch the bond market, which curiously enough nobody is talking about right now.

Yes, it’s a rhetorical question 😉