SBF has single handedly done for the White-boy-afro what Adolf did for the pencil mustache. End of an era. It’s no exaggeration to say that this is the biggest self-own in recorded history.

People were so upset by the 2008 financial crisis that we decided to create our own financial system…

That is now experiencing its own 2008 style financial crisis.

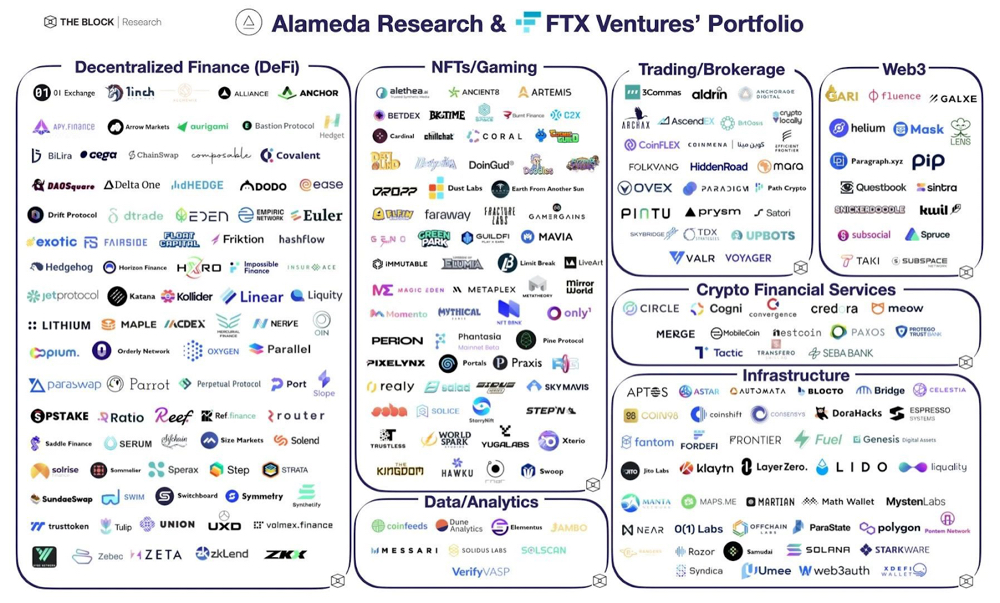

One thing to keep in mind is that the list of owners in FTX is a literal who’s who of Silicon Valley.

It’s like finding out Warren Buffet was invested with Bernie Madoff.

The stock market thinks this is just contained within crypto…

I think they are wrong.

Expect VC and Private Equity to have big exposure to this whole mess… and for the contagion to spread.

A lot of people were secretly hoping for crypto to bring down the legacy financial system…

BUT NO NOT LIKE THAT!!!

Always be careful what you wish for, you may just get it.

It’s becoming very clear that investing in crypto now carries career risk with it and institutional investors are now OUT until further notice.

A sad state of affairs… and one caused solely by moral hazard, greed, and corruption.

This a rare double inside day pattern which is resolving to the downside as we speak.

Obviously, when the trend, the price action patterns AND the sentiment AND the fundamentals are in alignment that makes for a high probability short.

Once we break below the 16K lows expect a sharp drop that might just well be the end of the train wreck.

But that’s gonna play out how it’s gonna play out… very hard to predict.

During times like these it’s important to maintain one’s cool and focus on your own financial survival.

For one you may want to familiarize yourself with how to move any of your remaining crypto assets off exchange – any exchange.

Always remember, not your keys not your coin.

Anyway, in the spirit of looking forward I’d like to show show you the investments I think will outperform over the next decade or so.

(if you missed any of the emails leading up to this catch up HERE)

Today I’d like to talk about one of the BIG things I think you can use to make a lot of cash in the next few years.

Supply shocks

While everyone is focusing on the money printing as a cause of inflation… it’s a lot more complicated than that.

What REALLY caused the inflation pimp-slap was the double whammy of stimmy checks and money printing working it’s way through the colon of the financial system at the same time as China shut down it’s manufacturing capacity to purportedly stop Covid.

And at the same time Russia stopped exporting Oil, Gas and wheat.

Well it turns out, that there is only enough “stuff” that the world needs if the trade routes are open for full globalized trade.

In our Wealth Creation Summit on Thursday, I’m assembling a superhero team of expert traders to discuss what we think are the slam dunk trades that will benefit from the reversal of globalization.

Whole industries will be wiped out (looking at you commercial real estate – and I’ll be talking about the best way to short it).

Meanwhile different industries will FLOURISH as nations race to build supply capacity back onshore.

If you want to stay ahead of the game register for the Wealth Creation Summit HERE

P.s. If you want a peek under the kimono of our New Economy Bootcamp program… you can’t buy it yet (I’m going to release it for Black Friday with a huge discount) send me a message to mikesneweconomybootcamp@gmail.com and I’ll give you a sneak preview.