The Red Pill Quants Story

How It Started

Back during 2008 financial crisis, Mike founded the infamous Evil Speculator blog in response to the big market crash that ended up wiping out the combined assets of millions of retail traders excluded from accessing the Federal Reserve's numerous bailout facilities.

Over the many years of sharing his market analysis, live trades and even turn-key trading systems, Mike has seen it all. During his 20 year trading career he has literally helped 1000s of traders, whilst learning from the best and avoiding the mistakes of the worst.

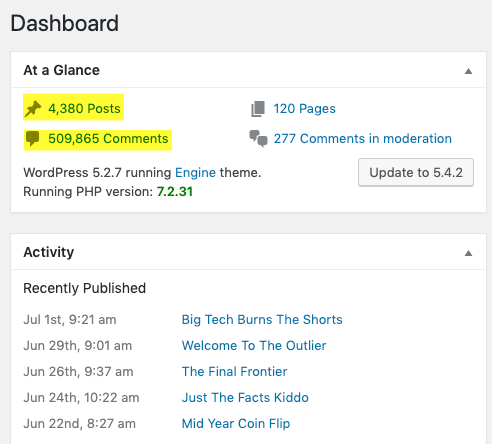

Over the 12 years active on Evil Speculator, Mike has posted all of his trades, both the winners and the losers in plain site for everyone to see. Today millions of traders read the Evil Speculator blog on a daily basis, including some of the top professional traders in the world. Over the years Mike has cranked out over 4000 insightful posts that would literally take several months to read back to back.

A side benefit of hosting a popular trading blog is that one runs into a lot of interesting people from all stripes of life. One of the professional traders who had followed Mike for a long time was Tony. During one of Mike's extensive posts about implied market volatility, Tony was struck with sort of an epiphany:

"Man, this guy really knows what he's doing, he just gets it. We really should work together. Plus he's old school German! They are always in-it-to-win-it."

So Tony reached out to Mike, they ended up joining forces and over time dove deep into the world of quantitive trading. They learned python, consumed everything there was to learn about quantitative trading whilst also collaborating together on various trading systems. But that is only the beginning of this story.

The Problem

Over the years, not a day goes by that we receive questions asking us to teach someone our style of trading. And the ugly truth nobody ever tells you is that not everyone is cut out to be a trader in general. Even fewer are successful option traders, quant traders are an endangered species, and quant options traders are considered unicorns.

Trading in general is difficult and requires an advanced background in calculus, coding, probability, and statistics. It also requires years of effort to not only understand these advanced concepts, but to actually develop the skill and experience to turn them into a profitable edge.

Effectively we are all competing with a legion of PhDs and street smart geniuses that have invested years and sometimes decades in their educations. The vast majority of the PhDs that work in quant finance for example happen to either have a physics, math, or chemistry backgrounds.

On top of spending 10+ years acquiring a intellectually demanding and expensive education at some of the top university in the world, they then have to learn how the financial markets actually function, which often is a reality check in itself and reduces the survival rate even further. Intelligence and talent are only one part of the equation - streets smarts and psychology is another.

Forget about BUDS - from hundreds of thousands of highly gifted nerds who dream of becoming wealthy quant traders only a handful ends up having what it takes to make the cut and turn that dream into reality. The extensive skill set and mental discipline required to hack it in this exclusive field makes NASA's astronaut training program look like pre-school.

Suffice it to say that anyone who actually makes it over all the hurdles and manages to work for an institutional trading firm keeps their secrets very closely guarded. It's an old axiom among traders that whatever everyone knows isn't worth knowing.

Which means that these guys have built a deep moat around their respective fortress of forbidden knowledge. That moat is the extensive knowledge required to play in the quant trading domain. And who can blame them! Imagine you had a holy grail trading system - would you want your secret to get out and see it arbitraged away in a matter of days? We didn't think so ;-)

The 21st century options market is no different and has rapidly evolved over the past decade. Back in the days (i.e. until about 2010) it used to be run mainly by institutional traders, hedge funds, and of course your run-of-the mill retail trader eager to 'beat the market' with a small trading account and an even smaller skill set.

However over the past decade the field is becoming increasingly dominated by quant trading firms who are leveraging the power, speed, and sophistication of machine learning and artificial intelligence. This is causing many traditional participants to be disadvantaged at best or at worst squeezed out of the market entirely.

Positioned at the bottom of the food chain it is no understatement to say that the average retail trader bent on trading options today walks into a thermo nuclear war equipped with the equivalent of a home made sling-shot. Don't let your fancy trading platform and all those 'must have' indicators fool you.

They are mostly for show and have never been proven to offer any significant edge to anyone. It's nothing but a distraction designed to suck you in and spit you out once you've been sucked dry. And there are plenty more where you came from.

While you are busily drawing fancy lines on your chart a network of liquid cooled super computers humming along deep in the bowels of some high frequency quant trading firm piped directly into the CBOE via a direct fiber or microwave connection has already calculated 10 million ways of how to screw you ahead of expiration.

Which is the very reason why over 90% of retail option traders lose over the long term. About 7% do okay but not spectacularly, which leaves the final 3% - a small minority who manages to be profitable consistently on a long term basis. Unless you are one of those 3% I hazard to guess the big question rolling around in your mind right now is:

Is there a way to teach quant based option trading to regular mortals, people like me who are not math geeks, already have a career, or perhaps are retired?

Well, we would not have wasted our time writing this if there wasn't.

The Solution

Learning how to trade is a bit like learning martial arts, playing the piano, or studying a craft. At some point of expertise you realize that you've come full circle and that most things are based on and revolve around very basic principles. As most everyone is good at something this most likely is an experience you've made in your own life.

One of the realizations we both had is that most of the quant related concepts that offer us an edge are actually pretty simple when you are able to explain them in plain English, not PhD geek speak. Not to pad our own shoulder but dumbing down complex topics and making them accessible to retail traders has been on display daily over on Evil Speculator over the past 12 years.

Take for example our 'El Floridita' implied volatility strategy. We must have read 100s of pages of academic research pieces, some very complex and guaranteed to put the average human to sleep in 60 seconds flat. But the end result - the basic principle that drives its edge is rather trivial and can be explained to anyone with an IQ above room temperature. More importantly: learning how to actually trade it is even simpler.

The knowledge and skills necessary to benefit from the numerous quant based option strategies we have developed after years of research is exactly what we teach in our Foundations training. We don't waste our and your time trying to turn you into a quant trader. Instead we teach you the skills necessary to not only survive but thrive in this highly competitive 21st century marketplace.

The solution to teaching quant strategies to regular retail traders is a simple paint-by-number approach taught in our RPQ Academy. The RPQ Academy is your draw-bridge across the moat of geekery into the quant fortress of knowledge.

You don't need to understand how the GPS works in your car in order for it to safely find your way to Whole Foods. Likewise, you don't need to know the math of how a Kalman Filter based mean reversion system works in order make money trading options. We've already done all that heavy lifting for you. All that's left for you to do is to follow in our footsteps. It's a non-brainer and anyone with a trading account and approximately one hour of time per week can do it.

That's all there is to Red Pill Quants - the decision of whether to continue doing what you've been doing or to join us over on the quant side is yours.

Mike

Professional Trader

After emigrating to the United States from Germany in the early 1990s I quickly realized the inherent opportunities of the nascent Internet revolution that was rapidly unfolding.

After a few years getting acclimated in Los Angeles I decided to relocate to Silicon Valley where I worked as a systems engineer for over a dozen companies which gave me the opportunity to learn a lot about about development and systems engineering on a large scale.

After several years riding the dot.com wave I hit max burn out after the bubble burst in mid 2000. It was a moment of introspection and it was then that decided that my time as an IT consult were numbered.

I decided to invest some of my savings into a small futures trading firm a friend of mine had started. Although the company went belly up only a year later I managed to learn a lot about the ins and outs of the trading business. The most lasting impression by far was how retail traders were systematically being taken advantage of by ruthless IBs and fly-by-night shysters.

The transition into becoming a full time trader was painful and riddled with many mistakes, most of which I had to learn the hard way. My skills as a software engineer helped me in many ways but it also led me down many rabbit holes that could have been avoided by focusing on making money and not on building complex trading systems.

However in mid 2008 I finally was ready to retire from engineering and become a full time trader. I launched evilspeculator.com around the same time and much to my surprise it quickly grew into a thriving community of traders.

A few years in I met Tony who exposed me to many aspects of the institutional and quant trading world I had been mostly unaware of. That marked my own red pill moment and it's been fun ever since.