Most people can't be successful traders and never will. They simply don't have the skills required to be successful in 2020.

In the world of professional trading - options or otherwise - there are traders that look at charts, draw silly lines, do technical analysis and make trades based on those silly lines look. We refer to these as Aim-And-Shooters. It's 'Bro Science applied to finance.

"I think there's a Quad full U-Turn Jones Topping Pattern, this stock is going DOWN!!!"

"I think it's a triple flag double-lane bull chart formation, this stock is going HIGHER!!!"

These traders crash and burn hard, most of them have very short lived careers. Why?

Because unless you have a team of Quant PhDs working in your garage...

Tryting to predict the direction of a stock on a short term basis is a losing game..

If you think looking at charts with moving averages and silly lines on them is going to turn you into market Nostradamus, son you're trippin'.

But don't take it from us, take it from this guy.

That's Tom Sosnoff on the left, the man who founded Think Or Swim and sold it to TD Ameritrade for $750 million. He was a CBOE market maker, founded the Small Exchange, founded TastyWorks and is the man behind TastyTrade. To say the least, the man knows a thing or two about professional trading...

During the week of May 11th, 2020 I was watching a call-in segment on TastyTrade. A novice trader called in with a question and the conversation went something like this...

Novice Trader: "Hey Tom, why doesn't the TastyWorks trading platform have more charting tools and indicators?"

Tom: "Because professionals don't use charts. Do you think Citadel and RenTech are looking at charts?"

Five seconds of dead air followed. Deflated, the caller didn't know what to say... He just found out there is no Santa Claus. Finally, after regaining his footing, the caller goes on...

Novice Trader: "Well, then why do you have Tim Knight on TastyTrade doing a daily show talking about charts?"

On TastyTrade, there is an afternoon show with Tim Knight, who is a chart trader. Tim founded a company you probably know of, Prophet. It was purchased by Think Or Swim and was part of the platform for a long time.

On Tim's daily show, he goes through charts and does the usual suspects: support, resistance, trend lines, full u-turn jones chart patterns. You name it. All of the non-sense.

Tom: "Look, I bought Tim's company Prophet when I ran Think Or Swim. We integrated it into the platform. I really like Tim and he wanted to do a show. People like watching him, but take what he does with a huge grain of salt."

Tim is at least entertaining to watch with heavy doses of his dry pessimistic humor.

But the fact is in 2020, on most days at least 60% of all trading is done by algos. On heavy volume days, it's closer to 80%.

Do you think the PhDs that wrote these algos are using moving averages, triple top patterns and trend lines? Spoiler alert: HELL NO!

These days, almost all profitable trading strategies are quant based. Just like the house of any casino, they know the probability of success before taking a trade. And they also know how to stack the odds in their favor.

There was a recent article in Bloomberg talking about the arms race by hedge funds to acquire more quant traders. Starting salaries are well over $400k and these firms can't get enough of them. What's involved in becoming a quant trader?

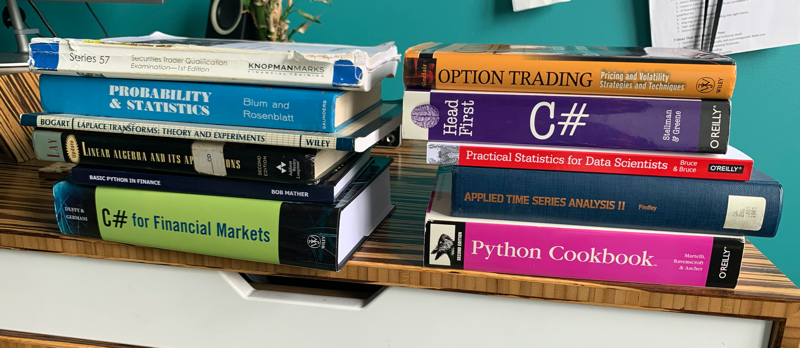

For starters, you'll need to master the content in these books. Not just have an understanding in them, master them. These are books that teach real skills that you'll need to master.

And then gather up all of these types of books and throw them in the garbage. These books are trading 'bro-science and try to convince you, to your peril, that you can do it too! Please don't give them away, torch them. If you give them to someone and they start falling for this BS, you're doing them untold amounts of harm...

Everybody else is telling you that you can get rich and everyone can get rich trading. Everyone knows they're liars, but anyone who wants to believe them badly enough, will believe them anyway.

And if you drink their pink Kool Aid and you don't have the right psychological profile... then six months from now your wife dumps your clothes in the front yard, changes the locks and files for separation.

But this isn't Trading Places... This is real life.

This isn't the YMCA mush ball league where everybody wins - just for showing up. The only people that win are the snake oil salesmen fleecing your pockets dry with courses, seminars, indicators and "master classes". Meanwhile, you're trading account keeps shrinking. How do you answer when your friends and family ask you "how's that trading thing going?".

This is real life... and 99% of people who venture into the world of trading don't have the skills needed to be successful in 2020 and beyond. This is just how it is son.

Here are just some of the skills you'll need to become a profitable quant trader:

And then you'll need about 10,000 hours of practical experience to become proficient.

If you're getting your trading education from a YouTube dode, who lives in his moms basement and drives his rented Range Rover to his day gig at Cinnabon...

Then you have a long, painful road ahead...

In my professional experience inside prop trading firms, I've seen hundreds of traders come and go every year. Most don't make it a year before calling it quits.. and these traders have access to professional mentors who are vested in their success.

You either have it or you don't. 99.5% of those reading this don't have it. Here is the reality...

Most people don't have the skills or innate talent required to make a living trading. And never will...

There are marketers out there that will promise otherwise: "Anyone can do it! Yeeeaaaaahhhhh! Just buy my $5000 course and you can do it too!"

If you're lucky, you'll spend only $1000s of dollars in courses and and only hours/week/months trying to make them work for you. Before throwing in the towel and moving onto the next shiny object promising trading riches. All while chasing the elusive dream that you too can make fortunes by learning to trade.

But most people aren't lucky...

If you're unlucky like most, you'll spend $10,000s or even $100,000s and years of your life chasing trading unicorns that don't exist. And possibly blow up your trading account out of frustration. Maybe twice.

No, not everyone can do it. In fact, most people have no hope of ever making a living trading. Sure, we can teach most people to make 20% or 30% a year. Which is exactly what we do in our Foundation training.

We can teach almost everyone to beat SPY by 10% a year.

But if you want to make a living trading, you'll need to do MUCH better than 10% a year.

Most people are far better off spending their time and money learning another way to make money. We're not here to sell you the dream of turning you into a master quant trader in 2 months or ever.... With magical powers of alchemy to transform your trading account from pocket change to millions.

It ain't happening, son. However, there is some hope.

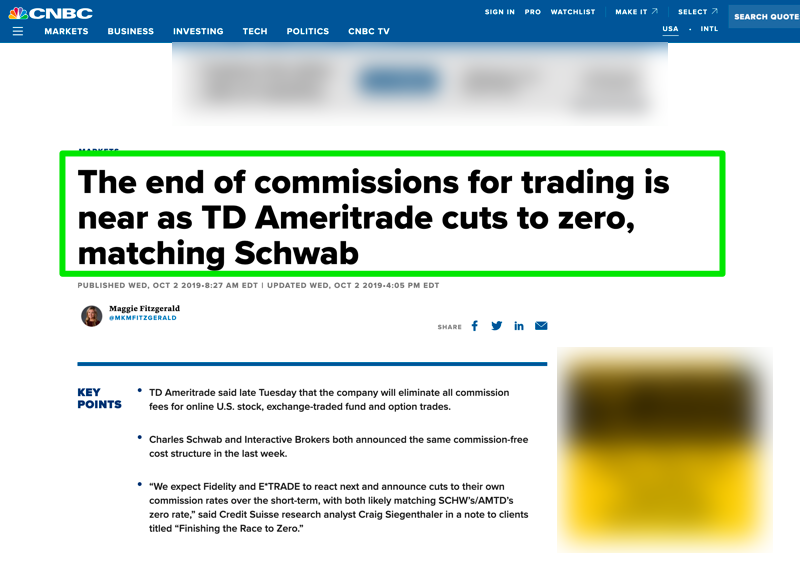

You seen, in 2019, the brokerage industry went through a massive change.

Commissions? What Commissions!?

Stock trading commissions effectively went to zero in 2019. Options commissions on Think Or Swim are $1.35 round trip. TastyWorks isn't far behind with $1 roundtrip plus exchange fees.

This completely changed the game for a lot of professionals. With the massive reduction in retail trading fees, it really no longer made any sense to be trading as a professional.

Professionals are fleeced dry with a non-stop barrage of platform fees, professional data fees, high commissions that used to be offset (and then some) by exchange rebates.

Instead of paying commissions like retail traders, we collected commissions for every share of stock we bought and sold. We got paid-to-trade. But that honey pot slowly dried up as exchanges got greedier and made it all but impossible for most high volume traders to collect rebates.

Although trading as a professional is very profitable, it's also a ton of extra work.

Exams, compliance, firm meetings, tons of documentation... none of which is required as a retail trader.

In short, unless you need 20:1 leverage on stocks, don't have your own trading capital and need access to difficult to short stocks, there is almost zero reason to be trading as a professional in 2020. Especially if you're kicking ass and have to kick a cut of your trading profits into the firms pool.

This change of retail brokerage commissions to essentially zero was the final break in the dam for many pro traders. Me included.. most of us with consistently profitable trading strategies are far better off trading in retail accounts.

When I peaced-out to the professional trading world, I had to retool my trading strategies to work on Think Or Swim and Tasty Works.

This is where you, the at-home trader get to benefit. Massively.

So what are we offering? We're offering you access to our quant options trading strategies. The live actual trades we're placing.

You get to ride on our coat tails. Live.

We have a single offering: Red Pill Quants Unlimited. You receive several live trades each week, as we place them, in real time. You can usually put the trades on within an hour of us posting them and get filled at the same price or better than us.

But aren't the trades complicated to place? Not at all.

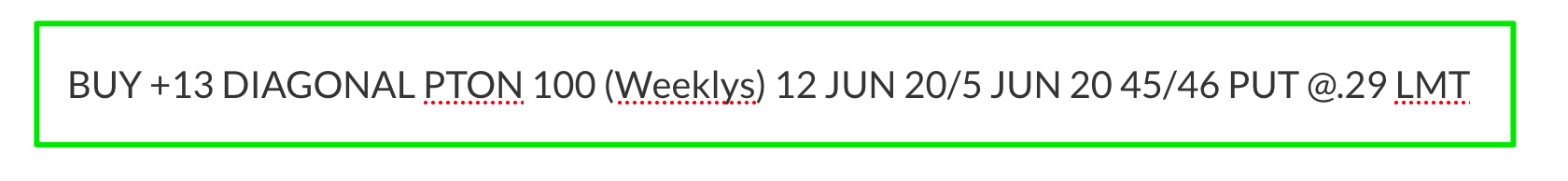

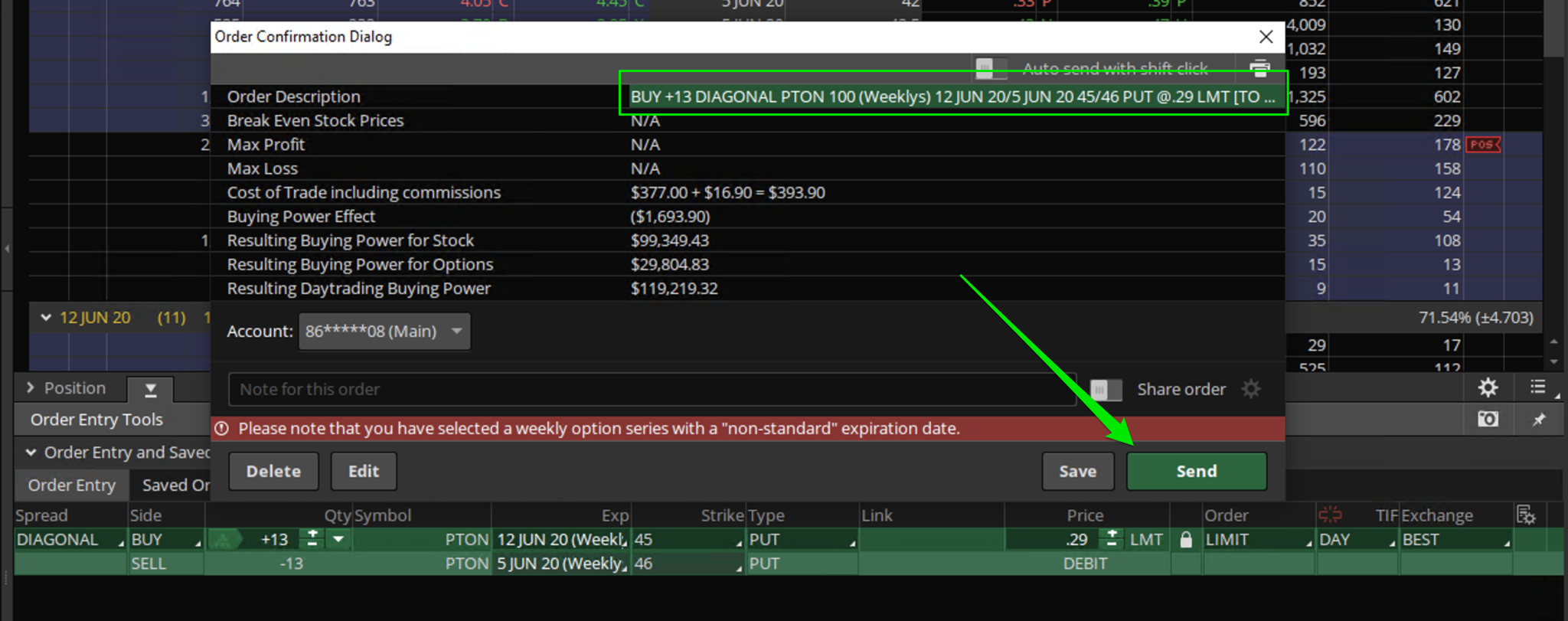

We run this strategy using Think Or Swim (TOS) short code to place the trades. In English, you literally are copy/pasting the trades into Think Or Swim. Just like this:

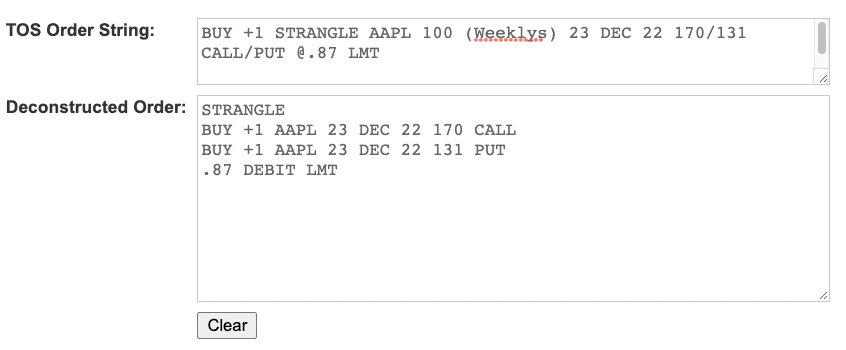

Becomes this:

We give you the trade in TOS format. You paste that text into Think Or Swim, hit Confirm And Send and you're done. Paint-by-numbers simple.

And we even have a paint-by-numbers simple video showing you exactly how to do that.

If you don't trade on ThinkOrSwim - no problem! We built you a handy utility that converts any TOS order string into human readable language.

The trades are simple to place. But our strategies are complex quant strategies running behind the scenes...

Behind the scenes, there is an extremely sophisticated quant strategy written in python running on our servers, generating the trades. We review them and post them live as they happen.

On Fridays, we spend about an hour closing our trades together and get paid. We ride into the sunset on Friday nights all cash.

We're not here to sell you delusions of grandeur that we can turn you into a professional quant trader. If someone else is and you want to believe them, go for it. When that course runs afoul, we might still be accepting new clients into our programs...

But we can guarantee you this: you can consistently grow your trading account with our services. We guarantee it. Find out more about how we can help you grow your trading account right now.