Cryptonaissance FAQ

Q.

What do I need to start using the system?

A.

- One or more crypto accounts that cover the entire universe of coins below. You might need more than one account depending on where you are, and the laws in your specific country ZEC, DASH, BCH, KNC, ETC, TRX, SOL, MANA, HNT, LUNA, ALGO, BNT, OCEAN, ANT, SNX, ICX, STORJ, ASX, CRV, CAKE, RSR, LTC, ADA, SUSHI, BAT, WAVES, LSK, EOS, MATIC, BLZ, ATOM, COMP, DOT, CHZ, SAND, REN, UNI, ETH, XRP, COTI, FIL, MKR, QTUM, AVAX, KSM, RLC, GRT, DOGE, OXT, SC, OMG, REP, GNO, ZRX, FTT, ANKR, ENJ, THETA, FTM, BAL, BNB, XLM, DCR, AAVE, XTZ, LINK

- Money in those accounts to trade. This money could be in your home currency (USD, EUR, AUD) or in BTC or in a stable coin like USDT or BUSD. IT DOES NOT MATTER.

The answer to almost any question you can think of that starts with “should I do….” is almost certainly that it doesn’t matter as long as you buy the correct amount of coins one way or another. How you accomplish this DOES NOT MATTER.

Q.

How do I execute the system?

A.

Easy. Every Monday you log into your account and enter your account balance. The software will tell you which coins to buy, and you buy them in the amounts that are listed.

If it tells you to sell coins you can either sell to USD (or another currency), BTC, or a stablecoin like USDT or BUSD. It doesn’t matter, there are differences, but it’s your choice. As a general rule, fees are significantly lower staying trading within crypto (selling to BTC or USDT).

The actual time of day doesn’t matter (it really doesn’t) but try and be roughly consistent.

If it tells you to sell coins you can either sell to USD (or another currency), BTC, or a stablecoin like USDT or BUSD. It doesn’t matter, there are differences, but it’s your choice. As a general rule, fees are significantly lower staying trading within crypto (selling to BTC or USDT).

The actual time of day doesn’t matter (it really doesn’t) but try and be roughly consistent.

Q.

Which exchanges should I use?

A.

In the bigger picture, it doesn’t matter much. You will, most likely, have to have accounts on more than one exchange.

I do NOT want to get into debates about which exchange combinations are best, or which exchanges are best.

I do NOT want to get into debates about which exchange combinations are best, or which exchanges are best.

Q.

I have an idea for the system I want to know if you have considered

A.

If I was the sort of person who would spend several years and several thousand hours developing a system, only to change it radically at the last minute based on the input of people I don’t know with no track record of developing trading systems… I’d be an idiot. If I was such an idiot I’m the type of person you never should have purchased a trading system from.

Q.

I am presently funding my new account. If my funds do not show up by Monday, should I transact my first coin buys on Tuesday or wait till the following Monday?

A.

Good question. Tuesday.

Q.

A question about the coin universe, in the event coins are added/ removed from exchanges ( a reasonably frequent occurrence) meaning they become available/ unavailable on all your selected exchanges will the universe alter accordingly?

A.

No. The universe is the universe because it is the most profitable. There has never been a situation where a coin has been unavailable on all supported exchanges so your premise is false.

Q.

Given the inherent high volatility of crypto markets (like this week!), do the system rules contemplate deploying entire intended capital this Monday, or will dollar cost averaging total capital over some period lead to better results? The whole point of this from my perspective is to remove discretionary decision-making

A.

No, the volatility isn’t a big deal because you are exchanging highly correlated assets. So it’s not like you are exchanging something dropping for something rising. You are exchanging one historically well performing coin for another coin that’s historically performing slightly better.

Q.

What time should I buy the coins?

A.

There is no set time. Coin picks come out at 00:01 UTC but that does not mean you have to do it then. By the way UTC is not GMT. During DST GMT is one hour ahead and it’s in sync outside of DST. Yes DST is stupid but that’s why governments keep doing it, just to screw with us twice per year and laugh about it.

It really and truly doesn’t matter, but try and be roughly consistent about the time.

It really and truly doesn’t matter, but try and be roughly consistent about the time.

Q.

Should we be buying BTC between now and Monday?

A.

You can buy BTC whenever you want and feel it’s at a good price.

What are the factors in choosing an exchange?

What are the factors in choosing an exchange?

Q.

How much time do I need to set aside for this?

A.

There’s a little bit of account setup, but once you are set up its a 5-10 minute process

Q.

Which exchange do you recommend?

A.

You need an exchange to accept real money AND an exchange to trade. They can be the same exchange but most people prefer to keep them separate.

As a trading exchange (the main exchange I use) I prefer binance. It’s easy to set up. Kucoin is fine as well, Huobi is fine. They are all basically fine.

You can get a Binance account by clicking HERE

As a trading exchange (the main exchange I use) I prefer binance. It’s easy to set up. Kucoin is fine as well, Huobi is fine. They are all basically fine.

You can get a Binance account by clicking HERE

Q.

Which exchanges are supported?

A.

Any exchanges (there are hundreds) that will a) accept your fiat (real money) and b) trade the list of coins below.

Here is a full list of exchanges. You can see there are thousands https://coinmarketcap.com/rankings/exchanges/

Here is a list sorted by country

https://www.cryptowisser.com/exchanges/

Do we need to set up accounts on multiple exchanges before Monday?

Here is a full list of exchanges. You can see there are thousands https://coinmarketcap.com/rankings/exchanges/

Here is a list sorted by country

https://www.cryptowisser.com/exchanges/

Do we need to set up accounts on multiple exchanges before Monday?

Q.

How do I get my money into a crypto account?

A.

That’s a good question! Not all exchanges accept real money. Some accept real money with a credit card only. Note that paying with a credit card will always be more expensive than a bank transfer. My advice is to take the time to transfer by bank/wire transfer, saving the fees is important. In a pinch, or in countries without crypto exchanges, localbitcoins.com is good but expect to pay about 5% over normal for the convenience.

Q.

What is USDT? BUSD? What are they for?

A.

These are “stablecoins”. Think of them like US dollars, but fake US dollars not backed by anything but people still accept them. Yes, I know it’s weird. Yes, they work like money for now, but that might change. No, I don’t know if it’s going to change.

The reason you might want to use these is that exchanges that work with real money (fiat) and not stablecoins have higher anti-money-laundering requirements (more paperwork) and higher fees.

I’m not recommending a course of action here. I’m not getting into the mix of which exchanges to use and which stablecoins to buy.

The reason you might want to use these is that exchanges that work with real money (fiat) and not stablecoins have higher anti-money-laundering requirements (more paperwork) and higher fees.

I’m not recommending a course of action here. I’m not getting into the mix of which exchanges to use and which stablecoins to buy.

Q.

I’m an American citizen and they won’t let me join (insert name>) exchange? What do I do?

A.

There are MANY US Citizen friendly exchanges. The biggest and most popular choices are:

http://www.binance.us

http://www.coinbase.com

http://www.gemini.com

http://www.kraken.com

http://www.binance.us

http://www.coinbase.com

http://www.gemini.com

http://www.kraken.com

Q.

I know there are are a lot of choices for exchanges? What do you recommend?

A.

Honestly, they are ALL FINE, and the differences are stylistic.

You need at least ONE account that accepts and gives real money (fiat) from a bank account and not just from a credit card (which is inherently dodgy) Real money exchanges are: Coinspot.com.au , independentreserve.com.au, swyftx.com, kraken.com , coinbase.com, gemini.com (there are many more)

Non-fiat (or mostly non-fiat exchanges) are things like binance.com, bittrex.com, kucoin.com, hitbtc.com and huobi.com

You can mix and match, and most traders I know have accounts with many different exchanges. I personally have bittrex, binance, coinspot, independent reserve, kucoin, coinbase, huobi, hitbtc.

You need at least ONE account that accepts and gives real money (fiat) from a bank account and not just from a credit card (which is inherently dodgy) Real money exchanges are: Coinspot.com.au , independentreserve.com.au, swyftx.com, kraken.com , coinbase.com, gemini.com (there are many more)

Non-fiat (or mostly non-fiat exchanges) are things like binance.com, bittrex.com, kucoin.com, hitbtc.com and huobi.com

You can mix and match, and most traders I know have accounts with many different exchanges. I personally have bittrex, binance, coinspot, independent reserve, kucoin, coinbase, huobi, hitbtc.

Q.

Is there a major benefit trading a USD pair up vs BTC pair up?

A.

Great question. There are three combinations here

1) ALTCOIN/BTC

2) ALTCOIN/USD or ALTCOIN/AUD

3) ALTCOIN/USDT or ALTCOIN/BUSD

In general, fees are much higher on ALTCOIN/USD pairs. So in general that’s what you should avoid if possible (though it’s no big deal, really)

there are two factors. Fees and Liquidity. As long as you have enough liquidity to do the trade, choose the one with the lowest fees.

1) ALTCOIN/BTC

2) ALTCOIN/USD or ALTCOIN/AUD

3) ALTCOIN/USDT or ALTCOIN/BUSD

In general, fees are much higher on ALTCOIN/USD pairs. So in general that’s what you should avoid if possible (though it’s no big deal, really)

there are two factors. Fees and Liquidity. As long as you have enough liquidity to do the trade, choose the one with the lowest fees.

Q.

Would you advise HODLing BTC/ETH as well as this strategy?

A.

If I wanted you to make up some brand new strategy I would have bloody told you so.

Wash your brain out with soap.

Get it through your freaking heads. I’m not “advising” you on anything. We have a system. The system tells you what to do. Do that.

Any time you are tempted to do some other dumb shit, a simple filter will help.

“Did the system tell me to do it?” No, ok then DON’T EFFING DO IT!

Wash your brain out with soap.

Get it through your freaking heads. I’m not “advising” you on anything. We have a system. The system tells you what to do. Do that.

Any time you are tempted to do some other dumb shit, a simple filter will help.

“Did the system tell me to do it?” No, ok then DON’T EFFING DO IT!

Q.

As a follow-up, clearly ETH has outperformed BTC in the past few weeks, what parameters are set for differentiating between holding those two when we’re out of AltSeason?

A.

Oh for fuck’s sake. The SYSTEM will tell you what to do. Do that. Don’t do anything else.

Also, the system outperformed ETH over the last weeks as well. So if you “decided to just hold ETH” you would have screwed yourself right in the ass, and deservedly so.

Also, the system outperformed ETH over the last weeks as well. So if you “decided to just hold ETH” you would have screwed yourself right in the ass, and deservedly so.

Q.

Is there a preferred approach to handling a situation where your chosen exchange doesn’t trade one or more of the coins used in the system? For example Doge not supported by Coinbase, etc. – would you reallocate based on what’s available, just skip the portion you can’t purchase, or something else?

A.

That’s a good question. If you can’t buy <coin-name> in your place of residence (laws are different everywhere and certain places have the capability to ban certain coins). FIrstly google “<my town> buy <coin name>” and see if there is an easy solution. If not, allocate those funds equally to the other 4 coins. It is HIGHLY unusual to not be able to buy a coin. These are the most liquid and popular altcoins, all with large market capitalizations.

Q.

What time Monday do the coin picks come out?

A.

Coin picks come out at 00:01 UTC.

Q.

Do I have to do it at the exact time?

A.

No. In testing it didn’t matter much at all, although you should be roughly consistent with the time. It doesn’t have to be exact, either. “In the morning before work” or “after dinner on Monday night” is close enough. Why? Because you are selling one set of coins to buy a different set. Mostly, if the coins you are buying go up, so will the coins you are selling.

Q.

Do I need to check it during the week?

A.

NOAnd in the strongest possible terms I would advise you to check it as LITTLE AS POSSIBLE.

Please heed my warning that the less you check the markets the EASIER this will be!

Please heed my warning that the less you check the markets the EASIER this will be!

Q.

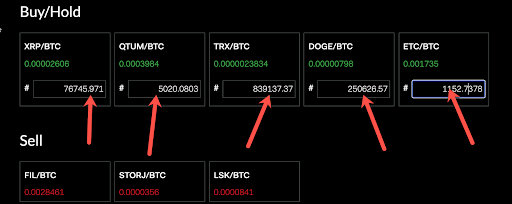

What is the difference between Limit and Market orders?

A.

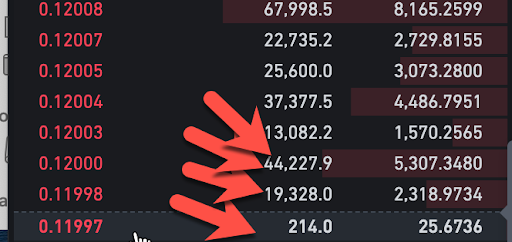

A market order buys from all the coins on offer, starting at the bottom until your order is filled.

Like this

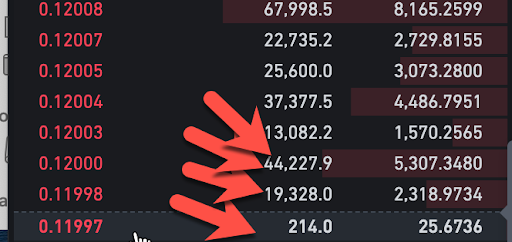

A limit order sets the maximum you are willing to pay.

Like this

A limit order sets the maximum you are willing to pay.

Q.

Should I buy at market or at limit?

A.

Good question. If your account is small market buying is fine. If you are buying more than $50,000 worth of coin each time it’s worth using limit orders.

Q.

What is a limit order?

A.

A limit order sets a maximum price you are willing to pay. It’s a way of making sure you don’t pay extra if the market starts moving quickly while you are placing your order

Q.

How do I use a limit order on binance?

A.

Go to markets > trade > coin name and scroll down until you see order type. Select limit (as opposed to market)

Q.

Which coins will I need to trade?

A.

This is the coin list. This list is actually a significant part of the “secret sauce” here, so please don’t hand it out.

BCH, BTC, WAVES, OMG, AAVE, LTC, ETH, MANA, TRX, QTUM, ATOM, KSM, DOGE, DOT, XRP, LSK, XTZ, ETC, ADA, ALGO, OCEAN, XLM, KNC, EOS, LINK

What you will notice about this coin list is that these coins are relatively well high capital coins with a lot of liquidity available. Most of the coins are available on most exchanges. Your preferred exchange will probably be missing a few, and you need a backup exchange(s) to handle that.

BCH, BTC, WAVES, OMG, AAVE, LTC, ETH, MANA, TRX, QTUM, ATOM, KSM, DOGE, DOT, XRP, LSK, XTZ, ETC, ADA, ALGO, OCEAN, XLM, KNC, EOS, LINK

What you will notice about this coin list is that these coins are relatively well high capital coins with a lot of liquidity available. Most of the coins are available on most exchanges. Your preferred exchange will probably be missing a few, and you need a backup exchange(s) to handle that.

Q.

Follow-up on the coin list question: I’m not seeing several of the coins we’ll be trading on either Coinbase/CBPro (TRX, QTUM, XRP) or Binance.us (TRX, XRP, KSM). Maybe we’re hobbled in the US??? I plan to eventually migrate some funds to a broader exchange with all the coins, but in the interim, should I just buy those coins I can buy on a weekly basis (adjusting position sizes accordingly) or should I just substitute in some of my own prior/current alt winners with strong momentum, so that I always have five in play (during alt season).

A.

There are plenty of solutions. I’m not going to get into the business of saying “this exchange is better than that exchange”. Why? Because I’m not qualified to answer. If you google buy <coin name> in USA you will always find a multitude of solutions.

Q.

Why trade a specific list of coins rather than the system choose from all 250+ available when coinspot release coins prior to acceptance on other exchanges. Could be early mover advantage?

A.

Good question, we tested it and the OPPOSITE was true, actually. Surprised me too. The real edge is when a coin is listed on multiple “big” exchanges.

Q.

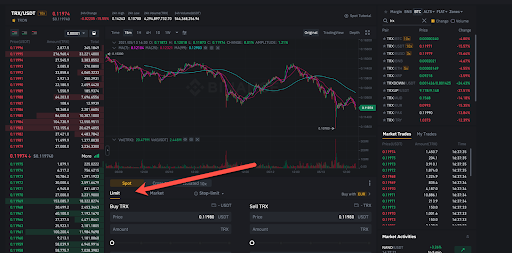

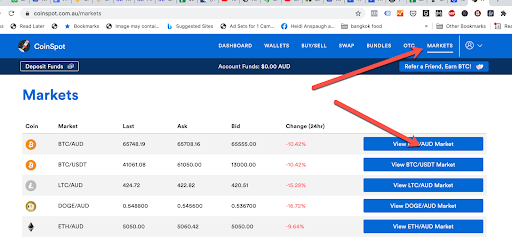

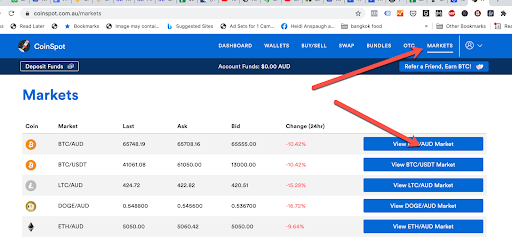

How do I see market depth on coinspot?

A.

Click on “markets” and it shows you

Q.

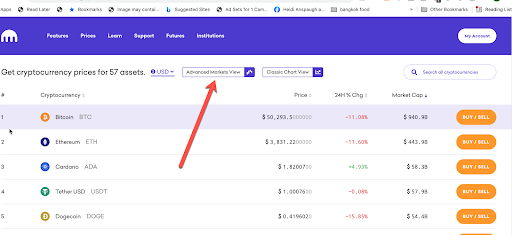

How do I see liquidity on Kraken?

A.

Use the “advanced market view”

Q.

I see the system asks for an account balance at login. Can I trade this on multiple accounts/ exchanges simultaneously?

A.

Yes you can have many accounts just enter the total of all of them in the account window and the program will handle the calculations.

Q.

Coin swap or Sell to Cash then Purchase new suite of coins: When we switch coins from one Monday to Monday, do we sell completely to cash or swap (the swap function in Coinspot charges a nosebleed ~4%)?

A.

I personally wouldn’t do anything with a 4% charge, that’s outrageous. Open up a second account with bittrex or kucoin or binance, do your trading there, and just leave coinspot as what you use for getting cash in and out of crypto. Coinspot is great for that.

Q.

When our accounts grow to the larger limit order (as mentioned above) do you give us a price target for that limit order?

A.

I’ll make a video showing how I do it. It gets a bit more complicated above 50K position sizing (so 250K account size total). Not difficult, just stuff to know.

The short answer is to pick a limit value around what the last traded price is.

The short answer is to pick a limit value around what the last traded price is.

Q.

If one “hypothetically speaking” would want to do this under the radar of the government and it’s lovely taxes, is that possible/any good tips?

A.

Can we participate in a felony conspiracy together? Damn straight we can. Hypothetically you’d transfer to a privacy coin like Monero, which keeps no records, and then do your trading on an exchange with weak KYC, and transfer it back out. Of course, in theory, actually getting your money out of crypto back into fiat is the harder part, but a smart guy like you would figure it out.

Opening crypto account for the first time; do I purchase BTC and then whatever the system says to buy on Monday, or just make initial purchase from cash on hand?

It doesn’t matter much at all. There can be small differences, but they really are small. Personally I purchased BTC on independentreserve.com.au and transferred it to binance.com to buy altcoins. Each Monday I sell into USDT (tether) and buy the coins I’m told.

Opening crypto account for the first time; do I purchase BTC and then whatever the system says to buy on Monday, or just make initial purchase from cash on hand?

It doesn’t matter much at all. There can be small differences, but they really are small. Personally I purchased BTC on independentreserve.com.au and transferred it to binance.com to buy altcoins. Each Monday I sell into USDT (tether) and buy the coins I’m told.

Q.

If I have an account of 10k, for example, and the system on monday says to buy 5 coins – should I spread the risk between all 5? Basically, the risk will be 20% on each pair. What is your suggestion on that?

A.

The software tells you exactly how many of each coin to hold. You don’t have to do any thinking or calculations. This is for stupid people like me, who don’t want to have to do a lot of thinking. I don’t want a new second job.

Q.

If you use two separate exchanges (one to accept money and one to trade) what coin/s do you recommend as the best (fastest, cheapest) to move value from the accepting money exchange (eg. Coinspot) to the trading exchange (eg. Binance) and then likely back again at some stage?

A.

I’m not getting into the “which exchange is best?” argument. Nor am I recommending specific exchanges. You need to be able to buy the coin list, using one exchange or a combination of exchanges.

Q.

Why are you so sure we are nowhere near the new bear market phase yet? Number of whales holding bitcoin is hitting new and new lows since BTCUSD reached 50k (picture below). Also negative rhetoric from US government or new strict rules on crypto transactions or some other “Black swan” event can send bitcoin flying well below current price. In this case the momentum system that only aims at buying crypto will inevitably lose money.

A.

Really great question. In fact if you think about it, this is the CRITICAL question in the whole idea. There’s many reasons why we aren’t anywhere near a top. Firstly there isn’t enough unbanked profit to make people start thinking about cashing out and not playing the game anymore. That’s a question of statistics, not opinion. We did a statistical analysis of the number of whales falling, because that number is actually quite small (around 1500 from memory) it was feasible to get an accurate picture of when the whales who sold, bought.

Turns out, the whales who started selling at around 40K had an average buy price of 21K. Which means they, on average, bought the breakout, doubled their money, and cashed out. Which seems like a perfectly sensible thing for them to do.

If you go through the webinar series (webinar 2 and 3) I think I layed most of the evidence out. I’m not being bullish for bullish sake here, I don’t think there’s any danger of the bull market being over yet.

We are due a significant pullback pretty soon, but I’d expect it after one more spurt. Could happen now, but unlikely. It’s trading though, so you never know until you bet. That’s why we make the reward after all… it’s for taking the risk.

There is an easy heuristic to tell if we are close to a top, though. It feels a bit shaky now, right? At a bull market top it doesn’t feel shaky at all, it will feel like prices have reached a permanently high plateau, and it’s blue skies ahead. That’s what it feels like every time, and that’s how you will know. When it comes time that you feel like you don’t want to sell, that’s probably close to the top. If you feel that it’s a little dodgy and could fall over anytime, that’s a great sign.

Turns out, the whales who started selling at around 40K had an average buy price of 21K. Which means they, on average, bought the breakout, doubled their money, and cashed out. Which seems like a perfectly sensible thing for them to do.

If you go through the webinar series (webinar 2 and 3) I think I layed most of the evidence out. I’m not being bullish for bullish sake here, I don’t think there’s any danger of the bull market being over yet.

We are due a significant pullback pretty soon, but I’d expect it after one more spurt. Could happen now, but unlikely. It’s trading though, so you never know until you bet. That’s why we make the reward after all… it’s for taking the risk.

There is an easy heuristic to tell if we are close to a top, though. It feels a bit shaky now, right? At a bull market top it doesn’t feel shaky at all, it will feel like prices have reached a permanently high plateau, and it’s blue skies ahead. That’s what it feels like every time, and that’s how you will know. When it comes time that you feel like you don’t want to sell, that’s probably close to the top. If you feel that it’s a little dodgy and could fall over anytime, that’s a great sign.

Q.

Just noting that there doesn’t seem to be a US version of any exchange where 100% of the listed coins are tradeable. From first glance, it looks like Kraken comes the closest. US traders may have to use multiple exchanges. (XRP is not tradeable from any of the listed US exchanges).

A.

You will need multiple exchange accounts. I personally have about 10 different ones.

XRP is the subject of a recent lawsuit. Many exchanges in the USA are reluctant to allow trading in it.

XRP is the subject of a recent lawsuit. Many exchanges in the USA are reluctant to allow trading in it.

Q.

I believe I have access to all coins except for XRP. I may start an overseas account for this but if I don’t what should I do when XRP is on the buy list?

A.

We are not in the business of recommending or endorsing exchanges. If you google “Buy XRP in <MY TOWN>” you should get a good answer

Q.

Only used Coinbase Pro before but charges are high and limited coins. Just trying to get my head around Binance. Looks like I have to buy BTC in order to buy most coins and looks like you only buy BTC pairs, not GBP or USD pairs, is there a reason for that?

A.

We are not in the business of recommending or endorsing exchanges.

Q.

I assume there will be times that fall back to cash is required. Is once a week sufficiently frequent to get out before serious falls occur?

A.

The eventual sell signal is not weekly, it happens in real time. No, I’m not explaining how it’s done.

Q.

Is there a recommended amount of capital to start with? And should I split that capital among the multiple exchanges?

A.

No minimum.

Q.

Any thoughts on tax implications?

A.

Tax implications depend on where you are in the world. Obviously, if you asked me (an ex con) for tax advice you are self-identifying as an idiot. I’m going to assume you weren’t asking me, since you may as well have asked a homeless guy for tax advice. I pay for tax advice and so should you.

Q.

I am new to using a Crypto exchange. Does the wallet apply to the standard non-futures platform or only the futures platform. I was looking at Kraken and their holding wallet FAQ only seems to apply to the Kraken futures platform. Sorry if I am being dense.

A.

Do NOT trade futures in cryptocurrency.

Q.

Do you recommend trading 5 coins on 5 different exchanges? Just to diversify the risk in case some exchange gets hacked.

A.

I wouldn’t bother if you are using major exchanges. Complexity is the enemy here. But in principle that’s not a bad idea at all. What I suggest is that you get started the easiest possible way, get into a comfortable routine and then decide on the level of security you want to operate with and adjust accordingly.

Q.

When we sell the 5 coins every week and re-buy 5 coins, do we sell the 5 coins into stablecoins like USDT, USDC first? And then Buy 5 other coins with stablecoins?

A.

If you want that’s a perfectly OK thing to do. It’s not the only way, but it’s what I personally do. You can also sell into BTC, or ETH, or fiat (but fees are higher). It DOES NOT MATTER!

Q.

I plan to invest 50K to 100K or more, do you recommend I start small first to see how things go and invest more later or just go the full 100K?

A.

That’s a good question. As a general proposition you should beware of “all or nothing” thinking. Usually “should I do this or that” is indicative of a mistake you are about to make. Might I suggest a half way strategy. Invest half and leave the other half in BTC.

This is a useful thinking principle for investing and trading. Whenever you are thinking in terms of “one or the other” you are usually making a thinking error and self-blocking your brain from seeing things clearly.

This is a useful thinking principle for investing and trading. Whenever you are thinking in terms of “one or the other” you are usually making a thinking error and self-blocking your brain from seeing things clearly.

Q.

Mole, how much skin in the game are you planning to have with this system, as a percentage of your liquid trading account as a whole?

A.

Why are you so interested in my net wealth? You do you, buddy, and I’ll do me. RIght now I have well over 1 million USD in crypto invested. Have I got skin in the game? I’m going to trade this exactly like I’m telling you to do it. I’m going to 10-20x my account this year (again) and if you follow these simple instructions you will too.

Q.

I’m wondering what all metrics you’re looking at to switch between alts / btc and cash. I know you won’t share exactly how but just curious to which ones are used.

A.

To find out more I’m going to need to to start fucking off. Keep fucking off, and I’ll let you know when you’ve fucked off far enough. No, not quite, keep fucking off a little more…

Q.

I’m curious if there’s a risk that we as a (large) group acting simultaneously might actually move the market, thus potentially invalidating some aspect of the system?

A.

Good question. The universe of coins we selected to trade was the least likely to be adversely affected by this. It is possible that we start moving the market, and I have a plan to mitigate it if we do. I am monitoring average trade slippage at various account sizes extremely closely. In theory, we have enough liquidity for a combined asset pool of approximately $150,000,000… but theory and practice sometimes don’t match up. We won’t know until we start to make large profits and the total account balances being traded go up. That’s what you call one of them “good problems”.

Q.

Mole, do you plan a new Cryptonaissance Wealth Engine for the next bull-run in 2025?

A.

Let’s stay focused on 2021. No flights of fancy, no dreaming. Let’s get this done, make sure we all get 10x or better returns, and then we think about what’s next.

If we can (and believe me, we will) get the exact top correct, I might be cute and release the shorting system I’m developing). Eyes on the prize, please.

If we can (and believe me, we will) get the exact top correct, I might be cute and release the shorting system I’m developing). Eyes on the prize, please.

Q.

I hold about 20 different coins and I plan to consolidate these into the recommended buys. Do you recommend I do this as a one off or more slowly over weeks or months?

A.

That’s also a good question. If you have certain microcap alts that you really believe hold 100x potential, you might want to keep some. This system is a safe, reliable, low risk (for crypto) way to 10-20x an account. It’s not going to be as good as hitting that .02 coin that goes to $100. But you don’t need to be lucky, which is nice.

To state the obvious, luck can be a bitch, and relying on luck is generally a mistake.

As a general proposition, this system outperforms the average altcoin and outperforms Bitcoin and outperforms Ethereum. It’s going to do better than the average altcoin investor picking coins by “doing their own research”. Who knows, you might be the world’s best altcoin picker, in which case you could beat the system. Could happen, but like always, you never know until you bet.

To state the obvious, luck can be a bitch, and relying on luck is generally a mistake.

As a general proposition, this system outperforms the average altcoin and outperforms Bitcoin and outperforms Ethereum. It’s going to do better than the average altcoin investor picking coins by “doing their own research”. Who knows, you might be the world’s best altcoin picker, in which case you could beat the system. Could happen, but like always, you never know until you bet.

Q.

How about an account setup video focusing on SECURITY concerns.

A.

I’m not a security expert, nor do I claim to be. I’m not an expert in the pros and cons of various exchanges either.

You figure out your own security regime. You can be as risky or riskless as you want to be. I’m not your daddy.

You figure out your own security regime. You can be as risky or riskless as you want to be. I’m not your daddy.

Q.

Are the sales to a particular coin (eg.BTC) or should they be converted straight to the new coin?

A.

Good question. Short answer is it doesn’t matter whether you sell to BTC, a stablecoin like USDT or to fiat (USD). Long answer is that it’s a tradeoff between fees and liquidity.

Q.

What happens if the prices change while I’m in the process of buying and selling?

A.

Good question. The system uses live prices and the amounts update if the prices change while you are doing things. If it’s not perfectly accurate it’s not a big deal. Near enough is good enough in this situation.

Q.

When its finally time to sell up everything and get out, is the intention to sell everything to BTC and then to FIAT and presumably at market not limit ?

A.

Depends on your account size, and the size of the market in the eventual top (which is unknowable). If you hit a market sell order for multi-million dollar orders you will always move the market. How much, it depends on many factors. Generally limit orders are preferable for cash, but unless your account is very large it’s virtually no difference.

Q.

Re: signing up for Trading floor Chat room I get a request to authorize full read and write access to my email, calendar, contacts etc. I must not understand the request because I would never authorize anyone but me to have this level of access. Please explain.

A.

This is a scam I’ve never heard of trading floor chat room. I will NEVER have a chat room, the LAST thing I want is to talk about trading while I’m doing my job.

Q.

Q1: Let’s say that by the time I am able to buy one of the coins on a Monday, the price of that coin has gone down, for example, 70%, on the day. Would this change anything?

A.

No it won’t change anything. If the coin goes down, most likely the coin you are selling to buy that coin has also gone down, so it’s a very small difference. Sometimes those differences work in your favour, but I suggest not even thinking about it, your brain will explode.

Q.

Q2: If I am not able to buy a certain coin on a Monday because none of the exchanges I have access to supply it, then could I buy more of the suggested coins that are available? ***I understand that this may yield worse results than the results from following the system exactly***

A.

Yes and in all likelihood it won’t make much difference.

Q.

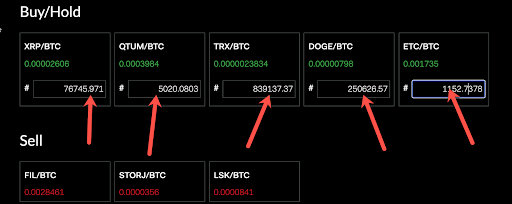

Are we trading crypto pairs? Eg. XRP/BTC, DOGE/BTC? I’m trying to understand how to read the signals that were sent out.

A.

You are buying crypto. You aren’t buying TRX/BTC or TRX/USD or TRX/USDT you are just buying TRX. What you use to buy TRX LITERALLY DOES NOT MATTER

Q.

Follow-up Question: If you choose USD pairs (as opposed to BTC pairs), how do we know what price and quantity to buy? Can you issue signals in USD or AUD pairs as well? Is a synthetic BTC position compulsory where we are holding a BTC short and long ALT.

A.

For example if the system tells you to buy 1,000,000 coins of TRX. Then you buy 1,000,000 coins of TRX. No, it doesn’t matter whether you pay for them with AUD, USD, USDT, or BTC or some other crypto.

Q.

When exchanging coins at start of each week, how should we handle any coins that remain in buy category from one week to the next? For instance, if XRP were to remain a buy next week, should we sell all five coins (including XRP) and then buy everything in 20% allocations (including rebuying XRP), or should we only sell enough XRP to maintain a 20% balance?

A.

Start selling everything in the SELL row. Then BUY everything you don’t already have.