What Is Quant Trading?

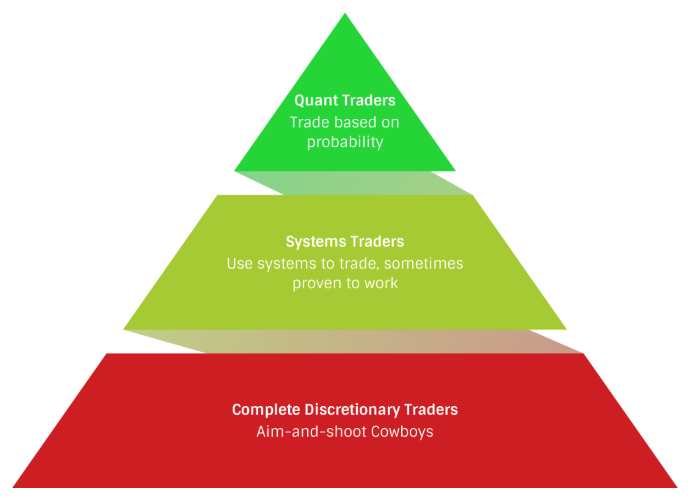

In the world of trading, there are essentially three types of players in the game:

The Food Chain of Traders

Discretionary Traders

At the bottom of the food chain, we have the Discretionary Traders. They look at stock charts, and based on their gut feel, they make a call on what they think a stock will do. They trade from a gut feel. Often, they can’t explain in black-and-white terms why they are making a trade.

They really have no trading system and it’s difficult, if not impossible, to test any of their trading techniques. Often they come up with jargon like Full U-Turn Jones to describe a pattern that appears on a chart.

As the name implies, not only do they have discretionary rules about what exactly a Full U-Turn Jones chart pattern is, but they also have discretionary rules about what to do when it magically appears!

In the proprietary trading world (also known as prop trading), we refer to these types as Aim-and-Shoot Cowboys. Not shockingly, most of these traders crash and burn by the 1000s and never make money long term.

Systems Traders

In the middle of the food chain, we have the systems traders, which trade with a system that has rules which can easily be followed. If a stock does thing A and thing B, then I’m going to buy it. If it does thing C and thing D, then I’m going to short it.

Systems Traders can usually explain their trading systems in a recipe type format. These types are a big step up from the Aim-and-Shoot Cowboys.

The most famous example of systems traders are the infamous Turtle Traders. During the early 1980s, two traders Richard Dennis and William Eckhardt made a bet: they could take people who had zero trading experience, train them on their trading systems and turn them into trading champions.

The recruits were housewives, school teachers, insurance sales people and others who had no prior experience in trading. In fact, a requirement to get into the Turtle Traders program was that you had to have zero trading experience.

They recruited this group from magazine ads and provided them with two weeks of training on the rules of their trading system. The rules were simple. One of the turtle traders, Curtis Faith, commented in his book Way Of The Turtle that they probably could have done the full training in two days instead of the two weeks.

Over the course of the 1980s, the Turtle Traders made millions. Some estimates put the numbers over $200 million. There are several books written about them and the rules of their trading system.

An upside of systems trading is that systems have rules that we can test, just as Richard Dennis and William Eckart did. While the rest of us were busy portaging our canoes in Oregon Trail, they were hard at work back testing their trading system on an Apple IIe.

For example, one of the turtle’s rules was if oil made a new 40 day high, they would buy it. They found that in the past, that if the price made a new 40 day high, it tended to continue moving higher.

There is no scientific way to explain this phenomenon aside from a momentum effect: things in motion tend to stay in motion. If prices move higher, they are likely to continue to move higher.

Or we could conjecture and say this happens because of FOMO – fear of missing out: traders see the price moving higher and jump on the band wagon for fear of missing a move higher. But the reality is that nobody can explain, in a scientifically sound way why this 40 day rule worked. And this is the downside of systems trading.

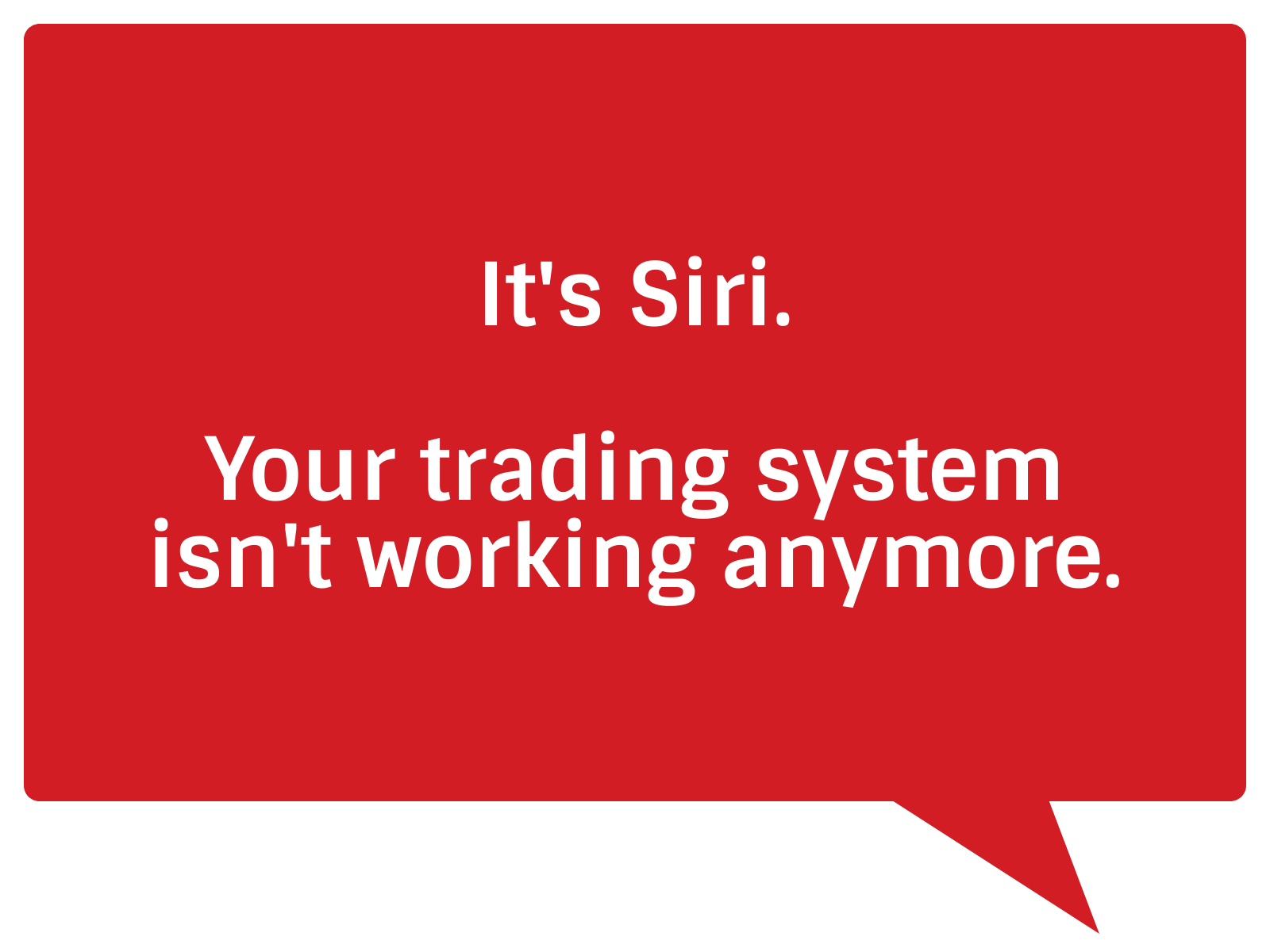

Eventually, the rules of the turtles fell apart and the system no longer worked. With systems trading, the rules often can’t be mathematically verified and proven to be statistically significant. There is no science behind them.

As such, over time these systems usually quit working. Usually without warning, the sign that they are no longer working is loses start piling up. Siri isn’t going to give you a heads up in advance.

Quant Traders

Finally we have the quant traders. The quant in quant trading is short for quantitative trading. In simplest terms, it means trading based on things we can measure and predict with a high degree of scientific rigor.

Quant trading can be super complex, but if you think of it in terms of probability, it’s really simple. Once you understand how this works, it’s super powerful. Super duper powerful.

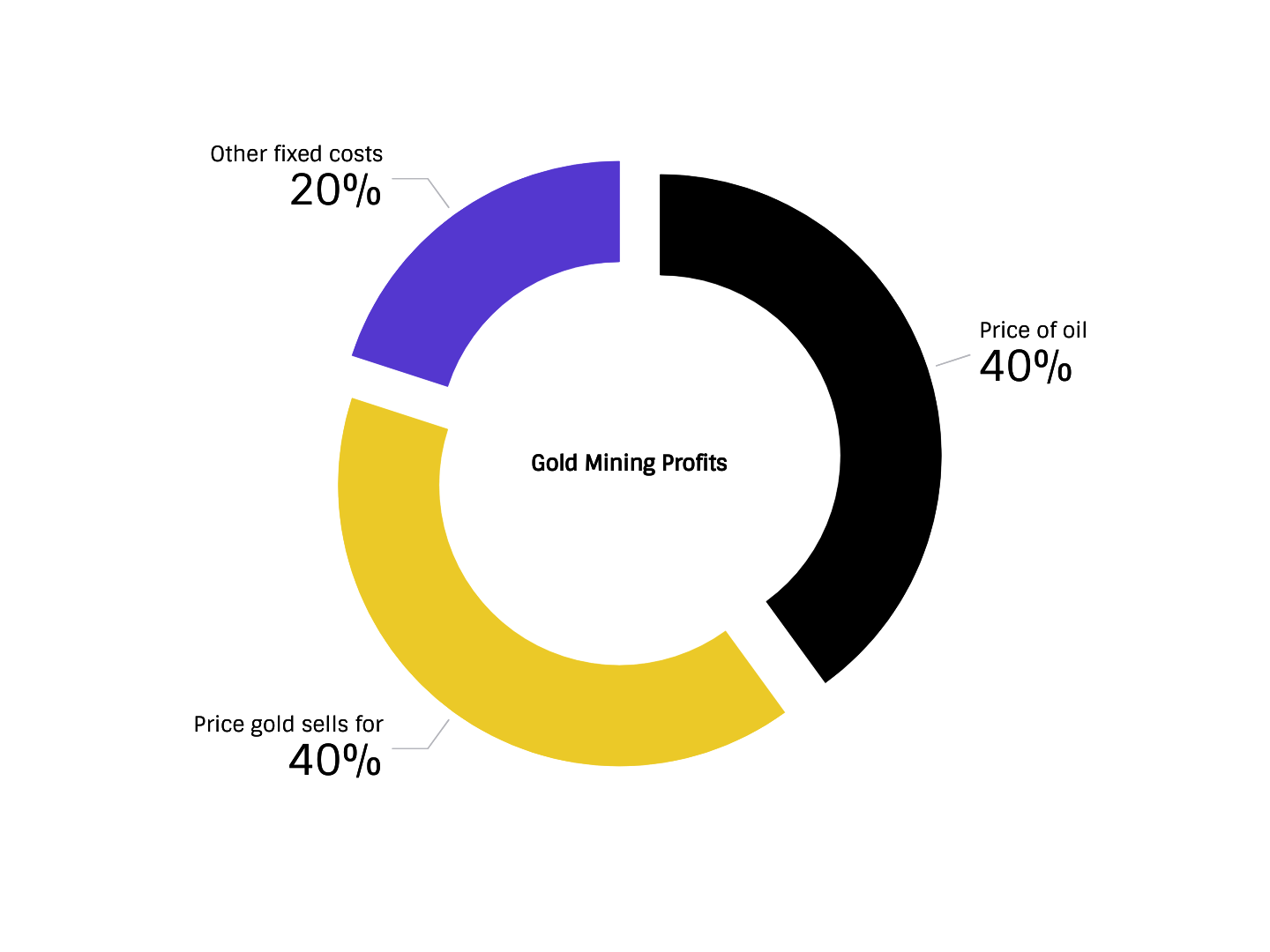

An example is the relationship between gold, oil and the profits of companies that mine gold. In stock trading, there are ETFs that track all of these sectors:

- GLD – tracks the price of gold

- USO – tracks the price oil

- DUST – tracks the price of gold mining companies

It’s a pretty simple ménage à trois relationship relationship between the three. Captain Obvious would likely agree.

Gold miners consume a lot of oil with the diesel fuel it takes to operate mining equipment. And they make profits based on how much they can sell the mined gold for. It’s bordering on economic simplicity of a Kool-Aid stand.

The price of DUST is highly dependent on the price of oil and the price of gold. Using complex geeky quant math, quant traders can develop a model that predicts what the price of DUST should be based on the price of gold and oil.

Now, just because we can see there is an obvious relationship here, it’s not good enough for quant traders. Seeing that there should be a relationship based on common sense is a qualitative relationship. But quant traders trade based on quantitative relationships or numeric relationships.

Quants perform complex mathematical analysis on this USO-GLD-DUST trifecta that confirms there is a strong mathematical relationship between the three. Once this relationship is determined to have a high probability of existing via geeky quant math, it’s quant party time! Are y’all ready for this?

Now the funs starts. We can build a trading strategy around this USO-GLD-DUST relationship using quant math or machine learning tools like XGboost.

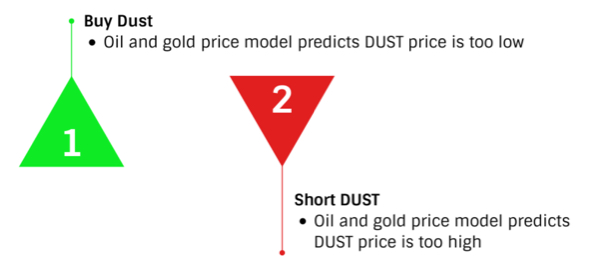

Gold Miners DUST ETF Trading Strategy

If our quant model tells us the current price of DUST is significantly lower than it should be (based on oil and gold prices), we buy DUST. If we believe the price of DUST is too high, then we short it.

When the price of DUST comes back in line where our model predicts, based on the price of gold and oil, we exit the trade. No trading strategy is complete with out a dorky title, so heretofore this strategy shall be known as Fort Knox.

It’s pretty simple. You don’t need to be a rocket scientist at NASA’s jet propulsion laboratory to wrap your head around the basic concepts. And given our paint-by-numbers tools, make them work for you.

The Red Pill Quants Difference

Quant trading is superior to essentially every form of trading because it’s based on relationships that can be mathematically verified to be highly probable. This is what makes quant trading superior.

It’s not exactly a secret anymore. There is an arms race underway by trading firms to acquire quant traders for their trading desks. It’s pretty common to have salaries in the $400k+ range for experienced quant traders.

In fact, at the most successful quant trading firm of all time Renaissance Technologies (RenTech), it’s speculated every quant on staff makes over $1 million annually. And they have almost 300 quants on staff!

15 Year Quant Education

The downside is it takes years of learning advanced math, statistics and writing python code to master. You probably don’t want to spent the next 6 years in grad school or getting a PhD in order to become a trader.

With our paint-by-numbers approach, we explain the concepts of quant trading strategies in an easy to follow fashion. Most people can grasp the basic concept of how quant strategies work, like our Fort Knox strategy example.

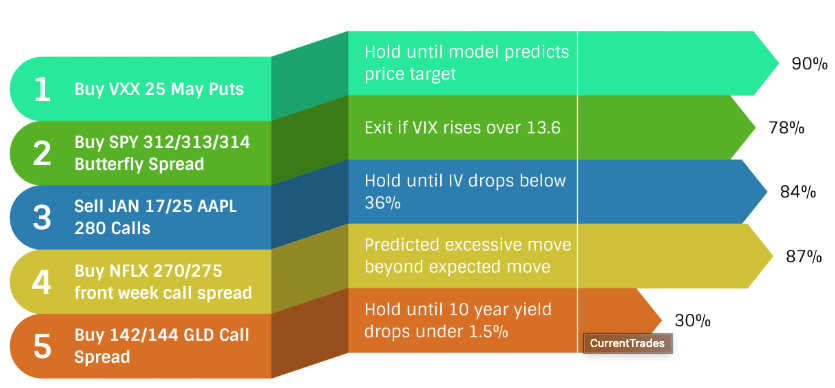

Current Trades

The difference? We do the geeky part. Our team develops the software code and mathematical quant models that do the geeky math and analysis. You can then apply it using our paint-by-number simple trainings.

Visit our Quant Academy to start trading like a quant right now, only without a PhD in rocket science.