In the world of trading and financial blogs it’s easy to get overrun with useless and outright false information. Over the years I have had many brushes with the turbulent world of prop trading, so I can tell you some secrets that pros know and retail traders only wish they knew. Until now!

The following essay is part of a comprehensive series I am posting in an effort to drive an 800 ton mining excavator through the mountain of mind trash that is preventing you from being a successful trader.

Rule #3: Technical Analysis Is Highly Subjective

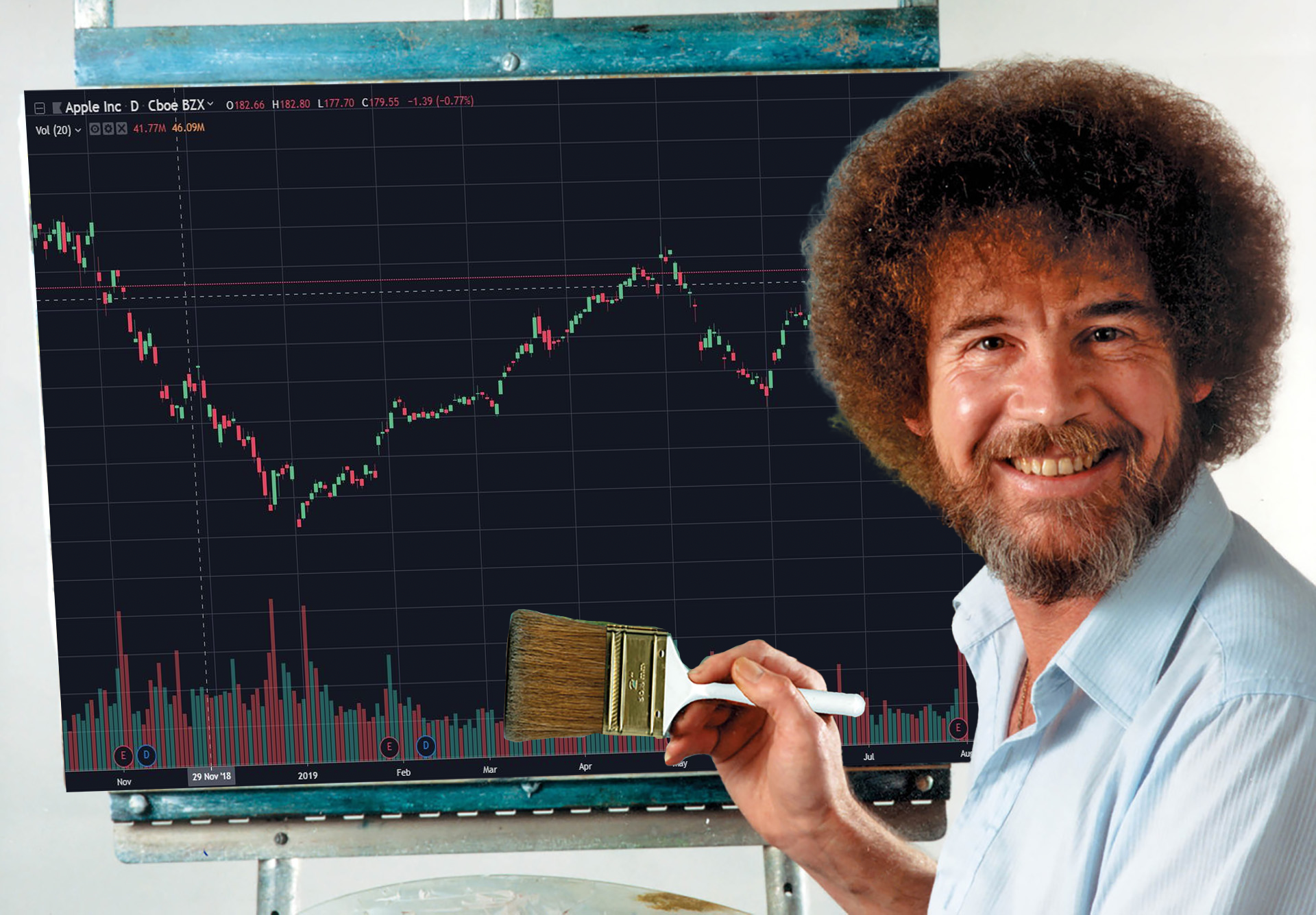

If you turn on CNBC or Yahoo Finance, you’re sure to see some guru in a suit, showing pretty stock charts, pointing out support, resistance, triple tops, double-top-full-u-turn-jones patterns and so on.

I was always shocked, and in my naivety, impressed with these so-called gurus who seemed to be able to take a simple stock chart and find all kinds of hidden patterns.

Similar to a Bob Ross painting in many respects.

Does the 30 day moving average mean something?

Isn’t the 60 day moving average the most important?

But isn’t the 90 day moving average what really matters?

Everyone knows that isn’t the 270 day moving average the magic moving average?

The reality is none of these averages mean much of anything. They will give you no edge in your trading.

We are all humans and as such, subject to cognitive bias. Cognitive bias means our brains find reasons and logic to support our desires.

Cognitive bias is invisible to us, otherwise it wouldn’t be cognitive bias. We might think we’re being objective in our decision making, but we see what we want to see. Often, our personal demons are a form of cognitive bias.

You might have a friend that is a compulsive drinker or compulsive gambler. To you, it’s glaringly obvious that having 10 drinks a day, everyday, is a problem.

But to someone consumed in a downward spiral of addiction, they will state their case based on some wild ass left field BS research with some Soviet era accounting to back up the results.

“Dude, there is a thread on Reddit that found some Irish researchers that discovered that drinking daily can reduce your need to take blood thinners for high blood pressure!”

Now that’s the sort of medical treatment I can get behind of 🙂

The trading equivalent looks just like this… You might take out a short position in AAPL because Tim Cook announced iPhone sales are going to be lower than expected this quarter.

Then AAPL stock rips higher anyway, causing you substantial losses.

Rather than using a properly placed stop loss in your AAPL trade, taking the loss and moving on, you go searching for negative AAPL opinions on Reddit. Sure enough, you quickly find someone who agrees with you:

NamelessTraderDode: “ALL SHORT AAPL!!! THIS TURD IS GOING TO ZERO!!!! AAPL IS DONE!!”

WoooHoooo! What a relief! You can keep your short position on and sleep well now, knowing you found NamelessTraderDode on Reddit who agrees with you being short AAPL. As a bonus, the message is written in all caps, the signature of all internet gurus.

If we were looking for a reason to be bullish on a chart, we can pull some technical analysis pattern out of our ass and make the case for ourselves. And if we’re looking to get short on a stock that’s raging higher, we can find some hidden pattern in that painting that makes the bearish case.

Removing all decision making that lends itself to cognitive bias is a key part of being successful as a trader. How do I know if a stock is in a bullish trend or bearish trend? Shouldn’t I just be able to look at the chart and tell?

Maybe, if you’re a trader who has been successful for the last 15 years. And still, you need an objective black-and-white way to make trading decisions, not a thinking process that leaves lots of room for interpretation.

Any trading system that leaves a lot of room for interpretation is going to be near impossible to trade successfully.

If you’re a new trader, you should have a system that leaves almost none of the decision making to subjective interpretation.

Having followed lots of fake gurus over the years and spent $1000s on their smoke-and-mirrors courses, I began to realize something.

Once I became a really good python programmer, I was able to test just about any trading idea I could dream up. Including lots of the systems developed by supposed gurus that left lots of room for interpretation probably doesn’t work.

What I started to realize is that almost any good trading system can be put down on paper as a set of objective rules that leave little room for discretion.

WARNING: Most trading systems that involve lots of discretion are very likely not to work.

These gurus selling this snake oil want it that way. Why? Because if the system they are pimping involves a high degree of discretion, you have almost no way of back testing or forward testing it to see if it works! If you were able to test it, you’d likely find out it doesn’t work.

If you need to think much about whether or not a stock meets the entry criteria of a trading system, the answer is NO IT DOESN’T!.

When you start thinking like this on a regular basis, it’s time to check yourself before you wreck yourself.

Pro successful traders reduce all aspects of trading that involve any type of discretion and replace them with paint-by-numbers simple rules.

Just like we do here at Red Pill Quants.

Take advantage of our 2023 kick start super sale which offers a massive discount if you sign up for Red Pill Quants Unlimited for an entire year.

Not good enough for you?

Right now on this page ONLY you can lock in LIFETIME access.

That’s right, never pay us a single cent again and enjoy our premiere options trading service for the rest of your natural (or unnatural) life.

Awesome, right? But you can only get it on this page, so hop off that fence and lock in those savings while my temporary insanity lasts 😉

LIVE cumulative P&L of all my trades over the past year can be found here.

See you on the other side.