I was born with a fairly pale complexion which has always forced me to stay out of the sun lest I end up looking like a roasted chicken after only minutes of being exposed to a UV index anywhere above 5. It’s not that I hate the sun – rather the sun seems to hate me, or at least it hates my skin as it insists on burning it. As a financial blogger who also trades for a living it’s easy to understand that summer is my least favorite season of the year.

And while July and September are somewhat tolerable it’s August in particular I’m always happy to say goodbye to. The fact that everything here in Spain shuts down for the entirety of the month does not really help matters. Oh and I should probably also mention the high humidity here ranging in the 80 percentile or higher.

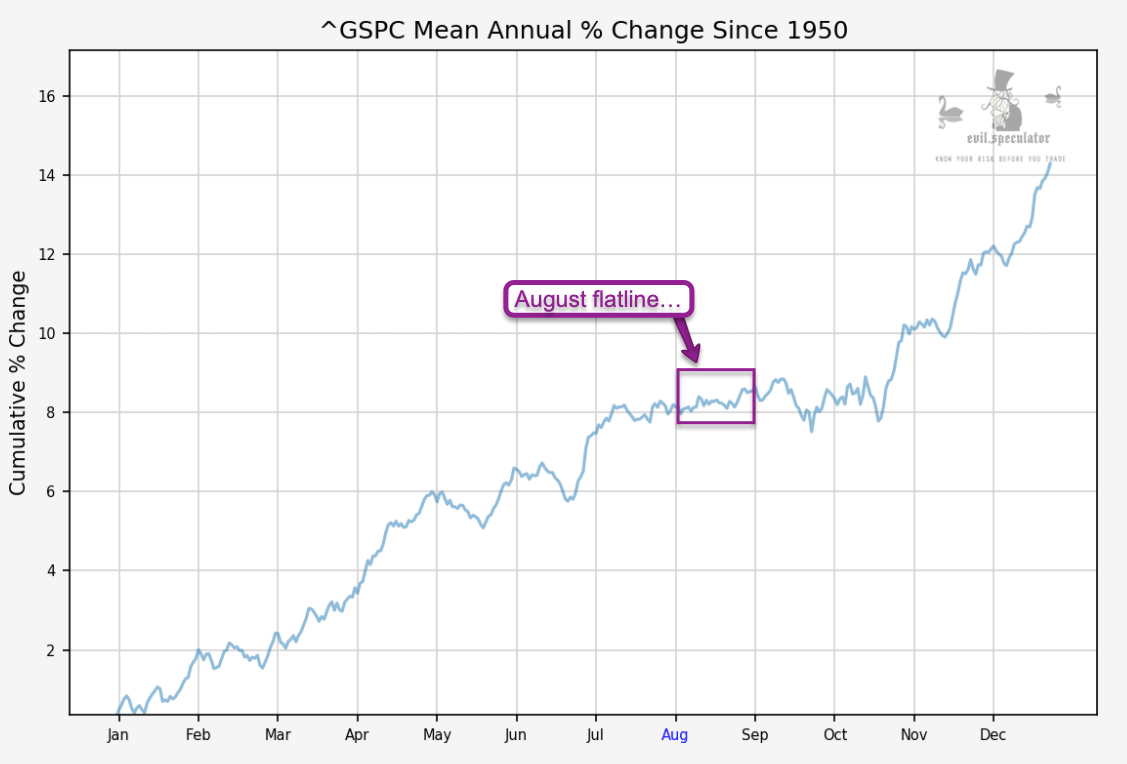

Let’s talk charts. The mean annual % change over the past 70 years shows us a complete flatline on average, which is great for selling theta to option trading retail suckers but is pure Kryptonite for anyone trying to report anything interesting about the financial markets.

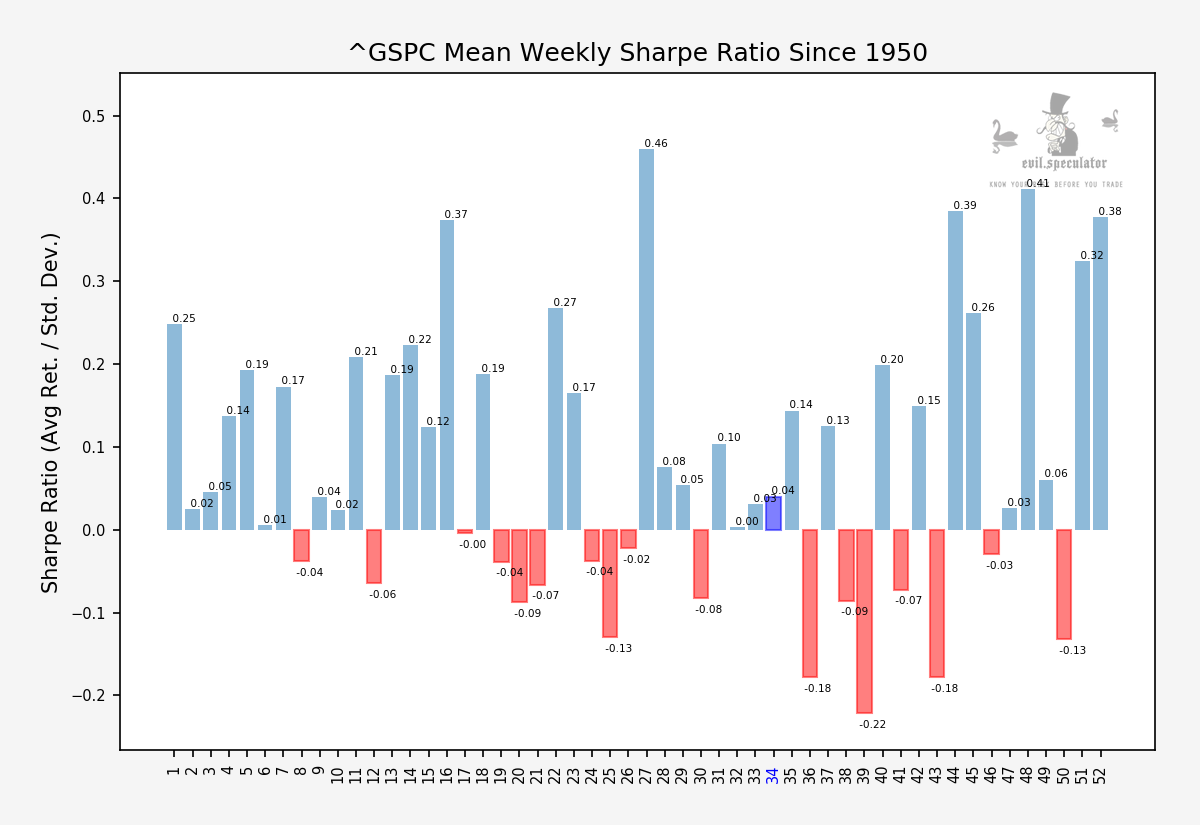

Fortunately things are starting to get a wee bit more interesting – next week that is – not in week #34 which only shows us a Sharpe ratio of 0.04. In the second half of 2020 that may of course be enough to push us toward new all time highs in equities. If not this week then my money is on week #35 which is the most bullish statistically for all of summer.

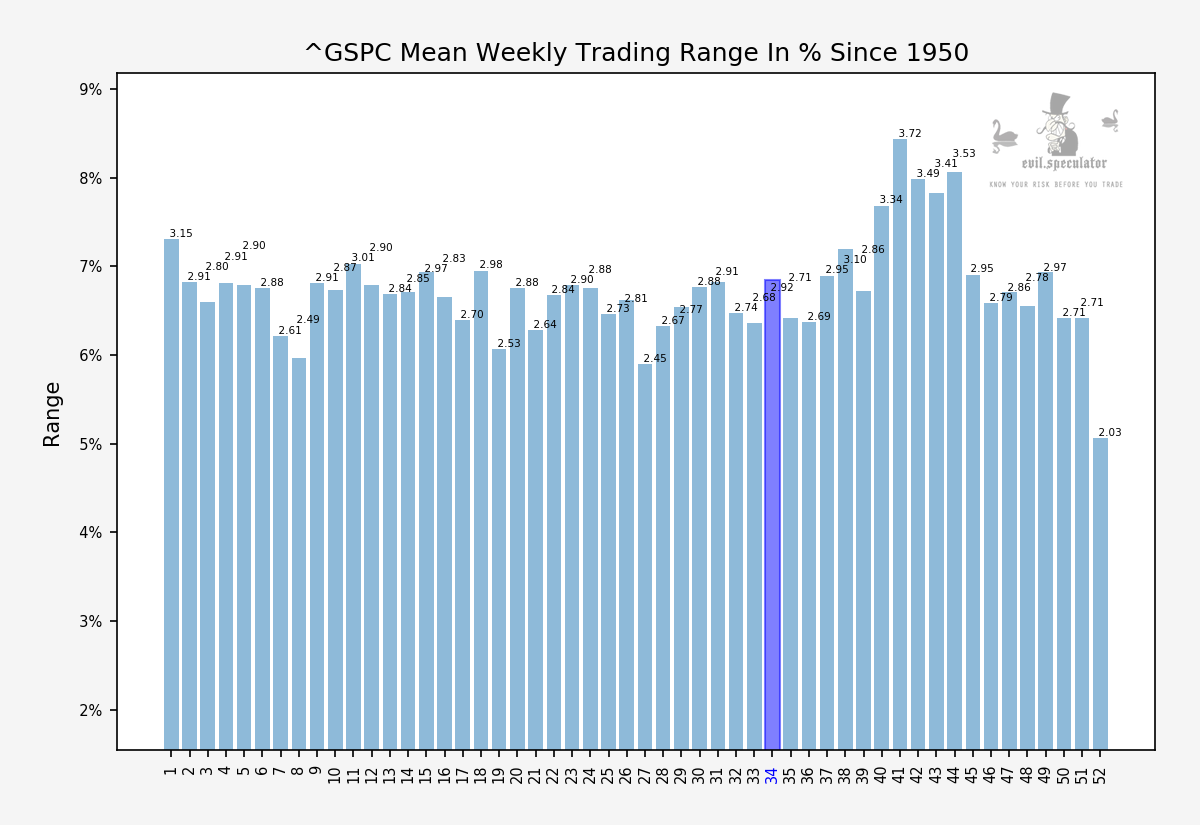

Trading range is slightly elevated given that we’re in a flat season, so expect a lot of noise with no clear directional bias. Basically the type of tape we’ve seen for the past 2 weeks.

More weekly stats plus a quick medium term update below the fold for my intrepid subs:

Please log in to your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.